Hello Readers,

Over the last 70 years, India and the Tax payers have come across different tax slabs since the Independence.

In this post we will see how the tax rates have changed.

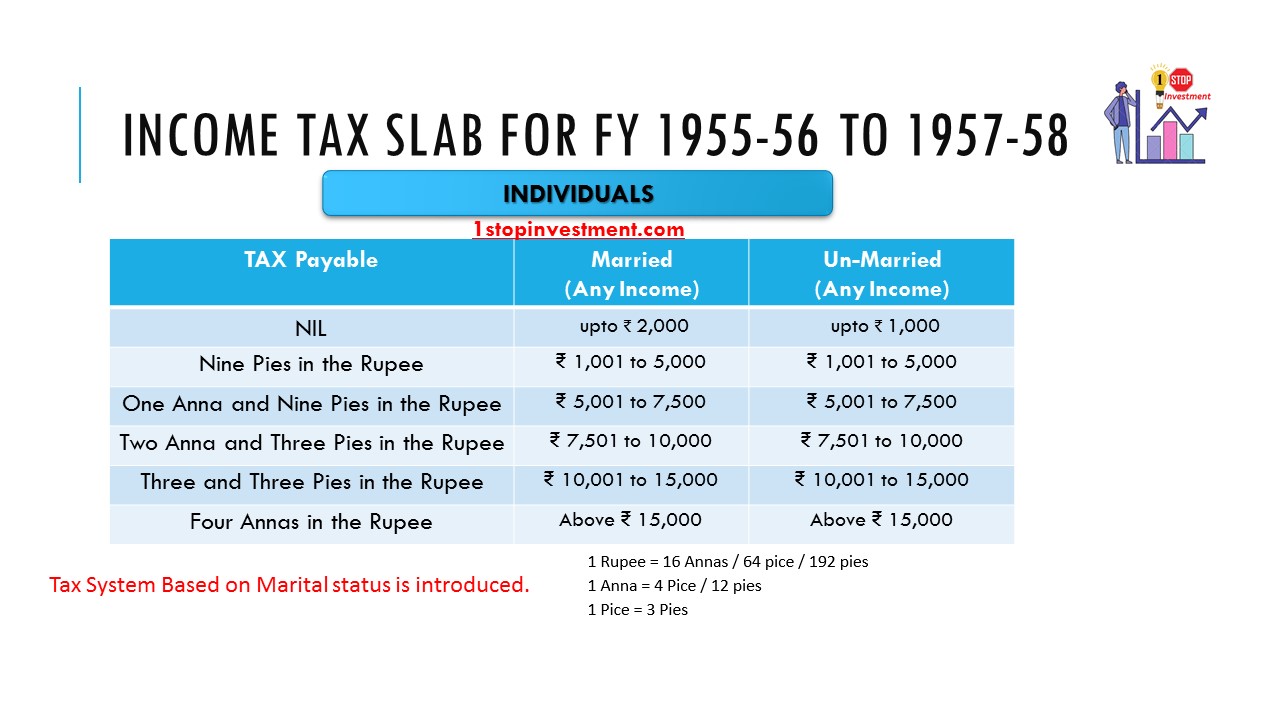

To understand older tax rates, we have to know little bit about our Coin System also.

Are you looking for any below ?

Indian Coin System History:

Post-Independence, first coinage of Republic India where The King’s Portrait was replaced by the Lion Capital of the Ashoka Pillar.

The Indian Monetary System has One Rupee consisting of 192 pies.

- 1 Rupee = 16 Annas / 64 pice / 192 pies

- 1 Anna = 4 Pice / 12 pies

- 1 Pice = 3 Pies

The above system was followed till 1957.After that, Rupee is converted to decimal series. Rupee is equal to 100 Naya Paise. After 1964, the word “Naya” is dropped.

Read the most popular article here :

Are you tired of switching multiple apps to track your fund performance ? – Solution to this is, Use an Automated Mutual fund Portfolio Tracker Spreadsheet

What is an Income Tax Slab?

An Income Tax Slab in India refers to a system where income is divided into ranges, and each range is taxed at a specific rate. As a person’s income increases, the applicable tax rate also increases, making it a progressive tax system.

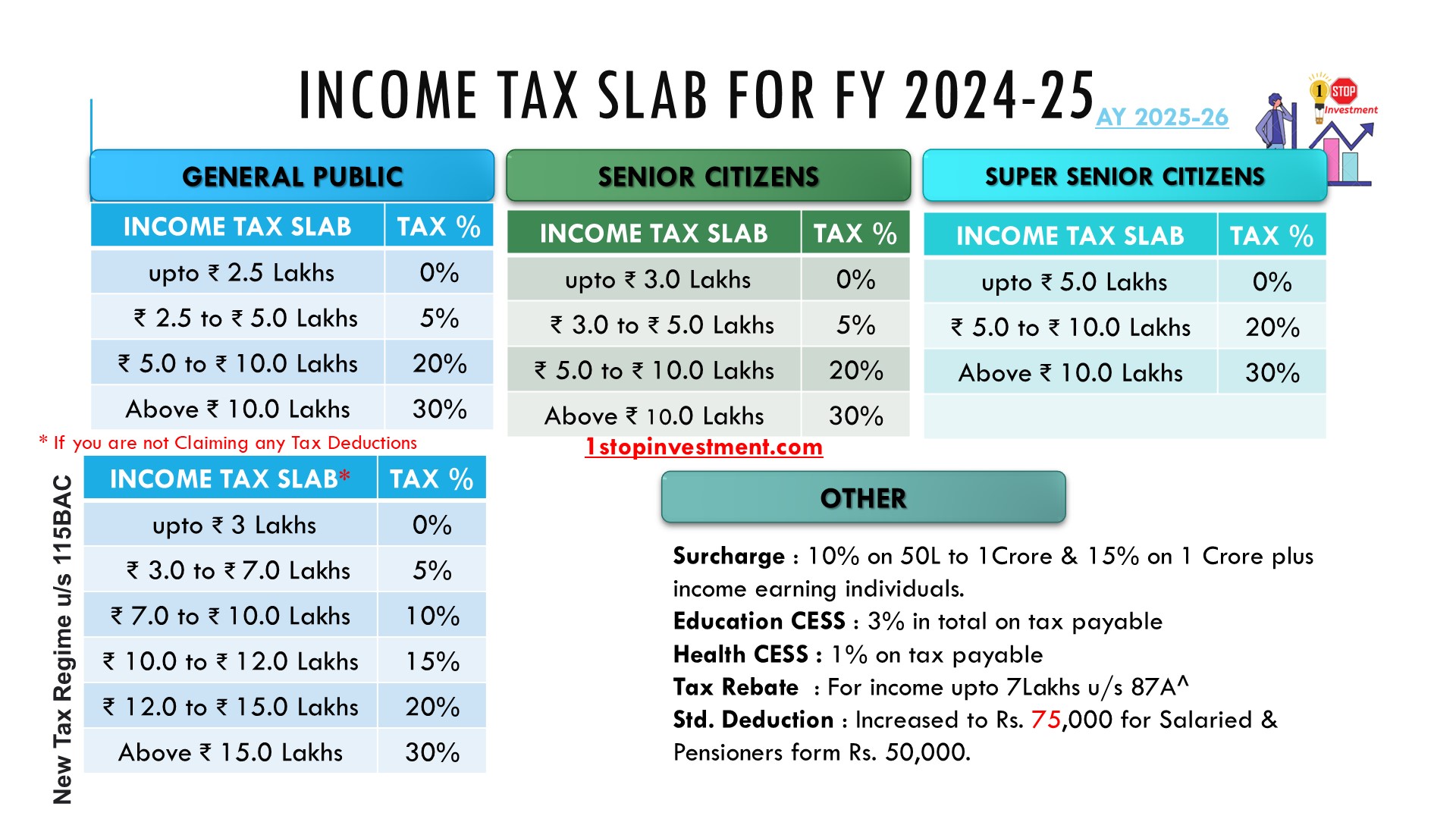

Income Tax Slabs for Individuals for the FY 2024 – 2025: (Latest Financial Year)

Changes made in the Latest Budget 2024 :

- Revised Slabs: The slabs have been revised in the new regime i.e) Slab is expanded by 1 Lakh in the 5% & 10% category and no changes in the old regime.

- NPS Contribution: The deduction limit on employer’s contribution to NPS has been increased to 14% from previous 10%.

- Increased Standard Deduction: To Rs 75,000 from Rs.50,000

Income Tax Slabs for Individuals for the FY 1947-48 & 1948-49

FY 1949-50 to FY 1954-55

Late finance minister, John Mathai has reduced tax on incomes up to Rs 10,000 by a quarter of an anna.(3 Pies)

Maximum rate of income tax reduced from 5 annas to 4 annas. Wealth tax comes in.

The same tax system is followed for 6 years.

Income Tax Slabs for Individuals for the FY 1955-56 to 1957-58

There comes two tax different slab system for Married and Unmarried peoples.

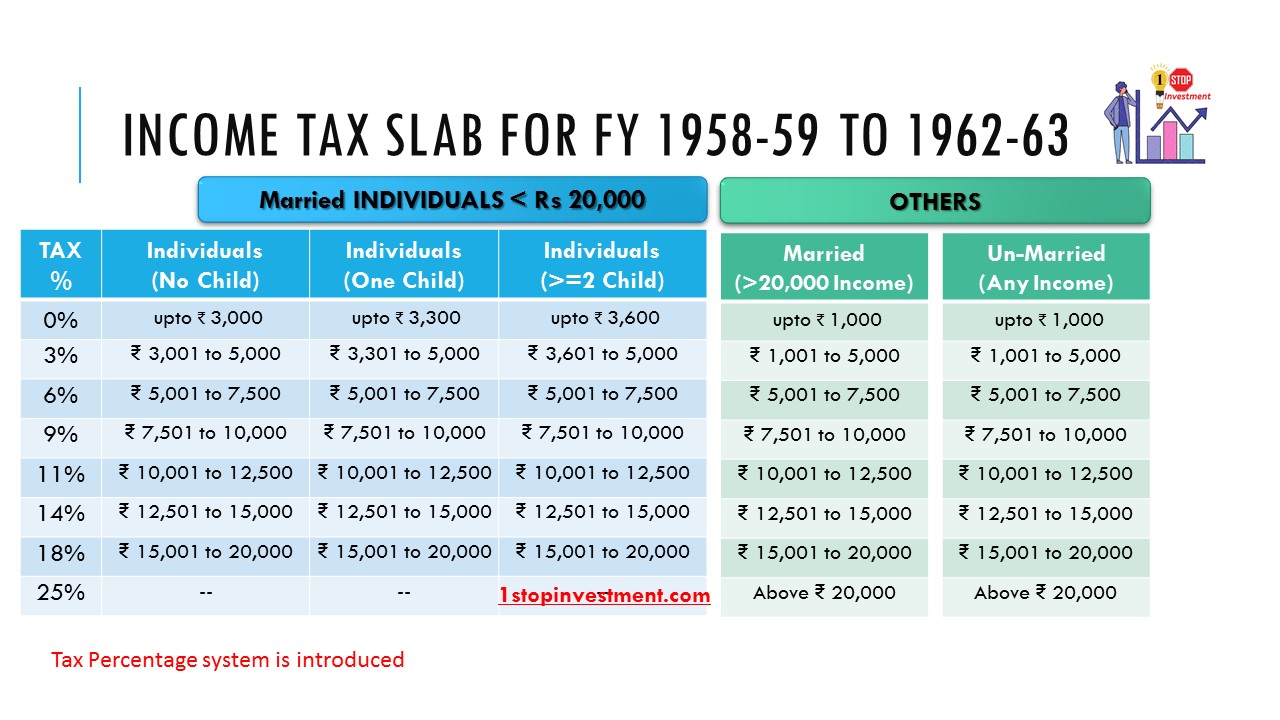

FY 1958-59 to FY 1962-63:

The Tax Percentage system is introduced due to the Decimal series monetary system. The slabs are varied as per the count in the family.

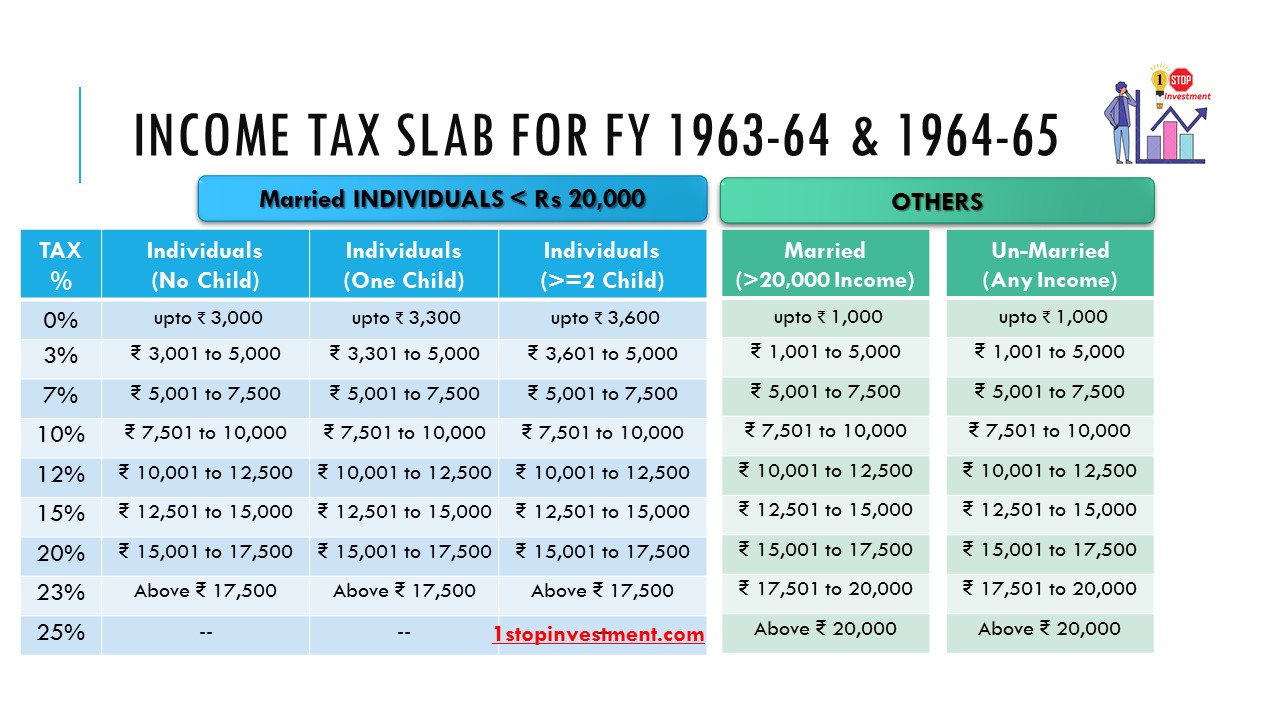

FY 1963-64 to FY 1964-65:

There is increase in Tax percentage and variation in Tax Slab also.

FY 1965-66 to FY 1967-1968:

The Surcharge tax is introduced. Also, Tax slabs are Consolidated into one.

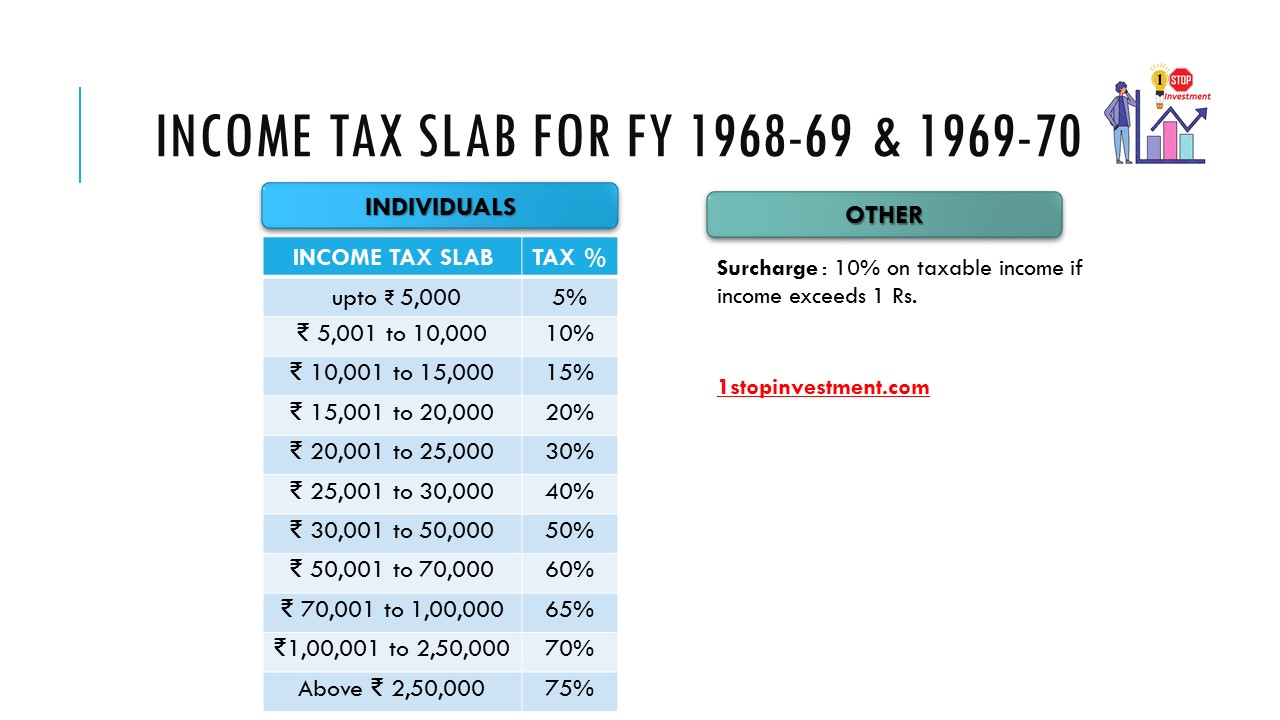

FY 1968-69:

FY 1970-71 to 1973-74:

Again, Zero Income Tax slab is introduced. In 1970-71, the personal income tax had 11 tax brackets with the tax rates progressively rising from 10 per cent to 85 per cent. Even if we add surcharge, the highest slab attracted 93.5 percent tax. In the year 1973-74, the people qualifying under the highest tax slab were imposed with 97.75 percent tax.

This is the Period when the highest tax rate applicable to an individual could have gone up to an astronomical level of 97.50 per cent!

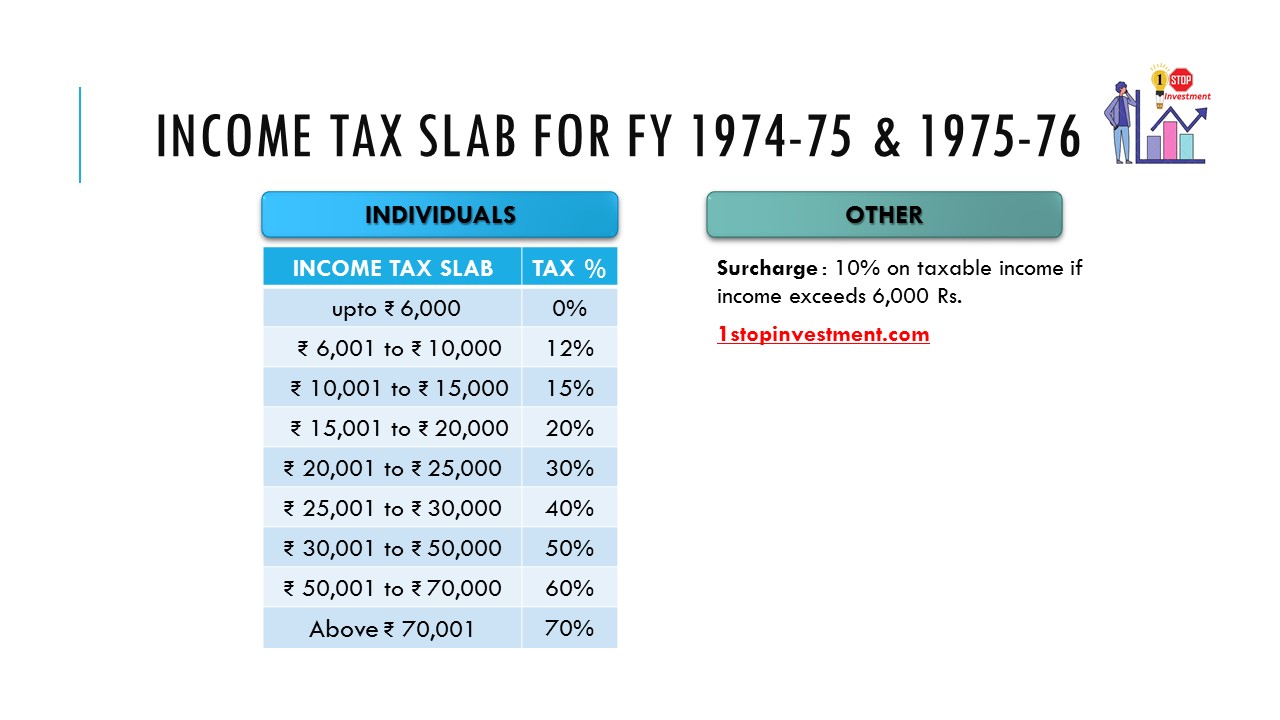

FY 1974-75 & 1975-76:

Few tax slabs were removed from the previous rates.

FY 1976-77 to 1981-82:

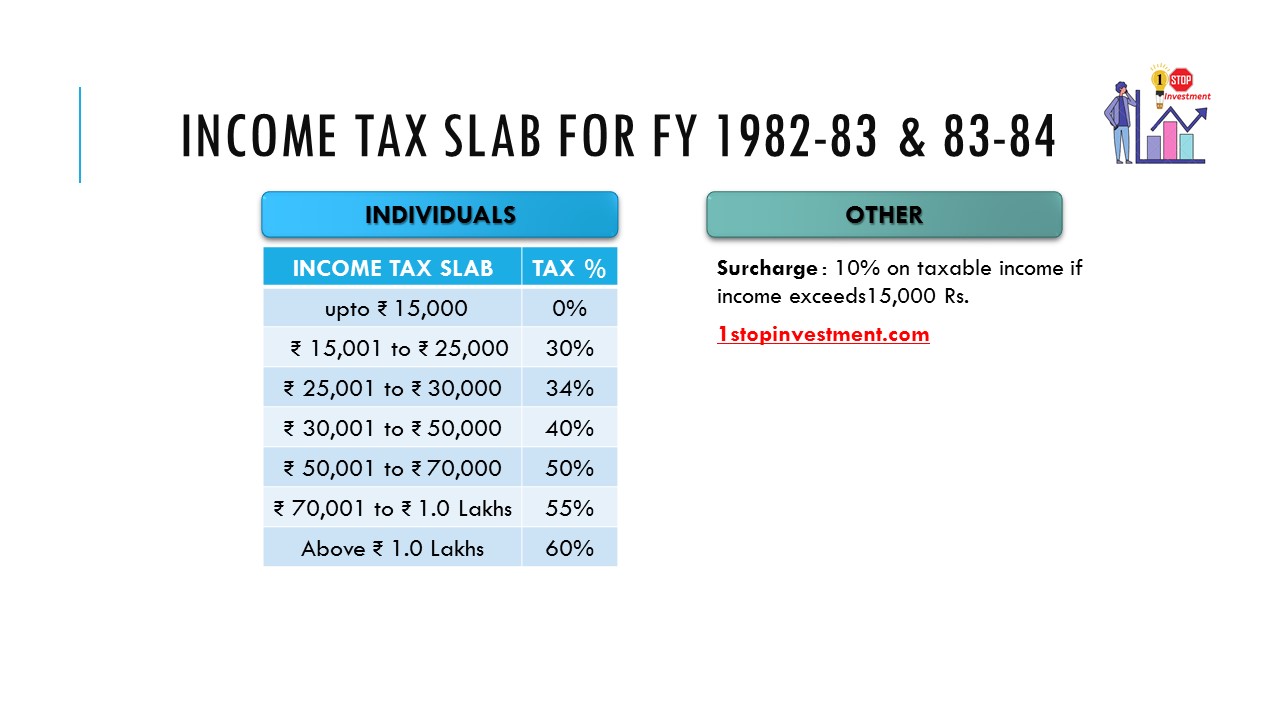

Financial Year 1982-83 & 1983-84:

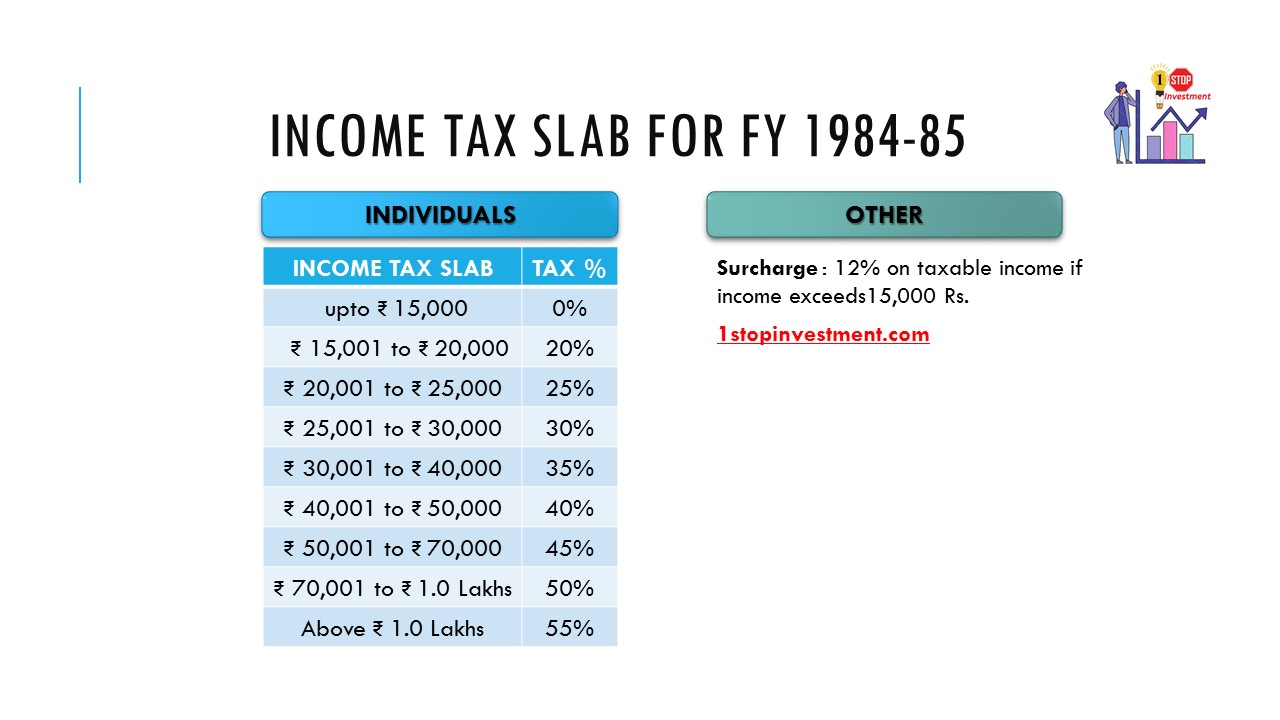

FY 1984-85:

FY 1985-86 to 1989-90:

Income Tax Slabs for Individuals for the FY 1990-91

FY 1991-92

Income Tax Slabs for Individuals for the FY 1992-93

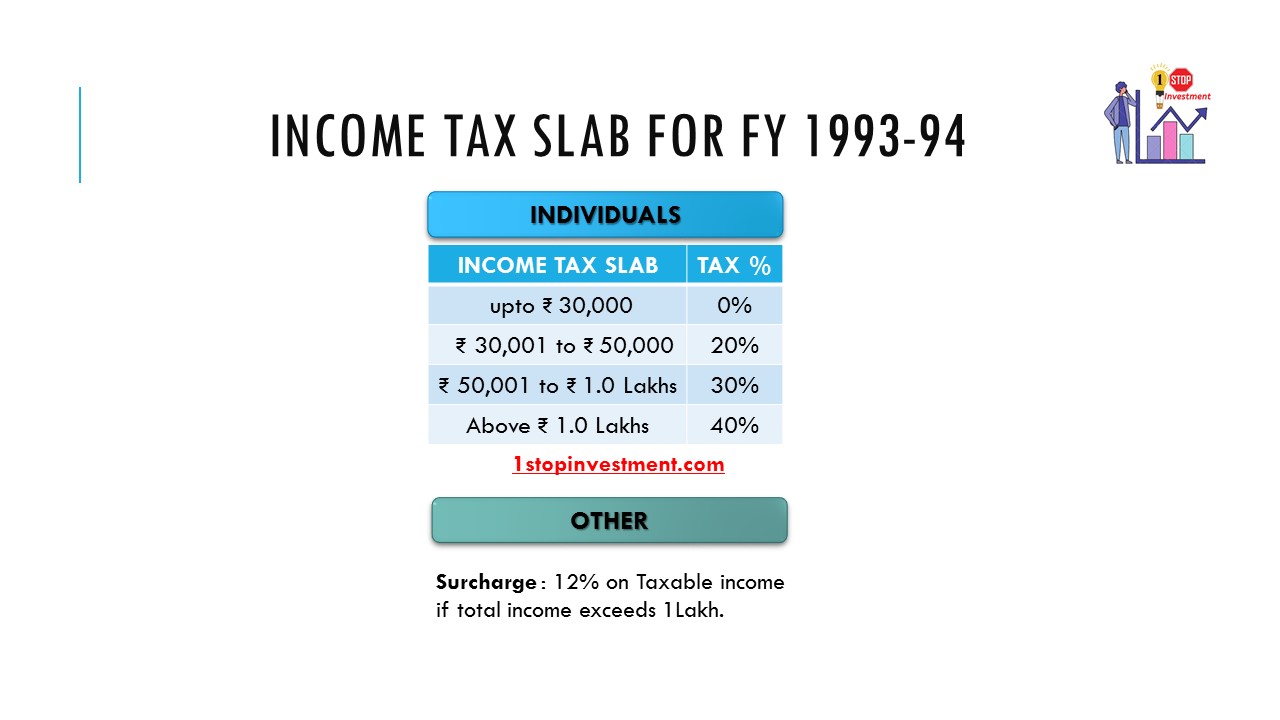

Tax Reform Committee (TRC) advised the Indian government to reduce the tax slabs to three and hence, in the year 1992-93, the same was achieved. The tax slabs were: 20, 30 and 40 percent.

Financial Year 1993-94:

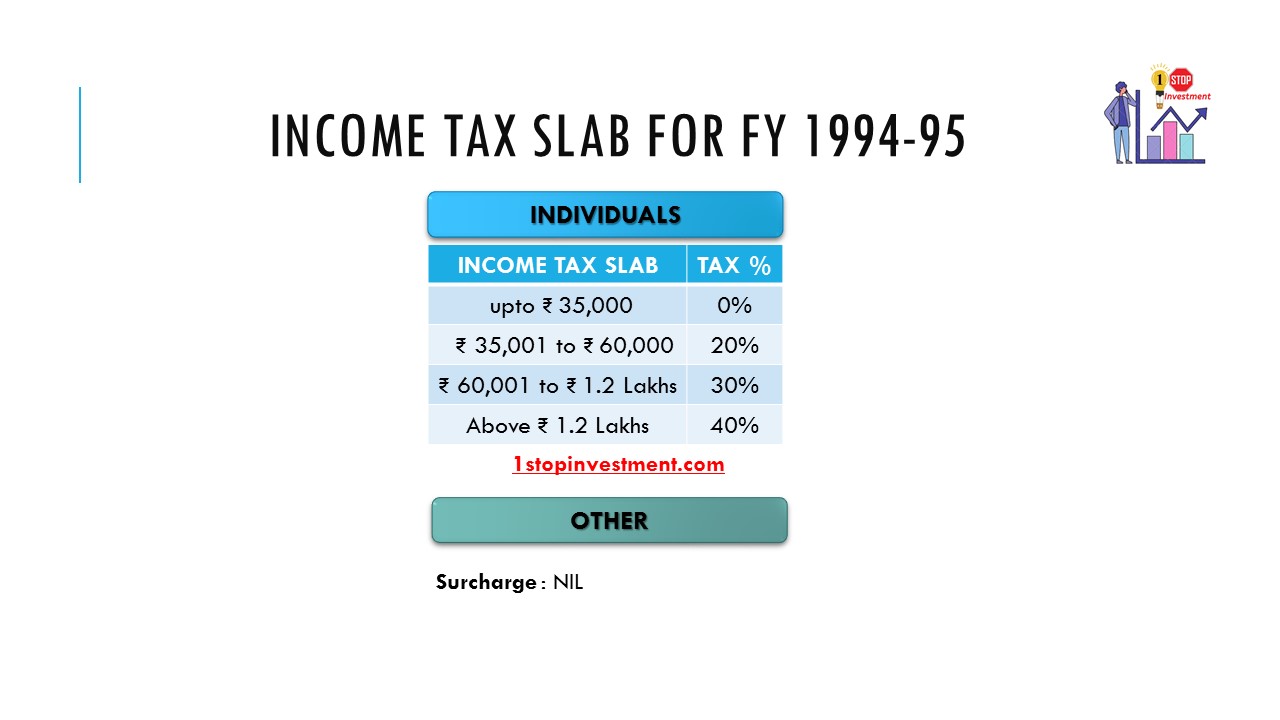

FY 1994-95

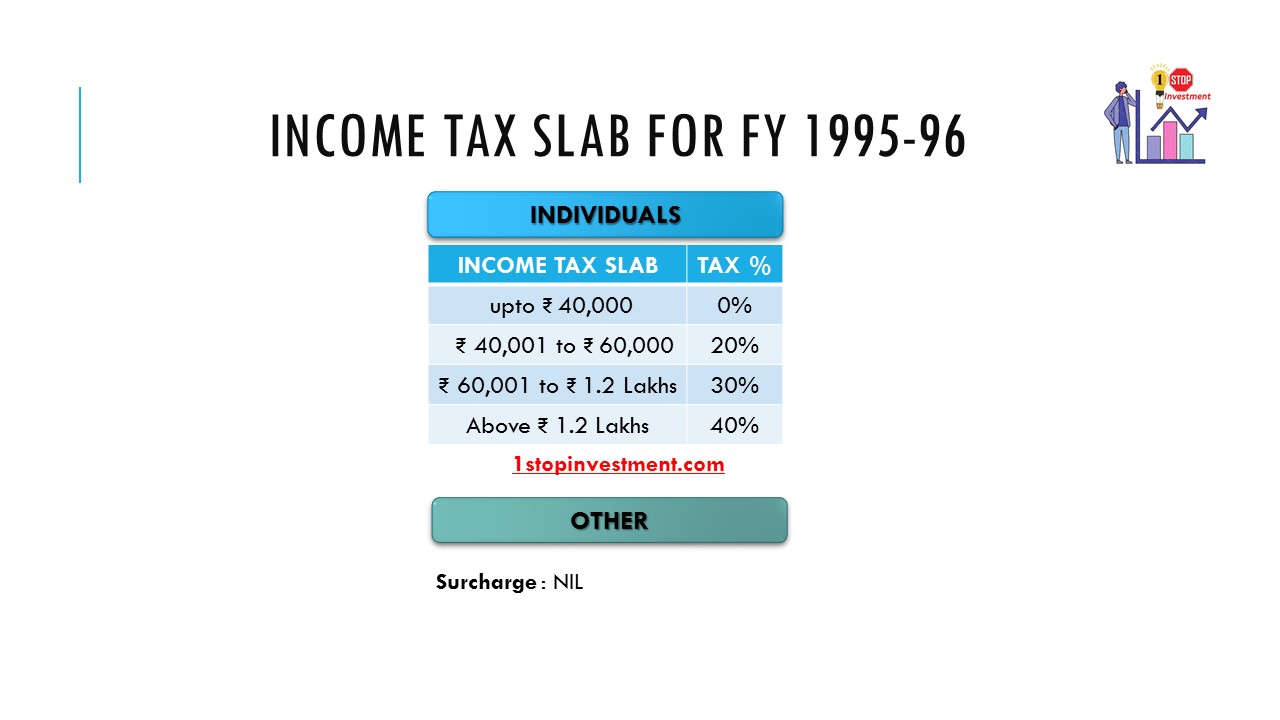

Income Tax Slabs for Individuals for the FY 1995-96

Income Tax Slabs for Individuals for the FY 1996-97

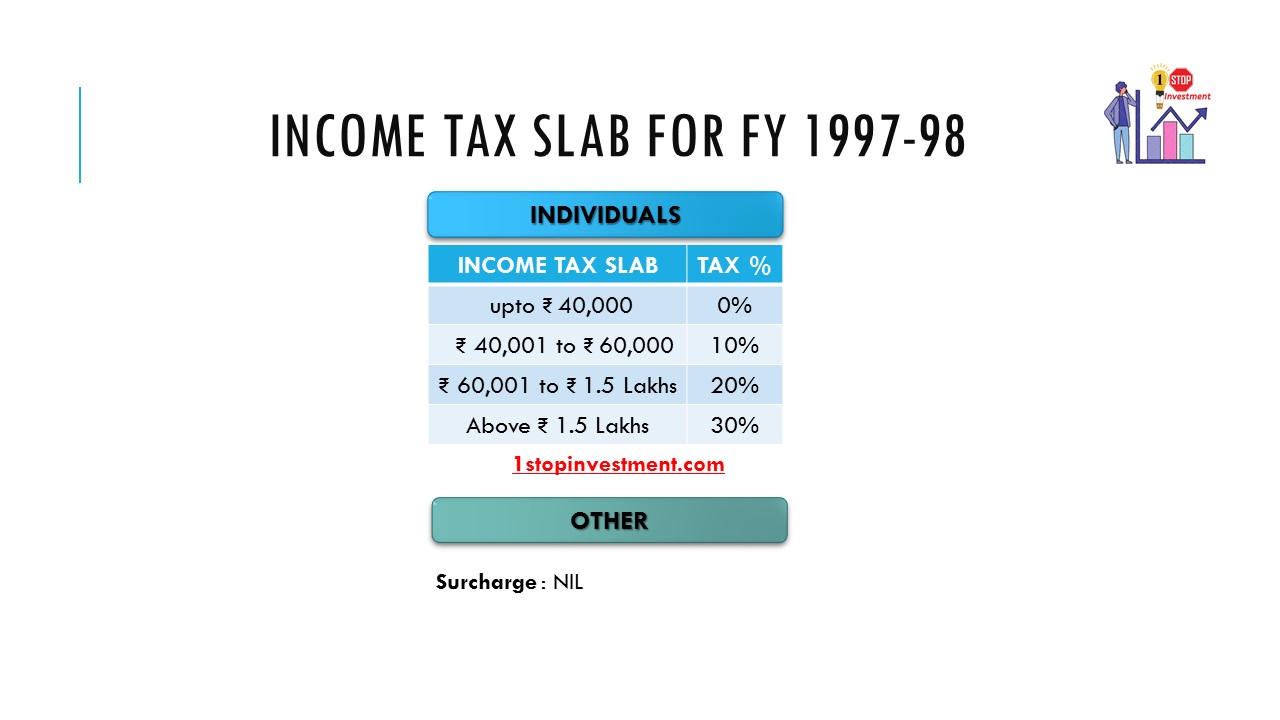

FY 1997-98

The limit of standard deduction was increased to Rs. 20,000 which was applied uniformly to all salaried taxpayers.

Income Tax Slabs for Individuals for the FY 1998-99

Exemption limit raised to Rs 50k. Standard deduction raised to Rs 25k.

Income Tax Slabs for Individuals for the FY 2000 – 2001

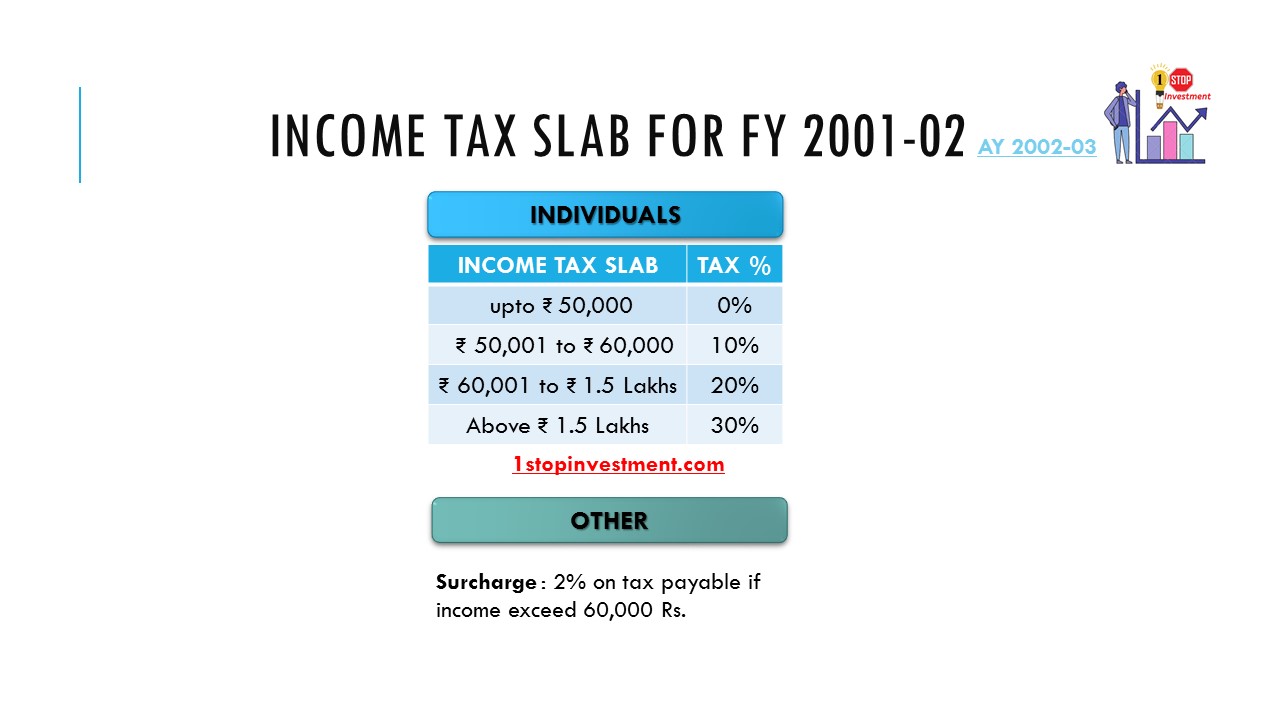

FY 2001 – 2002:

All surcharges abolished except surcharge at the rate of 2 per cent for the National Calamity Fund.

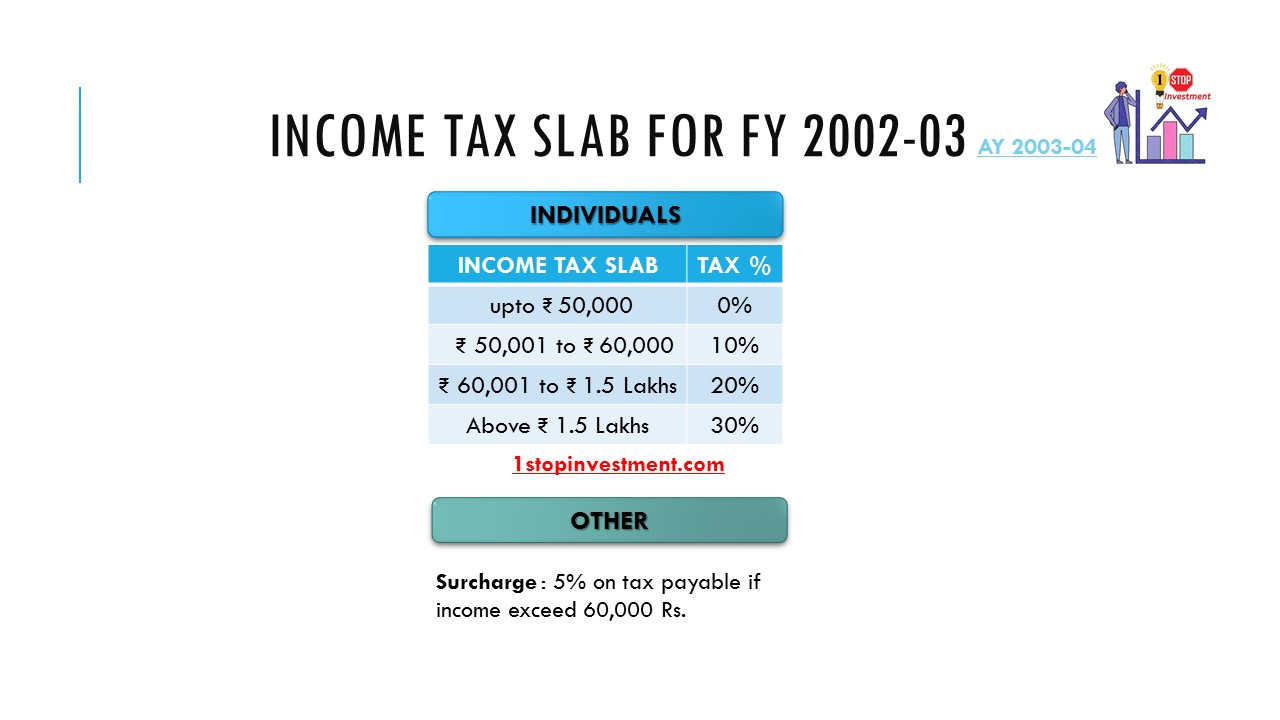

Financial Year 2002 – 2003:

FY 2003 – 2004:

Financial Year 2004 – 2005:

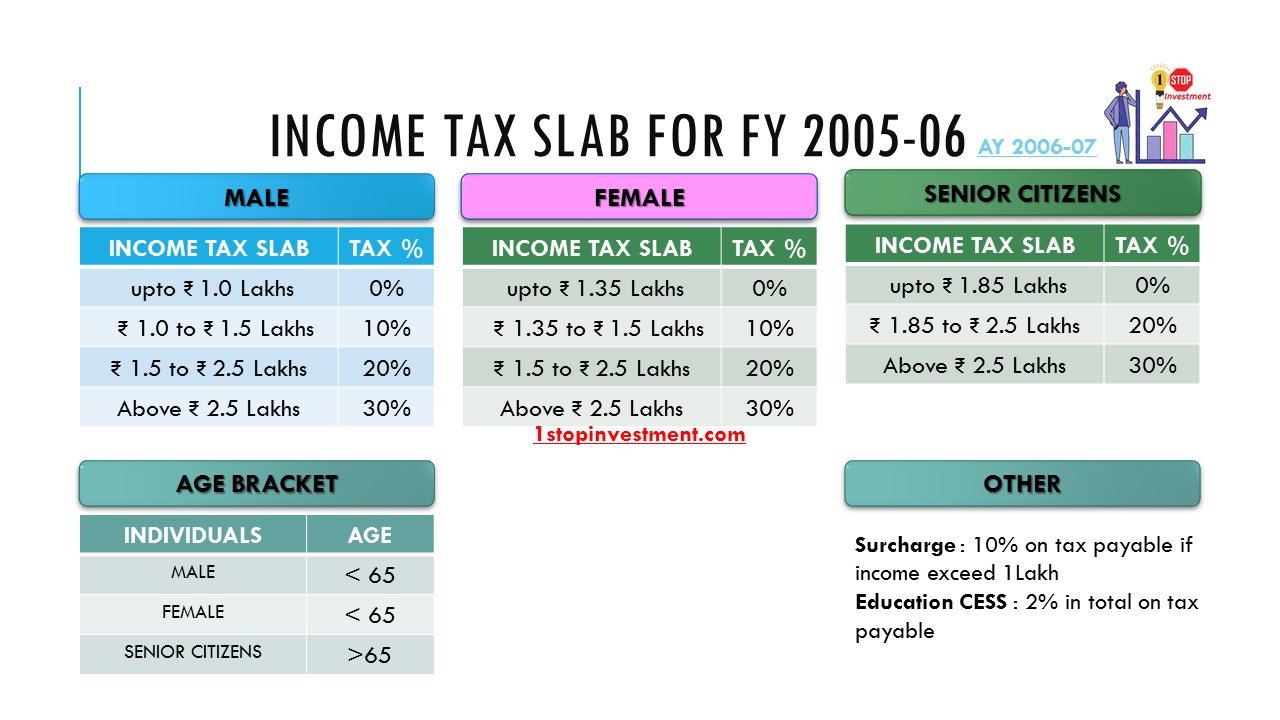

FY 2005 – 2006:

FY 2006 – 2007:

Financial Year 2007 – 2008:

FY 2008 – 2009:

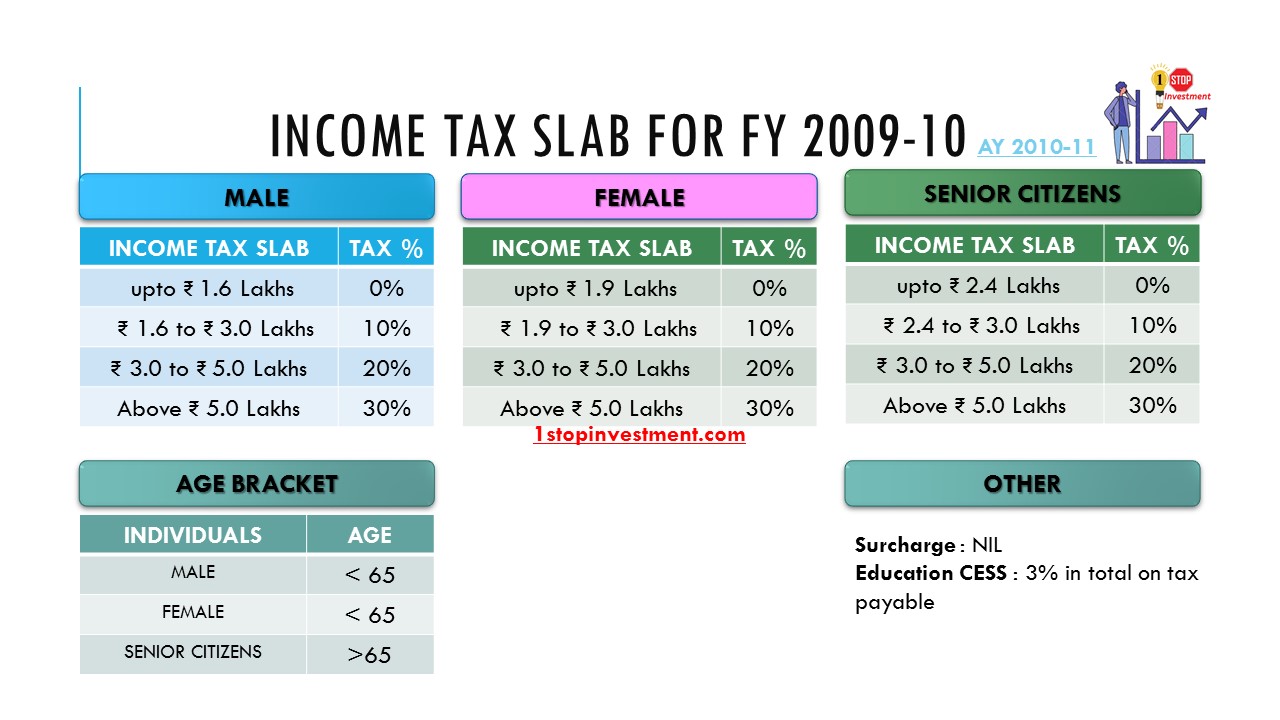

FY 2009 – 2010:

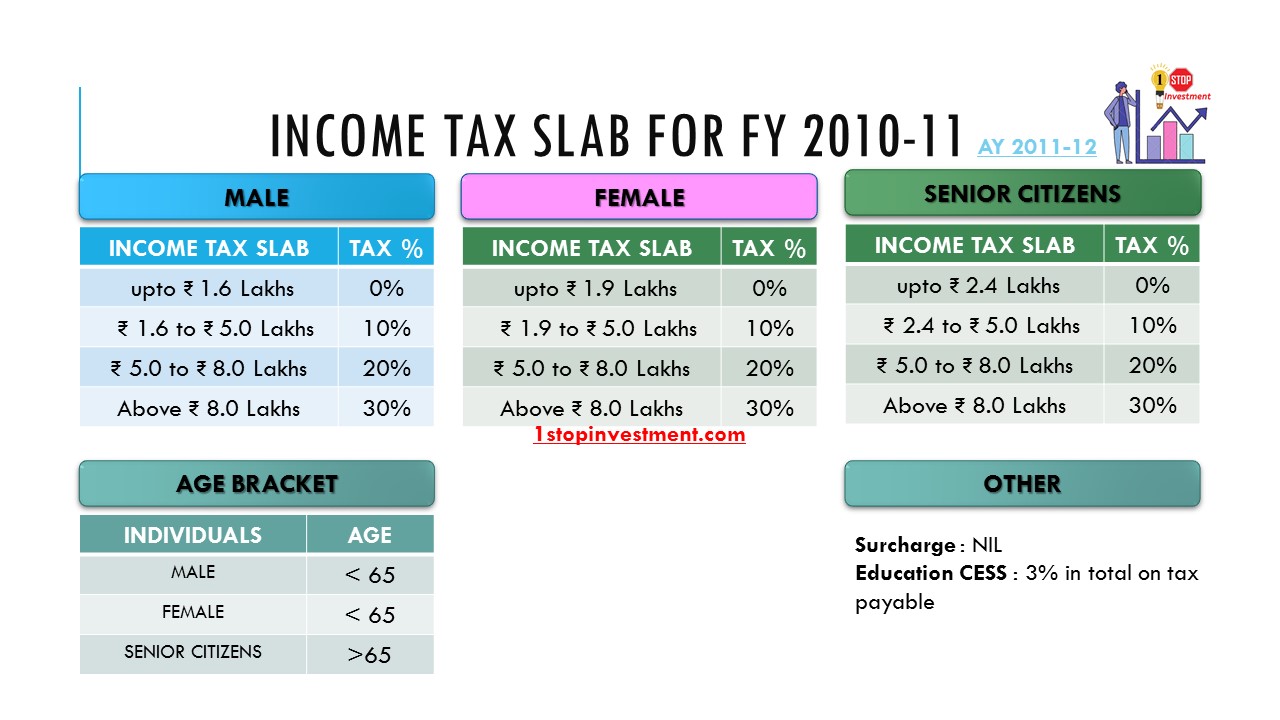

Financial Year 2010 – 2011:

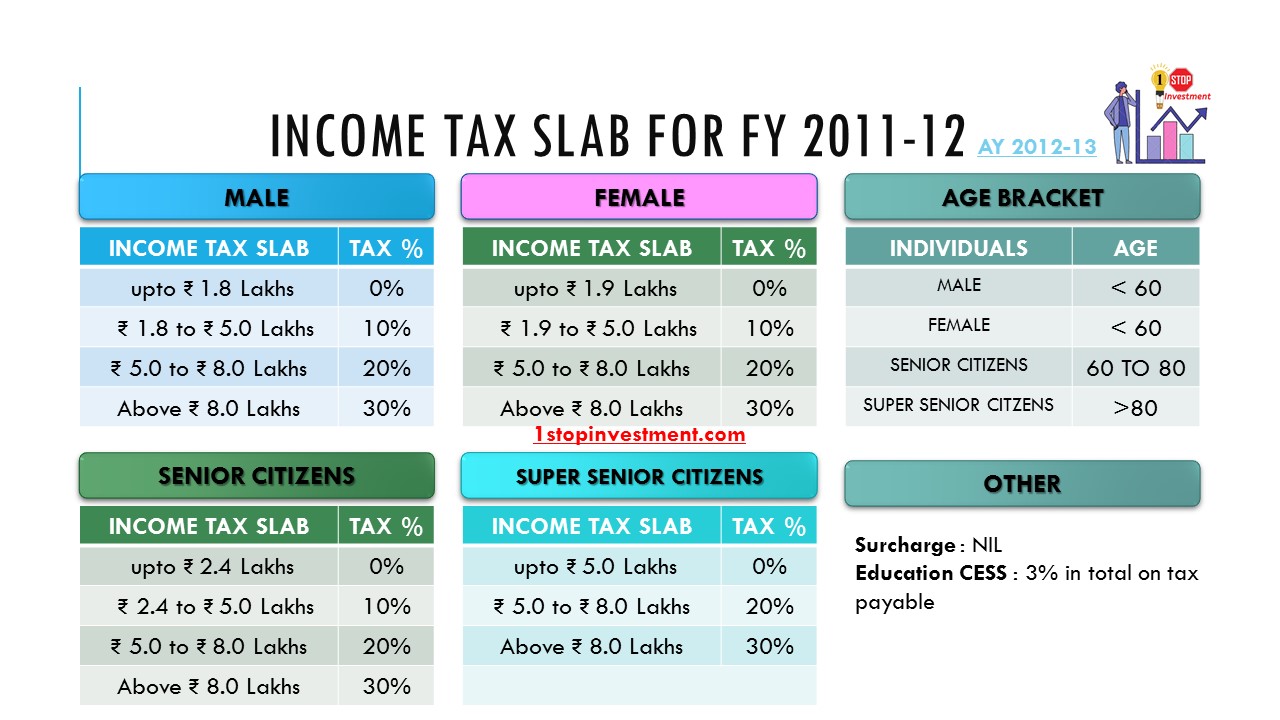

FY 2011 – 2012:

FY 2012 – 2013:

Exemption limit for the general category of individual taxpayers has raised from Rs 1.8 lakh to Rs 2 lakh, and the tax slabs were changed slightly.

Financial Year 2013 – 2014:

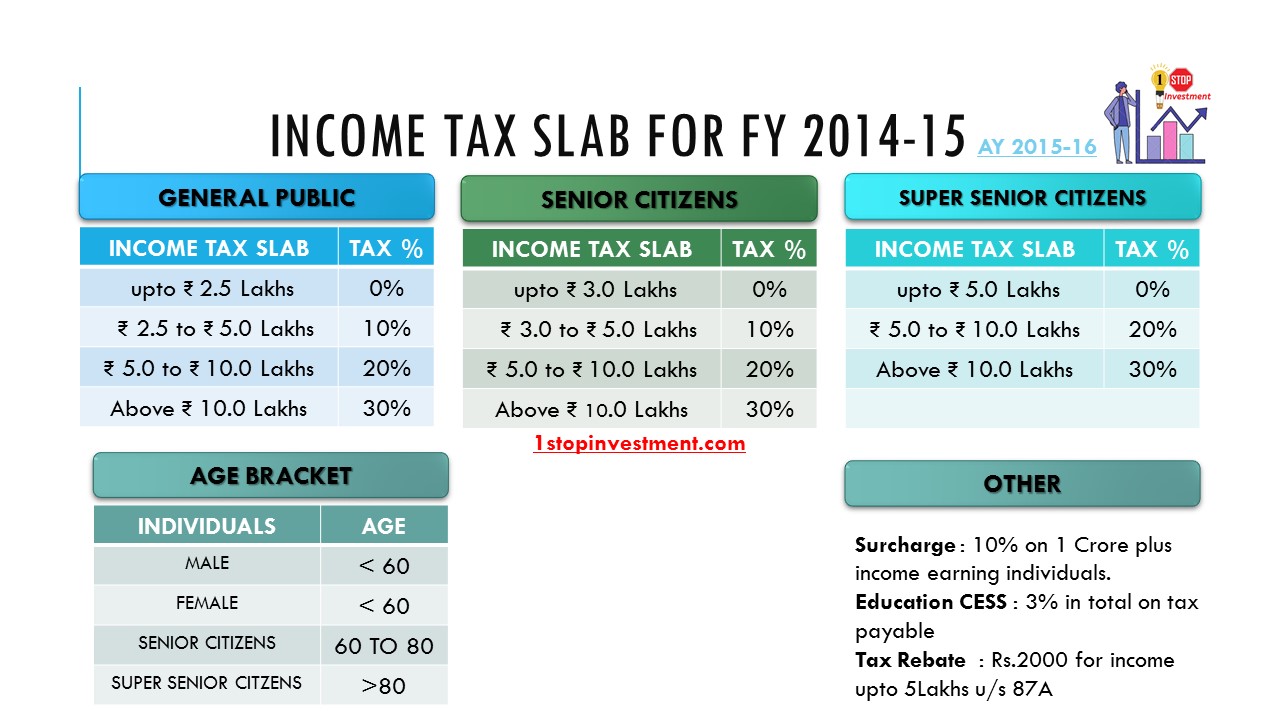

FY 2014 – 2015:

With the passage of Finance Bill, 2015, wealth-tax was abolished with effect from the assessment year 2016-17. The wealth tax was replaced with a surcharge of 2 percent on the super-rich with a taxable income of above Rs 1 crore. Taxpayers, therefore, were not required to file a wealth tax return from Assessment Year 2016-17 onward.

FY 2015 – 2016:

There is no change in the Basic Tax slabs.

Financial Year 2016 – 2017:

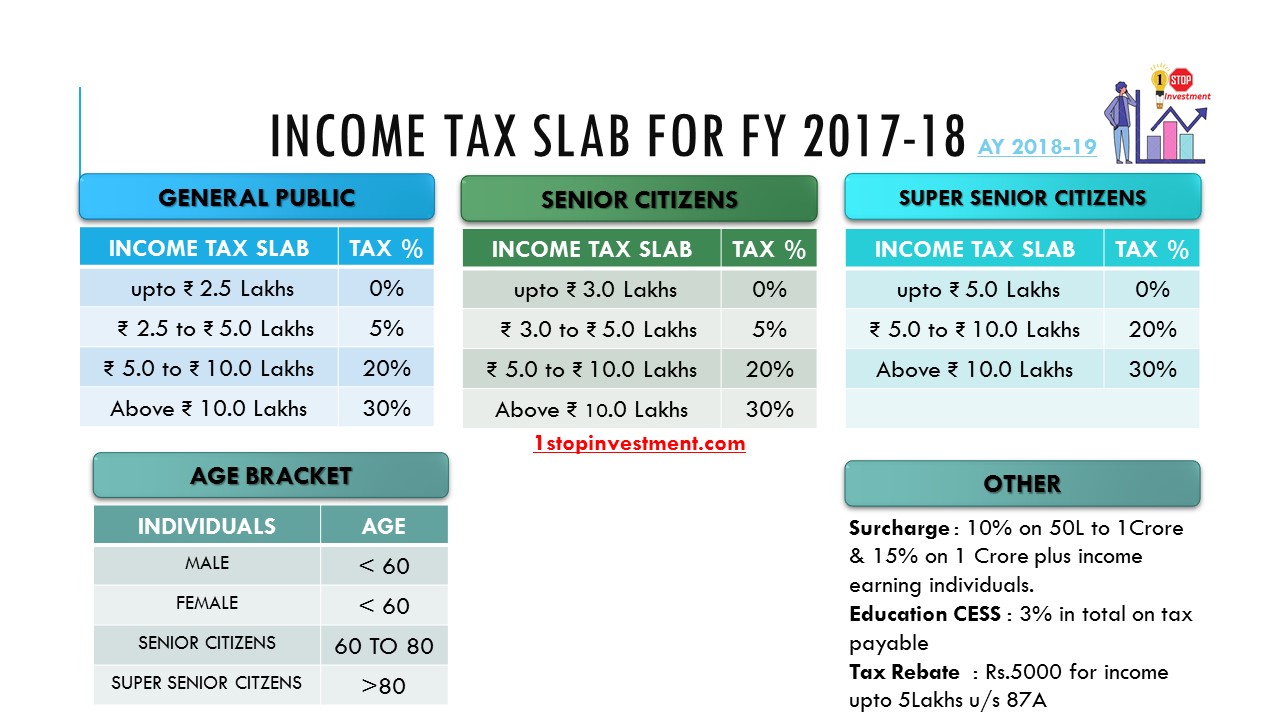

FY 2017 – 2018:

FY 2018 – 2019:

Financial Year 2019 – 2020:

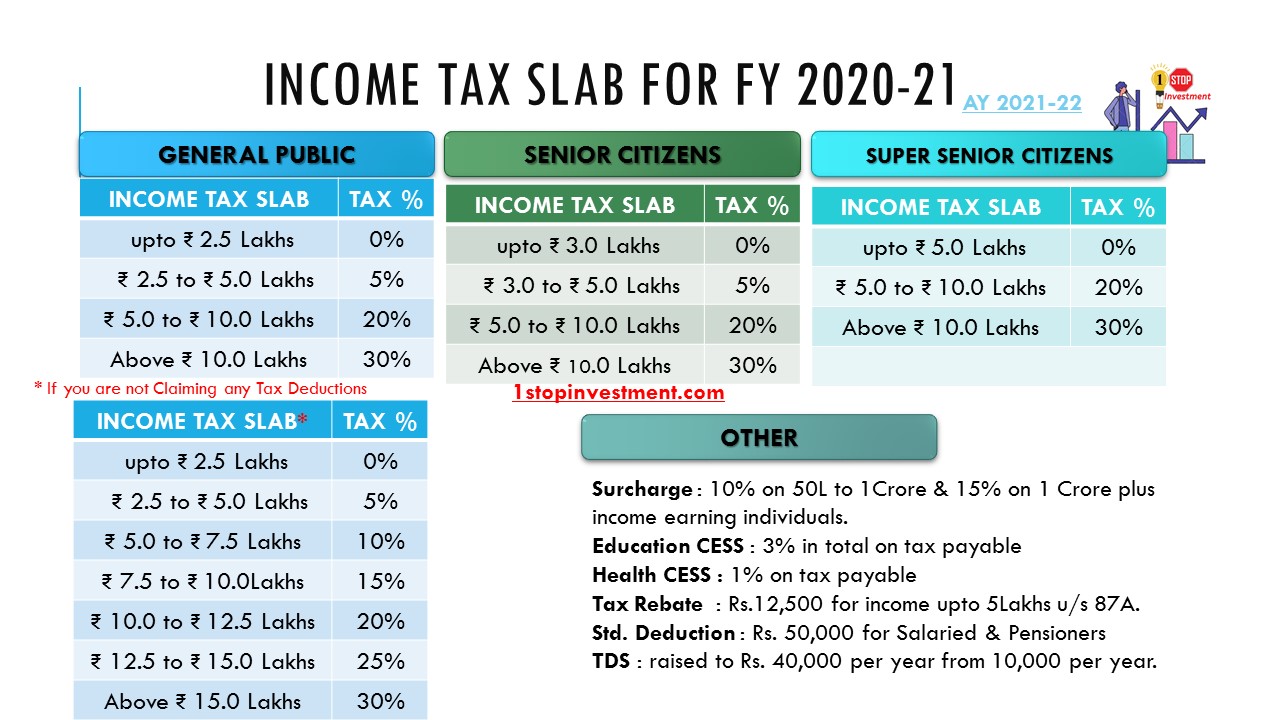

Income Tax Slabs for Individuals for the FY 2020 – 2021:

Income Tax Slabs for Individuals for the FY 2021 – 2022:

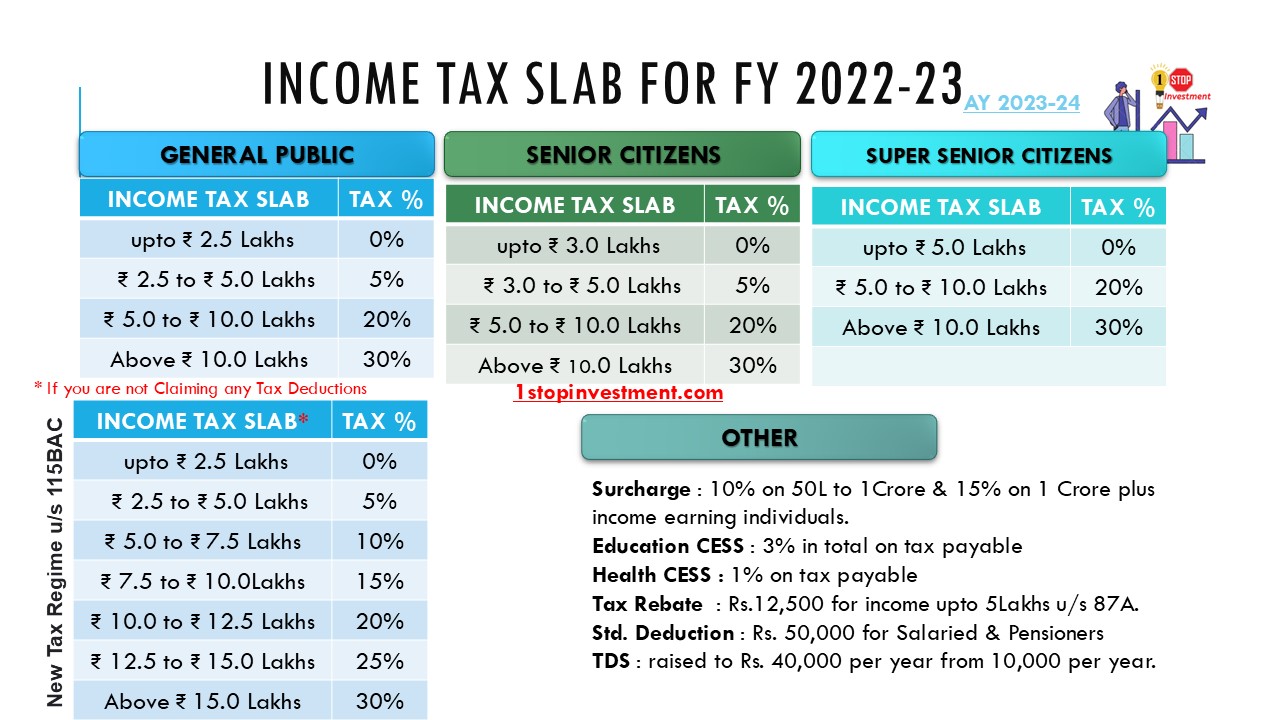

Financial Year 2022 – 2023:

No Change from the previous year.

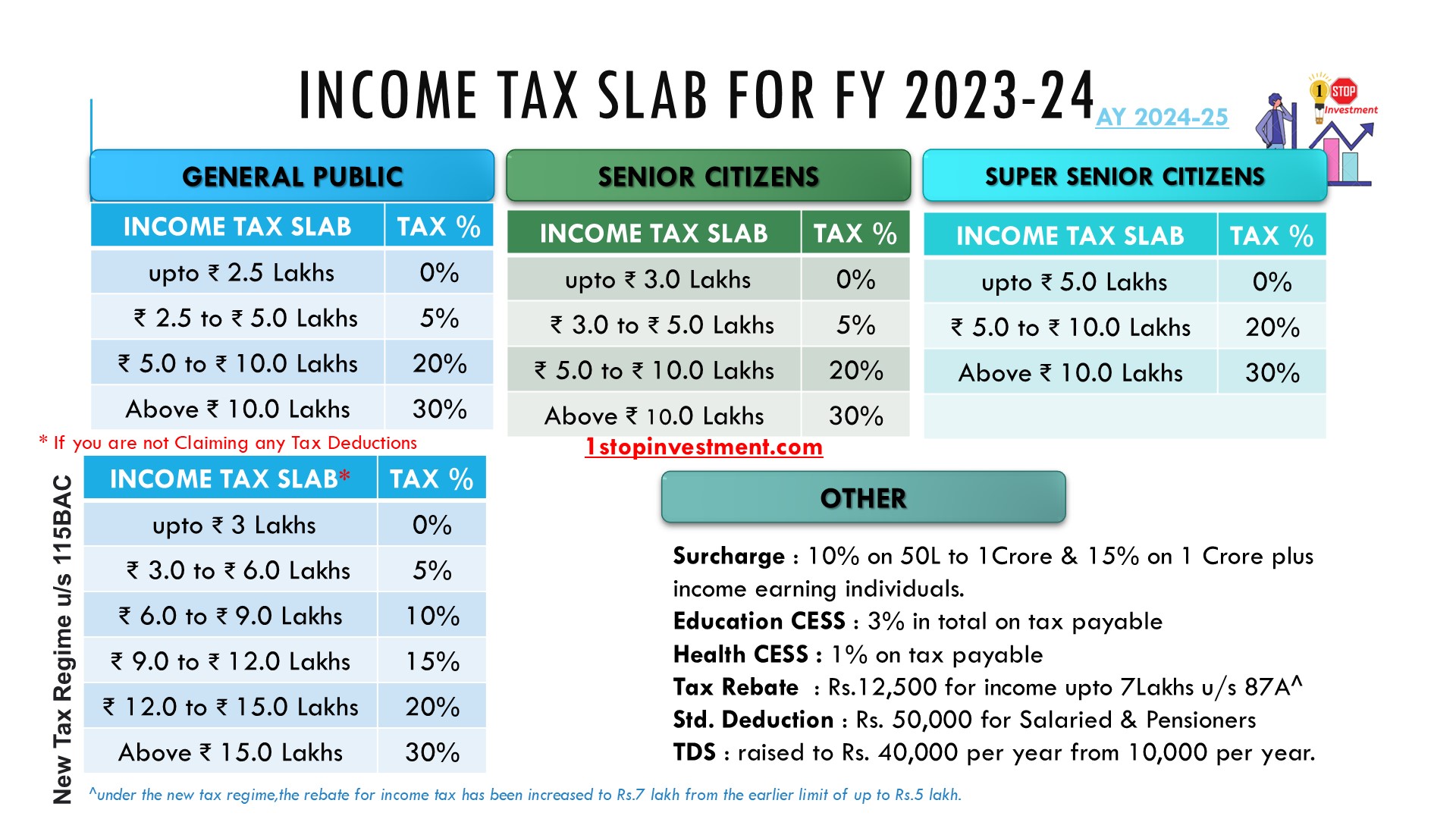

Financial Year 2023 – 2024:

No Changes in the Old Tax Regime. Slabs are revised in the new Tax regime.

CONCLUSION :

As we seen from the above various tax rates,

- Personal income tax rates were extraordinarily high during the decades of 1950-80.

- The personal income tax rates have steadily declined in India, with the maximum marginal rate of income tax coming down from a mind boggling 97.5 per cent to a much more manageable 35.88 per cent.

- So We shall rather complain about our Taxes, we shall know and utilize the tax system efficiently.

Happy Investing and Save Taxes.

Read more other articles here.

Please Check out other Calculators available here and other excel sheets available here!