Hello Reader,

“Mutual Funds!” When a beginner hears this word anywhere, he/she usually thinks that this some sort of investing where mostly people lose their money.

But the reality is not true. Yes, during the downwind times, the portfolio may take a nosedive and cause pain to their heart. But from the past data, each fallen market has seen a new and vigorous rising market most of the times.

“Money is where the heart goes”

Mutual funds are one of the best prevalent methods for first-hand investors to build wealth.

It is first important to understand what mutual funds are.

Mutual funds are there in India from 1964.UTI was setup by Parliament and the first equity fund is launched in 1986.

What is Mutual Funds?

A mutual fund is a pool of Investor’s money managed by a professional Fund Manager.

Simply put, the money pooled in by a large number of investors together to earn good returns on their capital is what makes up a Mutual Fund.

Let me explain it with an example to understand better.

Let’s say in a vegetable market, 100kgs of vegetables costing 10,000 rupees are available and the seller wholesales it by 100kg only. But you don’t have money to buy 100kgs as a whole. Your 4 other friends also want to buy vegetables and each have Rupees 2000 with them. So You and your friends decide to pool ₹2000 each and buy the whole box. Based on the contribution, each receive 20kgs. Now You hold 20kgs of vegetables, you can sell them as and when you want and get benefitted as per market conditions.

A common misconception is that Mutual Funds are only for stock market investments or shares. Here is a list of few commonly used terms when talking about mutual funds and beginners should understand how it works.

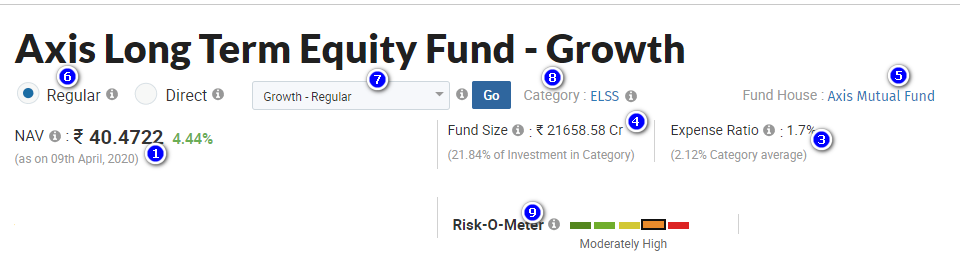

I will walk you through with an example. See below fund

Common Terms in Mutual Funds

1. NAV or Net Asset Value

In Share market, Equity shares has a trading price. Likewise, In Mutual funds, The performance of a particular scheme of a mutual fund is denoted by Net Asset Value (NAV). In simple words, NAV is the market value of the securities held by the scheme.

2. Units

Similar to stocks, Unit represents the Quantity you want to purchase/sell. For any investing amount, Units is equal to amount invested divided by the NAV of the fund.

3. Expense ratio

Every AMCs have their associated expenses like Fund Manager Salary, Operating Costs, Advertisement Cost, Advisor Commissions, Net Profit and other misc. expenses.

In short, Expense ratio is the cost of running and managing a mutual fund. Mutual funds deduct a portion of your investment value as fees to cover the above said expenses. Usually this is adjusted in the NAV Value at the end of every day. Expense ratio is generally expressed as a percent.

Expense ratios are less in Direct Fund and costlier in Regular funds.

For actively managed equity schemes, the total expense ratio (TER) allowed under the regulations is 2.5 % for the first ₹100 crore of average weekly net assets; 2.25 % for the next ₹300 crore, 2 % for the subsequent ₹300 crore and 1.75 % for the balance AUM.

For debt schemes, the expense ratio permitted is 0.25 % lower than that allowed for equity funds.

A scheme with a consistently decent track record, but a higher expense ratio may be better than the one which lower expense ratio, but gives poor returns. So Expenses ratio alone should not be the only criterion while selecting mutual fund scheme.

4. AUM – Assets Under Management

AUM is the overall market value of the mutual fund scheme. It indicates the fund size. Higher the AUM size means many investors have already invested in that fund. AUMs will rise when the fund’s assets, perform better in the market and fall when it underperforms.

AUM also indicates the Fund’s popularity and performance in its Category.

5. AMC – Assets Management Company

An Asset Management Company (AMC) is a Company that invests the money pooled from individual investors in various securities with the motto of finest return to investors in exchange for a fee. AMC keeps the portfolio diversity by investing in both high-risk and low-risk securities such as stock, debt, real- estate, shares, bonds, pension funds, etc.

Please see below list of AMCs.

List of all Mutual Funds Companies

- Aditya Birla Sun Life AMC Limited

- Axis Asset Management Company Ltd.

- Baroda Asset Management India Limited (formerly known as Baroda Pioneer Asset Management Co. Ltd.)

- BNP Paribas Asset Management India Private Limited

- BOI AXA Investment Managers Private Limited

- Canara Robeco Asset Management Company Limited

- DSP Investment Managers Private Limited

- Edelweiss Asset Management Limited

- Essel Finance AMC Limited

- Franklin Templeton Asset Management (India) Private Limited

- HDFC Asset Management Company Limited (Corporate Identification Number – L65991MH1999PLC123027)

- HSBC Asset Management (India) Private Ltd.

- ICICI Prudential Asset Management Company Limited

- IDBI Asset Management Limited

- IDFC Asset Management Company Limited

- IIFCL Asset Management Ltd.

- IIFL Asset Management Ltd. (Formerly known as India Infoline Asset Management Co. Ltd.)

- IL&FS Infra Asset Management Limited (CIN U65191MH2013PLC239438)

- Indiabulls Asset Management Company Ltd.

- Invesco Asset Management (India) Private Limited

- ITI Asset Management Limited

- JM Financial Asset Management Limited

- Kotak Mahindra Asset Management Company Limited(KMAMCL)

- L&T Investment Management Limited

- LIC Mutual Fund Asset Management Limited

- Mahindra Asset Management Company Pvt. Ltd.

- Mirae Asset Investment Managers (India) Pvt. Ltd.

- Motilal Oswal Asset Management Company Limited

- Nippon Life India Asset Management Limited

- PGIM India Asset Management Private Limited

- PPFAS Asset Management Pvt. Ltd.

- Principal Asset Management Pvt. Ltd.

- Quant Money Managers Limited

- Quantum Asset Management Company Private Limited

- Sahara Asset Management Company Private Limited

- SBI Funds Management Private Limited

- Shriram Asset Management Co. Ltd.

- SREI Mutual Fund Asset Management Pvt. Ltd.

- Sundaram Asset Management Company Limited

- Tata Asset Management Limited

- Taurus Asset Management Company Limited

- Trust Asset Management Private Limited

- Union Asset Management Company Private Limited (formerly Union KBC Asset Management Co. Pvt. Ltd)

- UTI Asset Management Company Ltd

- YES Asset Management (India) Ltd.

5.Plans

There are Regular and Direct Plans available in each fund. ‘Direct Plan’ and ‘Regular Plan’ are both part of the same mutual fund scheme, have the same / common portfolio and are managed by the same fund manager, but have different expense ratios. In the Regular plans, there will be commission to the mutual fund broker / distributor. Due to this commission fees, regular plans have more expense ratio than direct plans. Lower expense ratio leads to higher returns to the investors.

You could invest in a Direct Plan online on the website of the mutual fund or the Mutual Funds Utility (MFU) portal, OR through a physical application form, which can be submitted at the investor service centre/branch of the concerned mutual fund or its its registrar and transfer agent (RTA).

6.Plan options

There are options like Growth & Dividend. In the Growth option, NAV price will reflect the actual growth. For example, if the fund priced 100Rs grows 20% in the next year then return would be 20Rs.

In the Growth option, NAV will be 120Rs in the Next year.

In the Dividend option, Some amount of the 20Rs will be given back to the Investors and NAV will be adjusted accordingly.

If the investors looking at the long term, Growth option is preferable to accumulate wealth.

7.Scheme Type

There are 3 types of Scheme in the mutual funds.

- Open Ended Schemes

- Close Ended Schemes

- Interval Schemes

Basic differences between those schemes are the Structure and Pricing.

An open ended fund is a fund which is officially launched after the New Fund Offer(NFO) ends.

A close-ended funds has a fixed number of units offered by the fund house through NFO and this type of fund does not allow entry and exit of investors after the NFO period, until maturity. Close-ended funds typically mature in 3-4 years from their launch date.

Interval Schemes are those that combine the features of open-ended and close-ended schemes. These funds are open for purchase or redemption only during specific intervals (decided by the fund house) and closed the rest of the time.

Open ended funds offer liquidity where as close ended funds does not offers that much liquidity.

8.Category

In the Open-ended schemes, there are 38 Categories and 6 in the Close ended schemes.

Please see the complete list of Schemes here.

9.Risk meter

SEBI(Securities and Exchange Board of India) had introduced Riskometer to help investors gauge the level of risk through a meter. The Riskometer will indicate five levels of risk – low (principal at low risk), moderately low (principal at moderately low risk, moderate (principal at moderate risk), moderately high (principal at moderately high risk) and high (principal at high risk).

Here’s how fund houses will use Riskometer

- Low – liquid funds and ultra-short term bond funds having average maturity of less than 90 days

- Moderately low – short to medium term funds having average maturity between 91 days and 3 years

- Moderate- income funds and gilt funds having average maturity of over 3 years; arbitrage funds and debt oriented hybrid funds having up to 20% exposure to equity components in the portfolio

- Moderately high- diversified equity funds, balanced funds, indexed ETF and gold ETF

- High- sectoral funds/thematic funds, international funds and sectoral ETF

10.KYC

Know Your Customer is a mandatory requirement by SEBI for declaring identity and address proof for the purpose of investing.

11.Lock-in Period

The investment cannot be withdrawn during this lock-in period. For example, ELSS Mutual Funds have a lock-in of 3 years. If the investment is withdrawn before the lock-in period, Exit load will be applied.

12.Exit Load

It is the penalty amount levied to the investors who exits in the lock in period. Investor should know about the scheme exit loads before investing. If you are investing for short term you should know about the Exit loads and lock-in period.

It is imposed by the mutual funds to discourage the premature withdrawals by the investors.

Exit load for the Equity funds shall be maximum upto 1%.

QUICK RECAP:

Please see the marked with reference numbers and I hope now you can know look into any fund and know it’s value.

You may check with AMFI or Moneycontrol or Valueresearch website for Latest NAV values with fund details.

Investing in mutual funds is one of the simplest ways to achieve your financial goals on time. Before you invest, take an adequate amount of time to go through the different fund options. Don’t invest in a fund because your colleague or friend has invested in it. Identify your goals and invest accordingly.

Happy Investing !

Watch out this Space to learn more about Mutual Funds investing.

Like!! I blog frequently and I really thank you for your content. The article has truly peaked my interest.

Its such as you learn my thoughts! You appear to know a lot approximately this,

like you wrote the guide in it or something. I think that you could do with a

few % to pressure the message house a bit, however other than that, that is wonderful blog.

An excellent read. I will certainly be back.

What’s up to all, the contents existing at this site are genuinely remarkable for people knowledge, well, keep up the nice work fellows.