Are you looking for any below ?

What is Tax Saving Fixed Deposit?

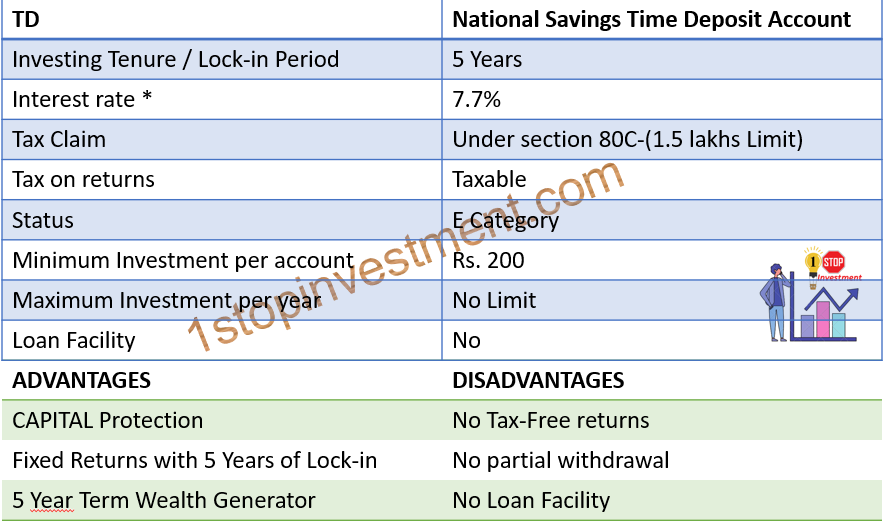

Tax saving fixed deposit (FD) is a type of fixed deposit with 5 year tenure where one can avail tax deduction upto 1.5Lakhs u/s 80C of the Indian Income Tax Act, 1961.

It is available in Postoffice or bank. In the Post office, it is called as TD.

TD stands for Term Deposit or Time Deposit in the Post office. The Central Government launched this scheme in 1982 and it’s continuing scheme because of the features it offers to the investors. This scheme is for the investors who want CAPITAL Protection and their short goal period is beyond 5 years. The Capital invested in this scheme is completely safe and guaranteed by the government.

Who can open this FD?

Only Indian resident is eligible for term deposit schemes

A resident can open any number of TD accounts.

A joint account can also be opened.

Parents or legal guardians can also open on behalf of a minor.

- NRI’s & HUF’s are not eligible for this scheme.

If the depositor’s status changed to NRI during the currency of the account, they may continue such an account till its maturity on a Non-Repatriation Basis.

Types of Accounts Availablity:

There are 4 kinds of accounts available with different interest rates applicable to each account.

- 1-year account,

- 2- year account,

- 3- year account and

- 5- year account -Tax Saving Fixed Deposit

Where can it be opened?

The account can be opened at any post office or authorized banks.

While opening the account, a Passbook will be given with investor and nominee details and Maturity date with value.

Nominee

The depositor has to indicate a nominee for the TD account. In an unfortunate event of death of the depositor, the nominee will receive the payments.

In the case of a Joint account, Joint holders are eligible to make changes in the nomination after the death of the one joint holder.

How long has to Invest :

The Investor has to remain invested in this account for any year depends on the type of account he/she chosen while opening the account.

A depositor has to make only one deposit in an account.

This scheme has the auto-renewal facility and when the investors don’t withdraw on the maturity date, it gets renewed for the interest rate on the date of maturity for the initially opened period.

How Risk-Free it is :

It provides Capital protection and Fixed Returns to the investor like any other PO schemes. This is more suitable for the people who don’t want to take any risk in their Financial planning.

Interest Rate

The Current Interest rate is 6.7% for 5 Years period. The Interest rate will remain the same throughout the tenure even if there is a change in interest thereafter. The interest rates have been reviewed by the finance ministry every quarter.

The Current Interest rate is 5.5% for the 1,2,3 years.

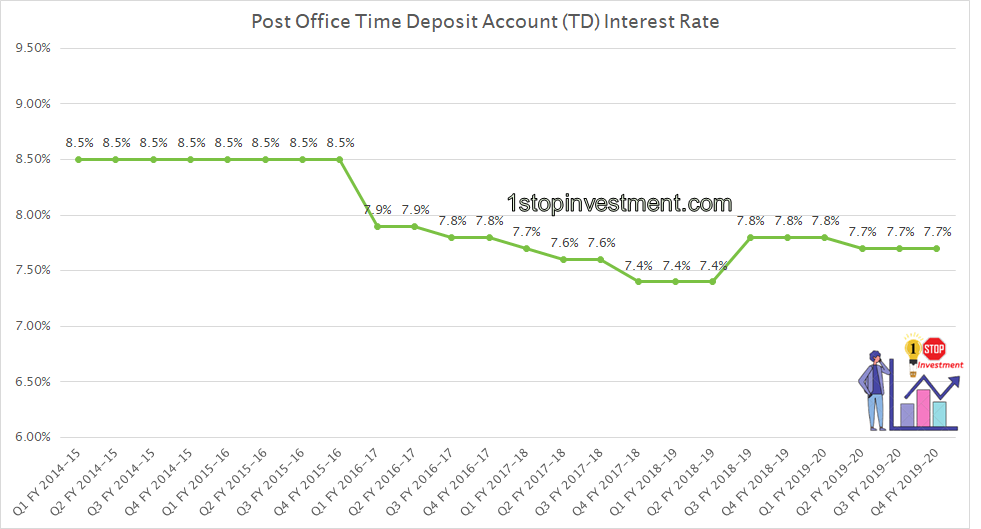

The below graph shows the historic rates of Interest for this scheme.

*Interest rates mentioned in this graph here as on date 1-Jan-2020.

Compounding frequency

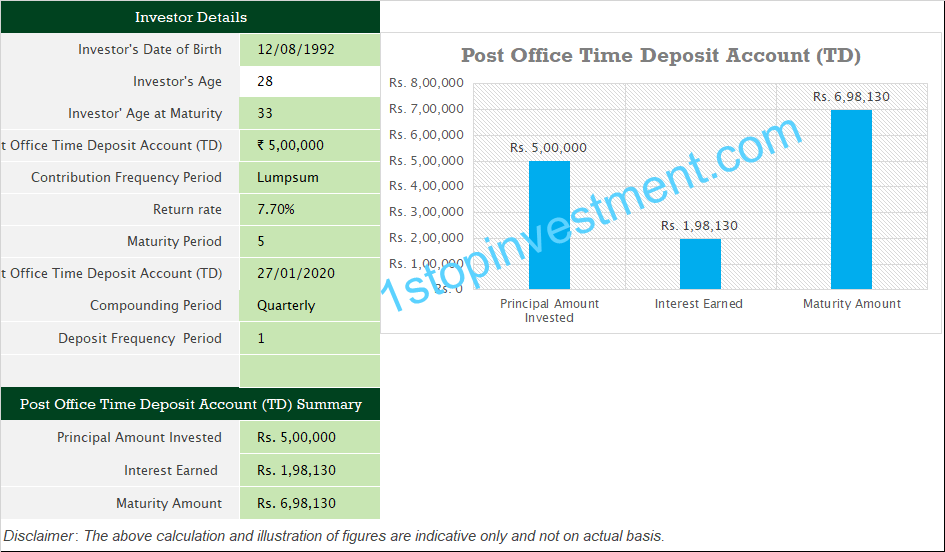

This scheme follows Quarterly Compounding method.

| TIME DEPOSIT INTEREST TABLE | |||

|---|---|---|---|

| YEAR | Amount Deposited |

Interest Earned |

Year End Balance |

| 1 | Rs. 5,00,000 | Rs. 34,351 | Rs. 534,351 |

| 2 | Rs. 34,351 | Rs. 568,702 | |

| 3 | Rs. 34,351 | Rs. 603,053 | |

| 4 | Rs. 34,351 | Rs. 637,405 | |

| 5 | Rs. 34,351 | Rs. 671,756 | |

Income Tax Benefits:

The deposit in the 5 Year Time deposit account is eligible for tax deduction up to Rs 1.5lakhs underSection 80C of the Income Tax Act,1961.

One cannot have any Tax deduction under Section 80C of the Income Tax Act,1961 for any other time deposits.

The Interest received is Taxable.

No TDS applies to the interest earned. However, the depositor has to declare it while filing Income Tax under “Income from Other Sources”.

Investment payments / Deposits

The payment mode shall be in cash if a deposit is below one lakh rupees.

More than one lakh rupees, It should be in the form of Cheque or Demand Draft(DD).

The minimum deposit is Rs.200 and No cap on maximum investment. However, the First deposit should be a denomination of the account.

Premature Closure

This scheme allows premature closure at any time due to the death of a depositor without any penalty charges.

Also, This Scheme allows Premature closure option without any penalty if it’s closed before 1 year from the date of opening. But the Interest rate will be based on Saving bank account interest rates.

Partial Withdrawal

No partial withdrawal is possible.

Transfer Options

The portability of the account from one deposit office to another is available.

Extension Period

Yes. With Auto-renewal option, one can extend the account maturity to another block year.

Loan Facility

No loan facility.

Summary

Example / Illustration

Conclusion

So for the peoples who want to increase wealth for over small tenure, TD is the best option to raise their capital without any risk.

Finally, TD shall be opened for goals like,

- Create a Lumpsum fund for the Investment or buy land.

Using Time deposits, Buy some assets and never make a mistake of buying some liabilities like Bike, Car, TV.

Please check out our FD Calculator available in our website.

Happy Reading Investors.. Click here to read more articles.

Pingback: How can you spend this Lockdown that may change your financial life forever - 1stopinvestment.com