Are you looking for any below ?

What is Term Insurance?

Term insurance is one of the life insurance products that afford monetary coverage for a certain term or a period of years.

If the policyholder dies during the policy term, the nominee gets the policy death benefit cover value.

In case of the survival of the policyholder beyond the policy term, the policyholder doesn’t get any benefit from the policy.

Unlike other life insurance policies, Term insurance has no cash value. In other words, the only value, it has, is the guaranteed death benefit from the policy.

Even though it doesn’t have any cash value, it offers very high coverage even for the less amount of premium paid towards the term policy. So it provides Financial security to the dependents of the policyholder against any shocking circumstances.

The beneficiaries can take the assured amount in one time or can opt for payments at regular intervals.

Many times, the insurance agents don’t recommend this product because they mix Insurance against Investment. But this is the highly recommended one which serves the true purpose of Life insurance.

Why Term Insurance is better

- Term Insurance offers high life coverage compared to traditional endowment plans at a lower premium.

- Term insurance premiums are the lowest amongst other types of life insurance policies because the premium does not have the investment return component.

- There are Flexi-plans available in the term plans also, where the survival benefits shall also be availed with a little extra amount of premium.

- It maintains the family’s living standard even in the absence of the sole earning member.

- It covers all D-uncertainties like Disease, Disability, and Death.

Now, will see the various types of term insurance plans available in India.

Types of Term Insurance.

Pure Term Plans

This is the modest method of the Term Insurance Plan. The sum assured does not change during the policy term and benefits are paid out to the nominee on the death of the policyholder. However, there are no survival benefits in this plan.

For Example, Mr. Ram, aged 35, has taken a pure term insurance plan for the sum assured 1 Crore for the period of 40years with premium paying term of 40years. Assume his annual premium would be approximately 20,000. Somehow in the unfortunate event of Ram dies before the age of 75, the policy covers his family and pays the sum assured 1 crore to his nominees. If Ram lives happily beyond 75, he paid 8 lakhs and the policy doesn’t provide any benefit to him or his family.

Return of Premium Plans

This plan is the same as pure term plan but here the plans have maturity benefit, i.e) the total premiums paid are returned to the policyholder if he or she survives till the maturity of the policy.

Now, we will see what if Ram chose this type of plan instead of a pure term plan.

While going for the return of premium plans, the premium paid would be more than the traditional plans. His annual premium would be around 35,000. If Ram dies before 75, the sum assured 1 crore will be paid to his nominees. If he survives beyond 75, the amount= 35000x40years = 14Lakhs will be repaid to him at the age of 75.

Increasing Term Plans

In this plan, if the policyholder wants, it has the option to increase the sum assured to beat the inflation or other purposes while keeping the premiums the same. The premiums of this plan will be higher than that of level term plans. It is always important to assess the needs when considering the term policy. But if you could not assess, there is an option to go with increasing term plans. It means with the same premium, some % of the life cover increases with the term.

If Ram selects this plan, he will be paying extra and his cover will be increasing 2Lakhs every year passes and He can opt this option either with Pure term plan or return of Premium plans.

Decreasing Term Plans

The reverse of an increasing term plan is the decreasing term plan. Here the sum assured drops yearly to match the decreasing insurance needs of the policyholders or his other investment will increase with time. These plans are mostly taken when someone has taken large loans and paying a heavy EMI and doesn’t want to burden his/her family with EMI. Usually, the Policy cover value would be more than the loan value. If he/she passes away during the loan period, with the life cover, his/her family would be paid a large sum and they can settle the loan amount.

If Ram has a housing loan of 50Lakhs with 15years. He can take an additional policy of Cover value 50lakhs under this plan for the same loan period.

Convertible Term Plans

Some of the life Insurance companies offer this plan where after buying a term insurance plan it can renovate it into some other plans like life plan or endowment plan of your choice in forthcoming years.

For example – If Ram has taken a term plan for 40 years but after 10 years he can convert this into a whole life insurance plan, endowment plan or any other plan of his choice if he so wishes or can continue the same plan also.

Joint life insurance plan

Term insurance plans can be taken jointly by married couples. In this plan, if one deceases, the other partner gets the sum assured and the plan continues. If the surviving partner also dies, his/her nominees get the sum assured.

For example – If Ram has taken a joint life term plan for 40 years jointly with his wife. If he dies, his wife receives the sum assured at one go or can receive partly until her life. After that the rest of the sum assured will be paid to her nominees.

Well, This plan is also applicable to business partners. Even Parents can opt for joint life insurance with their child to protect the child’s financial security.

Term Plans with Riders

A term insurance rider is supplementary coverage to the term insurance policy. Rider options fortify the term plans by offering additional benefits to the policyholders apart from the death benefit.

Most important Rider options which are the policyholder look into are as follows,

Accident Death cover rider

- If Ram selects this rider, he has to pay 2000rs additionally in his annual premium. He will be paid an extra amount if his death is by accident.

- People who travel very often should consider this rider option which gives a generous cover at a discount price.

Accidental Disability Benefit Rider

- If the policyholder met an accident and becomes permanently disabled, with the addition of this rider option, Policy company pay regularly for the next 5 to 10years in a certain percentage of the sum assured.

Accelerated Death cover rider

- If the policyholder expects a terminal illness in the future, he can choose this rider option and his family gets a part of the sum assured in advance and will be helpful for his treatment.

Critical Illness cover rider

- Critical illness may happen all of sudden and no one able to predict and better to buy this rider along with term plan.

- Adding this rider, the policyholder receives a lump sum on a valid diagnosis of a critical illness mentioned in the policy terms and conditions. The Major Critical illness such as follows,

- Cancer of specified severity

- Angioplasty

- Myocardial Infarction (First Heart Attack – of specified severity)

- Heart Valve Surgery (Open Heart Replacement or repair of Heart Valves)

- Surgery to aorta Heart and Artery Benefit

- Cardiomyopathy

- Primary (Idiopathic) Pulmonary hypertension

- Open Chest CABG

- Blindness

- End-stage Lung Failure (Chronic Lung Disease)

- End-stage Liver Failure (Chronic Liver disease)

- Kidney Failure Requiring Regular Dialysis

- Major Organ/ Bone Marrow Transplant

- Apallic Syndrome

- Benign Brain Tumour

- Brain Surgery

- Coma of specified Severity

- Major Head Trauma

- Permanent Paralysis of Limbs

- Stroke resulting in permanent symptoms

- Alzheimer’s Disease

- Motor Neurone Disease with Permanent Symptoms

- Multiple Sclerosis with Persisting Symptoms

- Muscular Dystrophy

- Parkinson’s Disease

- Poliomyelitis

- Loss of Independent Existence

- Loss of Limbs

- Deafness

- Loss of Speech

- Medullary Cystic Disease

- Systematic lupus Erith with Renal Involvement

- Third-degree Burns (Major Burns)

- Aplastic Anaemia

Source: www.iciciprulife.com

- The policy may either continue or terminate once the critical illness is found on the policyholder as per his/her policy T&C.

- Opting for policies with riders , may result in higher premiums , hence make sure that you don’t fall unnecessarily.

- If you are choosing these rider options, Please consult with your financial advisor or read the policy document carefully.

Waiver of Premium rider

- This rider assures the policyholder that if he/she could not pay future premiums because of accident disability or income loss, the premiums to be paid in the future are waived off.

Long term care rider

- This rider offers monthly payments if the insured is forced to stay at nursing home care.

With these rider options, the policyholders can plan for the unplanned events in their life.

Term Insurance Benefits

- Premiums are cheaper than other life insurance premiums.

- TI policies are simpler, Pay the premium and cover your life for the term needed.

- Term insurance has the Flexibility option to choose for short terms like 5 to15 years and long terms like till 75years or even 100years(few companies).

- While say Flexibility, it offers various types and riders options.

- One can avail tax deduction up to 1.5 lakhs under section 80C for Premium paid for their term plan.

- The Maturity benefits or the claim amount is also tax-free under section 10(10D) of the IT Act 1961.

- It offers a more competitive cover than the other cash value policies.

- It gives protection against liabilities.

Term Insurance Age Limit

The minimum age eligibility criteria are 18years and the maximum age limit is 65years.

The maximum cover for the age or maturity age is up to 75years. Some companies offer till the age of 100 or even Whole of life.

The minimum amount of sum insured should be Rs.10,000.

Term Insurance Premium Value

The term insurance premium value is the money paid by the policyholder to the company to get Insurance coverage.

The premium value is principally based on the various factors such as,

- Coverage amount / Sum Assured – Higher cover means for a higher premium and vice-versa.

- Age – Younger people pay a lower premium and older people pay a higher premium because the term period if more for the younger person.

- Term period – for a longer period of cover, the higher premium.

- Gender – Premium for Male is higher than females.

- Tobacco usage – A person who smokes pays a higher premium than who does not smoke.

- Alcohol consumers – one who takes alcohol pays a higher premium than non-alcoholic.

- Payout method – Lumpsum withdrawal pays a higher premium than the periodic interval of withdrawal.

- Rider option – Pays extra premium for the selected rider option

- Payment term – One-time payment option will pay lesser premium than the full period payment option. But Always prefer to go for yearly payment.

- Medical Condition – If any pre-existing medical reasons rise the risks, results in a higher premium

- Online policy purchase – It is simple and cheaper because no intermediaries involved.

- Occupation – People working in industries, mines, shipping, fishermen are considered as dangerous than working in an office and they need to pay higher premiums.

Term Insurance Claim process

For the Claim process, It is always better to communicate the insurance plan details with the nominees along with insurance company/agent contact number and explain to them the claim process while signing up for any insurance policy. It is the hard thing to do when we are alive but at least the policy taker should convey about the policy and later they can reveal the process.

Some people don’t reveal to their immediate family sometimes and This is why the Unclaimed benefits are higher and close to 300crores as per IRDA 2018-19 report.

- If the policyholder expires, First inform the insurance company.

- Then Fill up the claim form and register the claim with the supporting documents like

- Policy related document

- Medical & Death certificate

- Postmortem report in case of unnatural death.

- From the company, the Insurance inspector will review your claim and then approve the claim if it looks as if fit.

- If he found any problem while reviewing, he might reject your claim and again re-apply with necessary documents.

Term Insurance Policy Exclusions

Term plans mostly cover natural deaths. But there are some exclusions where the policy does not cover the insurer. Such situations like below,

- Accident due to racing in bike or car

- Death by participation in adventurous sports activities.

- Suicide

- Death due to the influence of drugs or alcohol

- Murder of the policyholder

- Failure to disclose the smoking habit.

- Death due to pregnancy complications or childbirth.

- Death due to natural disasters.

Income Tax Benefits

The premiums paid as well as the death benefits are exempt under tax regulations in India.

Premiums paid to a term insurance plan are eligible for a tax benefit under section 80C of the Income-tax Act, 1961. You can claim a deduction up to Rs 1.5 lakh a financial year for the premium paid for yourself, your spouse and/or children.

Apart from the above benefit, Insurance policies issued after April 1, 2012, get a tax deduction is applicable for the total premium amount valued up to 10% of the total sum assured. The limit of 10% would be increased to 15% if the policyholder suffers an ailment listed under section 80DDB or any disability listed u/s 80U.

A Hindu Undivided Family(HUF) can also avail of the above tax benefits under the above section.

The maturity amount or death benefit received is fully exempt under section 10(10D) of the Income Tax Act. This exemption comes without any upper limit to the beneficiaries.

Common Claim rejection reasons

Below are the probable reasons for the rejections of term insurance claims.

- Any blunder or cautious effort to suppress any required information. It is compulsory to assert all the related information undoubtedly and coherently in the proposal form. A self-thorough review of the proposal form should be done.

- Filling out an insurance application form by others.

- Not revealing about the previous life insurance policies( other term plans, ULIPs with insurance cover, Traditional policies).

- Providing incorrect information about employment/occupation.

- Incorrect medical history details.

- Ignoring the specified medical tests for higher sum assured policy.

- Lapsed policy – Always pay the premiums on or before the due date.

- Incorrect Nominee information

- Delay in filing claims.

Always be very transparent while buying the term insurance. Even not disclosing a small detail may lead to huge trouble to your dependents while claiming.

Age of the Life Insurance Companies :

Age of the insurance company is important in selecting a term insurance because it will you an vision about its survival in the future period. The below graph shows the age of the life insurance companies in Years.

The High on the above Chart is LIC with 64 years and No one in the Industry is atleast halfway mark to the LIC. The experience of LIC in the Life Insurance and their reliablity in the Industry makes their Term Plans premiums way costlier than others.

Source :ET

Claim settlement ratio :

It means the ratio of claims settled by the company to the total number of claims received.

Often when selecting the term insurance among other competitors, looking at this ratio will be useful. This Ratio will help users to identify the excellence of the life insurance company. But only this data might not helpful.

The latest claim settlement ratio for the financial year will be released by IRDAI ( Insurance Regulatory and Development Authority of India). Site Navigation to IRDAI: Home >> Reports >> Annual reports of the Authority. The reports will be available in English and Hindi.

The above report does not segregate the type of insurance products like endowment, term insurance or ULIPs.

Further Digging down the Report table, Please see below graphs for the ease of your understanding.

Claim-Settlement Ratio:

No guarantee that a company having the highest percentage of claim-settlement ratio does not reject the insurer’s claim.

Usually, the company with more than 90 to 95% will be taken as a factor for narrowing down the choices we had.

Average Amount-Settlement Ratio:

The average claim settled amount is more with lesser claims applied may indicate that the company has a good settlement towards Term Insurance Policy.

However, the Majority of the claim settlement goes in the category of Endowment plans, Most bigger companies have the average near to the Industry average claim amount settled.

How much Term insurance cover value do you need?

Often the Insurer gets confused while selecting the life cover. Here, I will reveal some handy thumb rules and will help to decide the right coverage amount. The Cover value depends on your expenses, not regular incomes. Assuming that the policy taker does not spend more than his income, the below methods can help you to arrive at a cover value.

Method-1:

1. If you are married, then the basic cover should be 10~25 times the annual income. Sometimes, the number shall be replaced with their children’s age until they enter college or aged 18.

For example – If Ram has an annual income of 10Lakhs, then the Coverage amount should be minimum 15x10Lakhs = 1.5 Crore.

2. Increase your cover based on the number of dependents,

For example – If Ram has 2 children, then to cover their education expenses & marriage expenses, 50Lakhs each (Considering the inflation rates). Now his coverage will be an additional 1 crore.

3. Now Look at your debt, housing loans, car loans, education loans, yearly medical expenses.

Sum up all the above debts and Include the previously calculated cover value.

For example – If Ram has a housing loan of 50lakhs, then to cover their EMI expenses, Now his coverage will be additional 50 Lakhs.

Now the Final Coverage Value will be 1.5+1+0.5 = 3.0Crores.

Method-2:

If Ram is running his family smoothly with a monthly take-home salary of say 60,000. Now if the family puts the Life cover annuity in a bank deposit that earns 6% interest, the Initial deposit requires 1.2crores. Now the Minimum coverage should be 1.2 crores.

Adding the dependents and loans, 1 crore (dependents) + 50lakhs(debt) , Final cover value will be 2.7Crores. However, the final cover value should be checked with below HLV table. Since RAM Annual Salary is 10lakhs, he is eligible to avail max fo 2.5 Crores.

Method-3:

1. By considering the age towards retirement, One can have the human cover value as = Multiplier x Annual Income.

For example – If Ram has aged 30 with an annual income of 10Lakhs, then to cover his family expenses for 30years, His cover value should be 25 times the annual income. The Minimum Cover value is 2.5 Crores.

Basic thumb rule that can be used to find out your HLV is as follows:

| Age In Years | Income Multiple of your annual income |

|---|---|

| 18-35 | 25 times |

| 36-45 | 20 times |

| 46-50 | 15 times |

| 51-61 | 10 times |

Nowadays the Favourite cover value is 1 Crore but you might have noticed that from the above methods, It is not the case for many.

However the above methods can act as handy rules, but for complete protection of family considering your other needs, you may consult with your financial advisor also. The above method may add value to the discussion with your advisor.

The average insurance cover by an Indian is less than 20Lakhs although his required insurance cover will be more than 1 crore. This Underinsured person mixes his insurance with investment products. Only the term insurance policy gives this high cover value with a lesser premium.

Always better to include the inflation rate while calculating the Insurance cover value because over the years the prices are going to keep rising. To Cover the family expense of 50,000 now may need 1,00,000 in the 10 years. Every 5 years review your insurance cover with the expenses. If some deficit occurs, add-on cover value periodically.

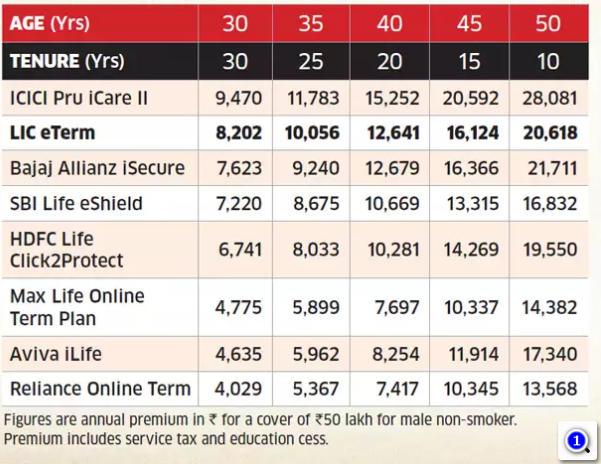

Lets us see the premium table below.

Premium table

However, earlier I mentioned 24 companies from the report. I have collected some of the companies details. This table is just to show how much premium for the coverage and with each year passing by, the premium amount increases. Start Early, Save Extra!

Surrender value

Surrender value is the amount which life insurance policyholders will receive when he/she decides to expunge the policy before the policy term period. Sometimes it is referred to as the “Cash-value” of the policy.

When the policyholder decides to surrender the policy, all the benefits associated with the policy also terminated.

As per IRDA, life insurance companies have been asked not to collect surrender charges if the policyholder chooses to end the policy after five years.

Pure term insurance plans do not have any cash value. Term insurance policies with savings components are only eligible for a surrender value.

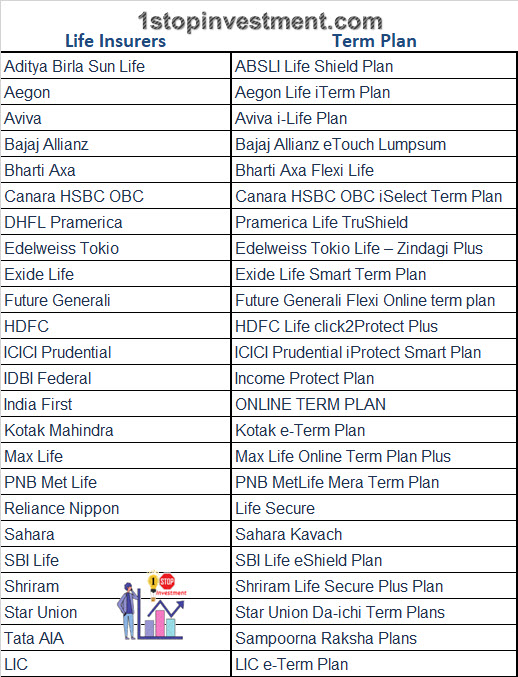

Term Insurance plans in India.

Before wrapping up, see the below table for the plans associated with the companies. Please refer to the company website for the full detailed description.

CONCLUSION

When someone is planning for Financial Freedom, Term insurance is being considered as the most important thing in their portfolio. This will not only provide financial support to their beloved ones but also gives security to attain their future goals without the policyholder’s presence.

Happy Planning your future !

Check out our Detailed article on Covid-19 health insurance in India.

If you have queries, Please mail us @ mailto1stopinvestment@gmail.com!

Great content! Super high-quality! Keep it up! 🙂

Pingback: How can you spend this Lockdown that may change your financial life forever - 1stopinvestment.com

Like!! Thank you for publishing this awesome article.

In exclusion section – ‘Murder of policyholder’ is not exactly true.

In case the insured gets murdered by the beneficiary and the investigation reveals the involvement of the nominee in the crime, the insurance company will reject the claim.Otherwise nominee gets SA.