Happiest Minds Technologies ipo IPO - Details

About the company

Happiest Minds Technologies Ltd is a Bangalore based IT service provider company. The business of the company is divided into three categories ; Digital Business Service (DBS), Product Engineering Service (PES) and Infrastructure and Management Security Service ( IMSS).

(IN Rs. Million)

Financial Performance

Valuation of Happiest Minds Technologies

Earnings Per Share (EPS): INR 7.04

Price/Earnings (PE ratio): 31

Market Cap : 2207 Crore

Return on Net Worth (RONW): 27.10 %

Net Asset Value (NAV): INR26 per share

Contact details

IPO Registrar

KFin Technologies Private Limited, Karvy Selenium Tower B, Plot 31 & 32, Gachibowli, Financial District, Nanakramguda Hyderabad – 500 032, India.

Telephone: +91 40 6716 2222 Fax: +91 40 2343 1551 E-mail: happiestminds.ipo@kfintech.com Website: www.kfintech.com Investor grievance e-mail: einward.ris@kfintech.com Contact Person: M Murali Krishna SEBI Registration No.: INR000000221

IPO Lead Managers

- ICICI Securities Limited

Company Address

Happiest Minds Technologies Ltd

53/1-4, Hosur Main Road,

Madivala (Next to Madivala Police Station),

Bengaluru – 560 068

Phone: +91 80 6196 0300

Email: investors@happiestminds.com

Website: http://www.happiestminds.com/

Happiest minds technologies IPO Subscription Details

| Category | No of Shares offered | DAY 1 | DAY 2 | DAY 3 |

|---|---|---|---|---|

| Qualified Institutional Buyers(QIBs) | 1,26,87,028 | 9,92,430 | 59,36,580 | 98,23,12,020 |

| Non Institutional Investors (NIIs) | 63,43,513 | 39,17,250 | 2,51,12,070 | 2,22,95,01,690 |

| Retail Individual Investors(RIIs) | 42,29,009 | 6,18,00,120 | 16,42,87,980 | 30,00,14,740 |

| Total | 2,32,59,550 | 6,67,09,800 | 19,53,36,630 | 3,51,18,27,450 |

| Subscription Times | - | 2.87 | 8.40 | 150.98 |

Post Subscription Details

Finalisation of Allotment

14-Sep-20

Click on this link to get allotment status.

Initiation of refunds

15-Sep-20

Transfer of shares to demat accounts

15-Sep-20

Listing Date

17-Sep-20

Opening Price on NSE

LATER

Closing Price on NSE

LATER

AUTHOR’S Final Note :

Considering the PAT growth YoY, IPO looks not much attractive. But the PE ratio greater than 30, IPO comes under High priced band.

For the High risk Investors, IPO is definitely worth a risk to apply and look for Listing gains.

Read here on How to apply IPO via Zerodha ?

For Low risk investors, Avoid this IPO in this market and post listing shall add few if you want to stay invested.

Grey Market Premium :

GMP was around 130 which is good indicator for the decent Listing gain.

What is Grey Market Premium and how it works

Additional Reading :

Nifty 50 – Heatmap and

- Jeysivaa

- 01 January 2025

Nifty 50 is the benchmark index of the Indian stock market. Here's an heatmap overview of its performance and weightage

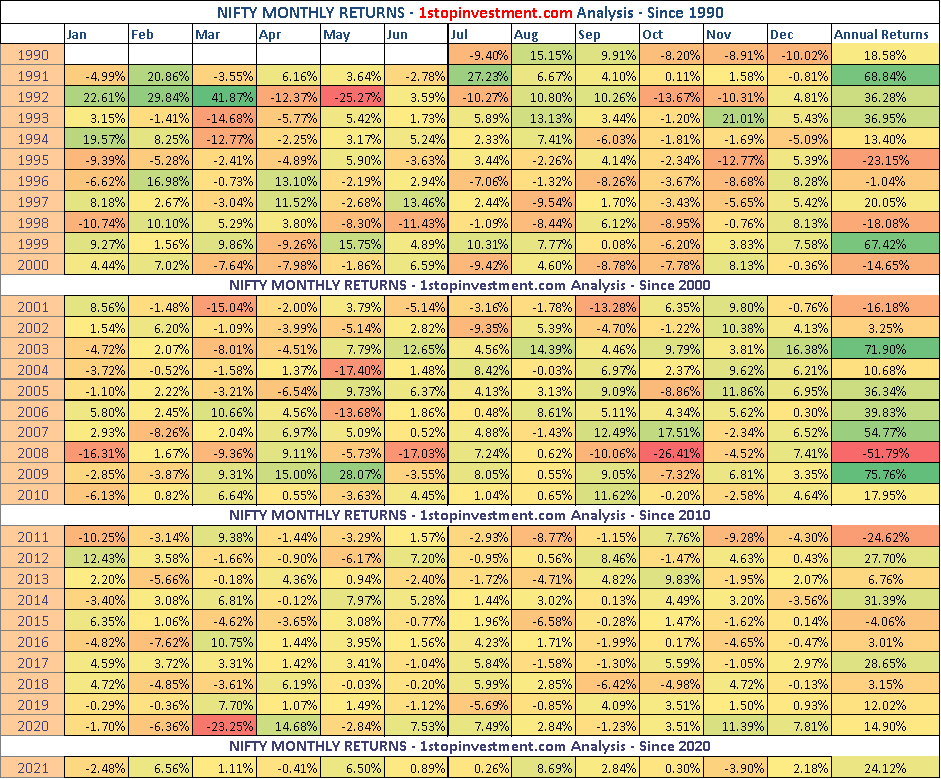

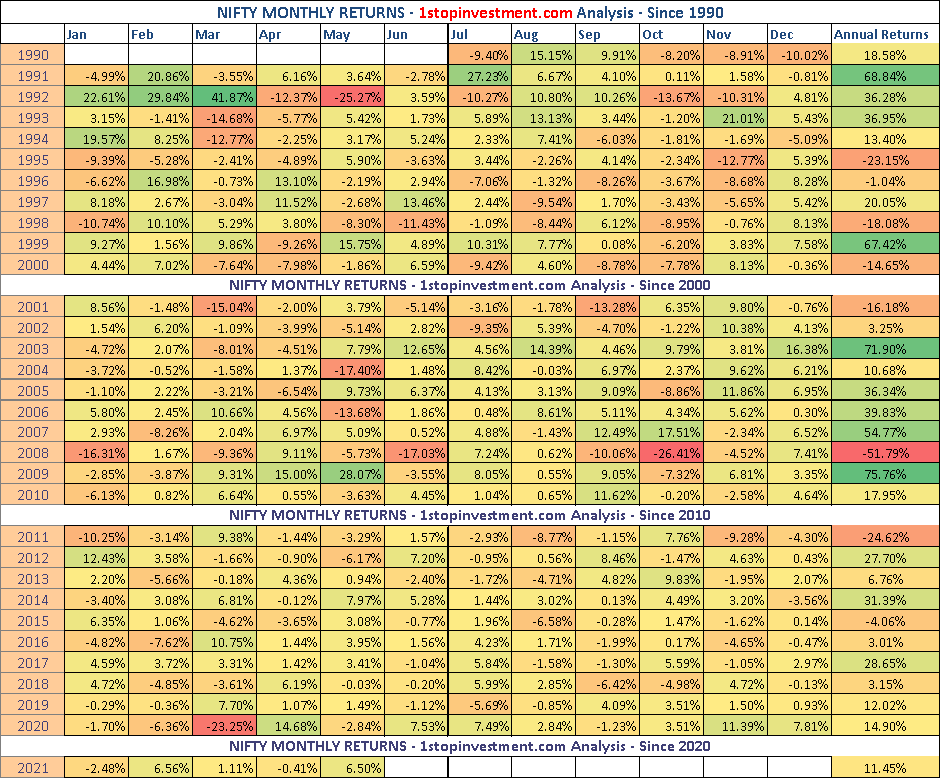

Nifty Monthly Returns – Year

- Jeysivaa

- 01 January 2022

Nifty 50 is benchmark index of an Indian stock market. Please see below graph for the Nifty and it’s weightage.

Nifty Monthly Returns – June

- Jeysivaa

- 30 June 2021

Nifty 50 is benchmark index of an Indian stock market. Please see below graph for the Nifty and it’s weightage.

Sensex 30 Companies and its

- Jeysivaa

- 12 June 2021

What is Sensex: The Sensex (orBSE30) index is a well-diversified 30 major companies in the index reflecting overall market conditions

Nifty Monthly Returns – May

- Jeysivaa

- 01 June 2021

Nifty 50 is benchmark index of an Indian stock market. Please see below graph for the Nifty and it’s weightage.

Disclaimer: “We are an educational forum for analysing, learning & discussing general and generic information related to stocks, investments and strategies. No content on the site constitutes – or should be understood as constituting – a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in our site content. We do not provide personalised recommendations or views as to whether a stock or investment approach is suited to the financial needs of a specific individual.”

“All types of content provided here are the bloggers personal views. It should not be considered as financial advice. You should consult with your own financial advisor before using any information provided here.”