Are you looking for any below ?

What is SCSS?

SCSS stands for Senior Citizens Savings Scheme. The Government of India introduced this scheme in 2004 to provide financial certainty to senior citizens with guaranteed regular income every quarter. This scheme is one of the best choices for the post-retirement planning for a regular income stream with the retirement corpus available. The Capital invested in this scheme is completely safe and guaranteed by the government.

Who can open Senior Citizens Savings Scheme?

Any Indian resident who aged above 60 on the date of opening is eligible for SCSS.

Any other Indian residents aged between 55 to 60, who have retired under a voluntary retirement scheme are also eligible to open the SCSS account with the 3 months of the date of retirement. A certificate from the employer is to be submitted while opening the account.

Any retired defense service employee (excluding Civilian defense Employees) are eligible for this scheme irrespective of the above age limits subject to fulfillment of other specified conditions.

If the depositor’s status changed to NRI during the currency of the account, the account shall be continued till the maturity period and no further extension is allowed on such account.

Where can it be opened?

A Senior citizen can open an account at any post office or authorized banks by submitting Form-A along with the amount of deposit in Form-D along with age proof.

A joint account is eligible with Spouse.

While opening the account, the post office issue a passbook to investors with nominee details.

Nominee

The depositor has to indicate a nominee for the SCSS account. In an unfortunate event of death of the depositor, the nominee will receive the payments.

In the case of a Joint account, the spouse is eligible to make changes in the nomination after the death of the depositor.

How long has to Invest :

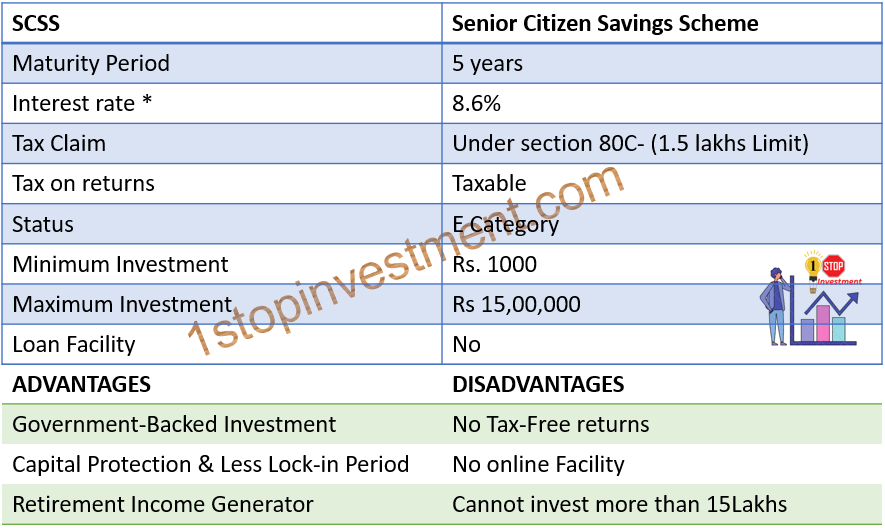

The Investor has to remain invested in this account for 5 years

Extension Period

The Investor is also eligible for the extension for a further period of 3 years.

How Risk-Free it is :

Since Government of India sponsors this scheme, it provides Capital protection and regular income to the investor. This is more suitable for the Retired people who don’t want to take the further risk in their Financial planning.

Interest Rate

The Current Interest rate is 8.2%. (Q3 FY2024-25)

Check out this page for latest interest rates for all Post office schemes

https://www.1stopinvestment.com/post-office-small-saving-schemes-interest-rates/

The below graph shows the historic rates of Interest for this scheme.

Compounding frequency

No Compounding. Simple Interest rate is calculated and interest shall be paid on 1st working day of April/July/October/January.

Interest credited into the account will not earn any additional interest.

Income Tax Benefits:

Tax deduction up to Rs 1,50,000 shall be claimed under Section 80C of the Income Tax Act,1961.

The Interest received is Taxable. If the Interest earned is more than 50,000 then TDS applies to the interest earned.

Investment payments / Deposits:

The payment mode shall be in cash if the deposit is below one lakh rupees.

More than one lakh rupees, It should be in the form of Cheque or Demand Draft(DD).

The minimum deposit is Rs.1000 or in multiples of 1000 and Maximum investment can be 15 lakhs. However, the deposit should be a lump sum single time investment.

Premature Closure

The scheme allows premature closure at any time due to the death of a depositor without any penalty charges.

Also, the scheme does not allow during the first year of completion.

However, after one year but before the completion of 2nd year, It allows premature closure with a penalty charge of 1.5% of the deposit.

Similarly, after 2 years of completion, it allows premature closure with a penalty charge of 1.0% of the deposit.

Extended accounts shall be closed without any penalty.

Partial Withdrawal

SCSS does not allow partial withdrawal option.

Transfer Options

The portability of the account from one deposit office to another is available.

Loan Facility

No Loan Facility is available.

Summary

Example / Illustration

Use this SCSS Calculator → https://www.1stopinvestment.com/calculator/scss-calculator/

Conclusion

So for the Retired peoples, this is the best option to lock-in their 15 lakhs and get periodical returns with the Capital protection.

Happy Reading Investors..

Click here to read more articles.

Get to know our Excel Templates here for your DIY investing…

Interest rates are now changed.