Public Provident Fund ( PPF ) was introduced in India in 1968 by the National Savings Institute of the Ministry of Finance under Indira Gandhi’s tenure. The Central Government is fully backing up this scheme and this is the reason why the investors with less-risk appetite choose this type of investment.

For more details, read on PPF (Public Provident Fund) Scheme-India.

Are you looking for any below ?

PPF Summary :

Option-1 – Lumpsum before April 5th

To gain the maximum interest, the account holder has to make the investment in Lumpsum of Rs.1,50,000 before 5th April every year.

Invested Amount : Rs. 22,50,000

Maturity Amount :Rs. 43,60,517

ROI : 93.80 %

Option-2 – Monthly before April 5th

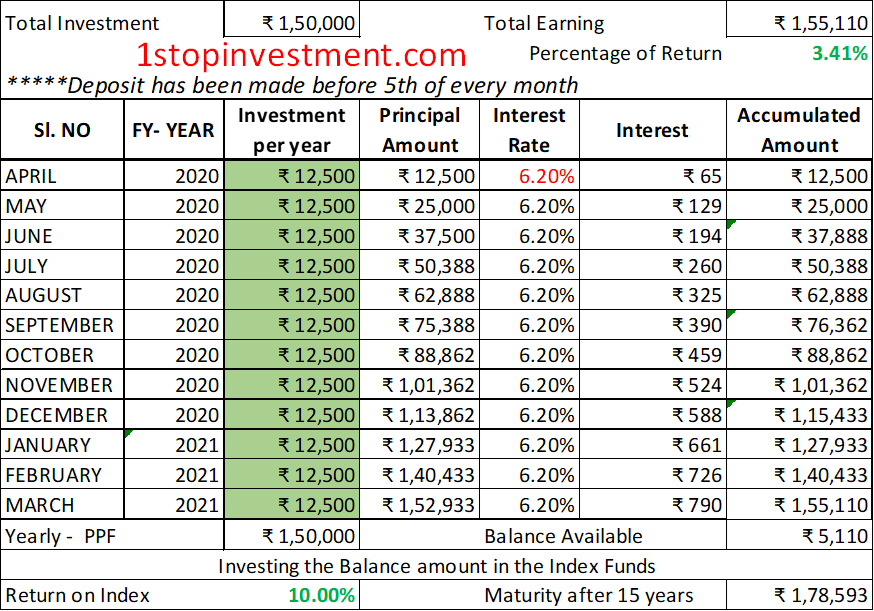

To gain the maximum interest, the account holder has to pay the monthly payment of Rs.12,500 before 5th of every month.

Invested Amount :Rs. 22,50,000

Maturity Amount :Rs. 42,14,190

ROI : 87.30 %

( Which is 6.5% less than the lumpsum method and 1.45L lesser than lumpsum method)

Option-3 – Monthly RD in any banks and Invest the Maturity in PPF.

In this Option, In the First year investor has to invest their monthly instalment in RD and the maturity amount has to be invested in the PPF. There will be a balance amount of near to 5000Rs and investor can invest the same into Index funds.

Invested Amount :Rs. 22,50,000

Maturity Amount :Rs. 45,39,110

ROI : 101.74 %

( Which is 7.95% more than the lumpsum method and 1.78L more than lumpsum method)

*6.2% interest is considered for 1 year RD , Quarterly compounding considered.

CONCLUSION:

Even if you are already doing lumpsum method, from this April you can start RD and follow the option-3. The Option-3 can be modified slightly also and invest the balance amount as per Investor Risk profile. Hope you know the trick to get more returns from PPF.

Please check out PPF Calculator to know your returns.

Share with your friends if you like this way of Investing in PPF.

To read more articles, checkout here.

Pingback: PPF (Public Provident Fund) Scheme-India - 1stopinvestment.com