Hello Reader,

Every Financial year, Tax payer always look for some tax saving Instruments under Section 80C in the Financial year to save Income Tax.

For those who look for not only tax saving but also seek lucrative return , Investing in the tax saving (ELSS) mutual fund schemes is the better option and save tax up to Rs. 46800 as per the Section 80C.

We will see the Top 5 schemes to invest in this article.

Equity Linked Savings Scheme (ELSS)

ELSS funds are the tax-saving close-ended mutual funds with a lock-in period of 3 years. The major portion of funds (minimum 80% or more) are invested in equity schemes. Equity schemes mean the fund invest in shares of companies of different market capitalization.

Under section 80C of Income Tax Act 1961, the investors can avail the tax benefit up to 1.5 lakhs per year.

Please read the Detailed Article on ELSS here.

Lets jump into the best funds to invest in FY 2021-22.

Factors to keep in mind while selecting a Good ELSS fund

The below few factors which I keep in mind while selecting a mutual funds.

The below are only a guidelines for selecting a fund who is DIY investors and read Disclaimer before taking any decision and if you are not comfortable with any filters, please comment it out.

Lets Keep it Simple method to choose a Good ELSS fund rather than complicating with any mathematical numbers like Sharpe Ratio, Standard deviation, Beta, etc.

1.Know the availability of Direct funds in the Category

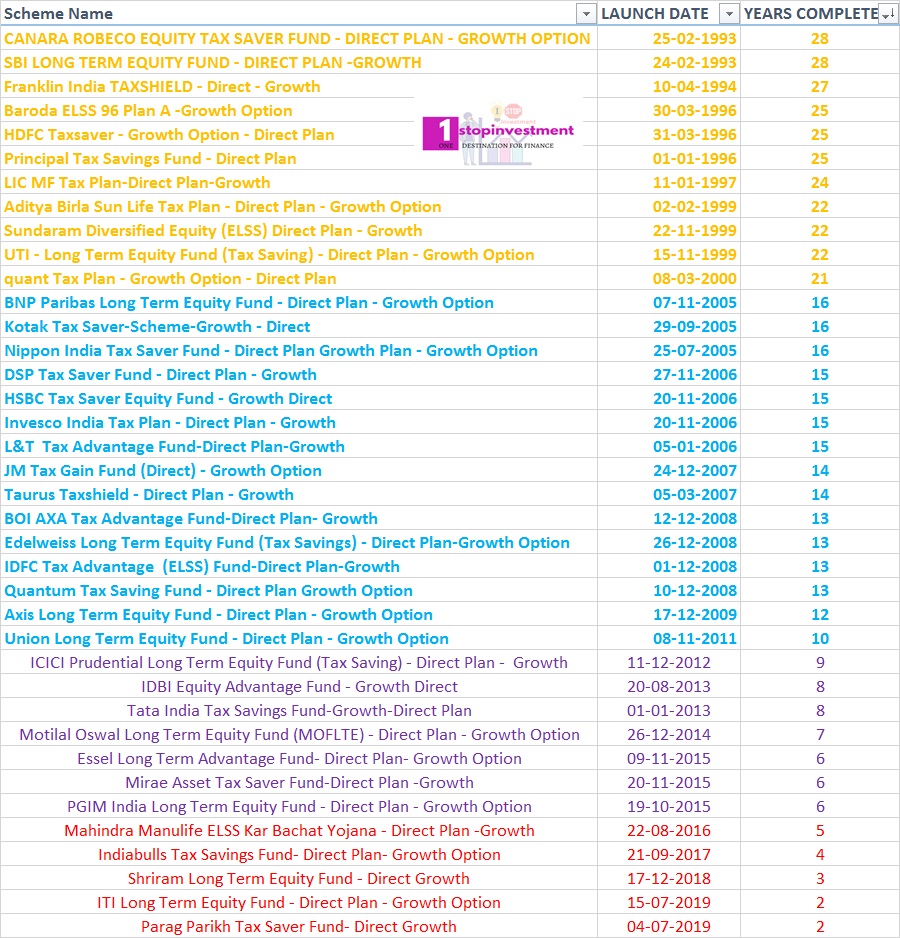

From the Scheme data available in AMFI website, there are around 38 funds of Direct plans available for the investor to invest.

2. Survival Period

I would like to go with AMC who has been in the market for more than 10 years. As per you risk profile, you shall increase the period or decrease the period as you want.

Please see below list with completed years.

Here for my Analysis, I have filtered funds with more than 10 years experience.

3. Measuring Performance

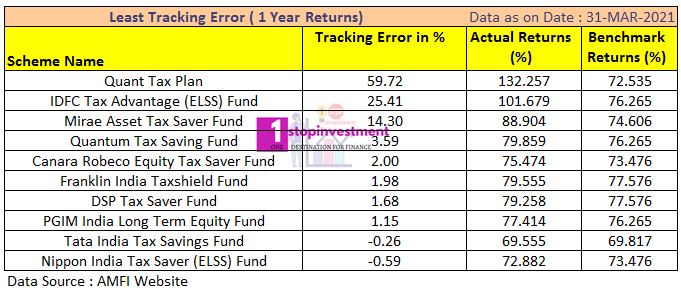

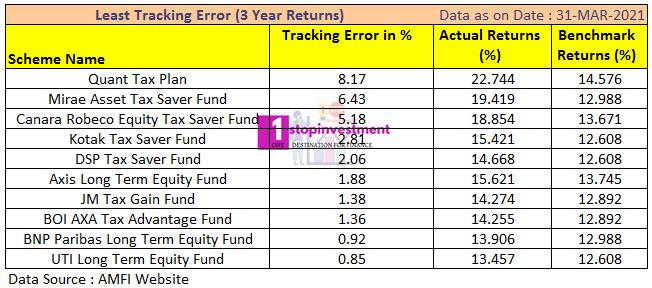

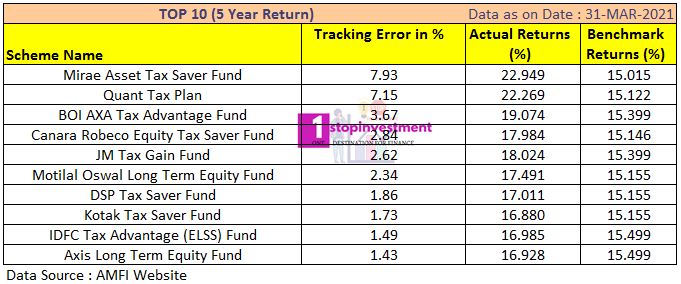

The Historical performance of the fund gives investor a confidence to invest but it is not guaranteed that similar kind of returns are expected in the future. But It is one of the few metrics by comparing apple with apple concept.

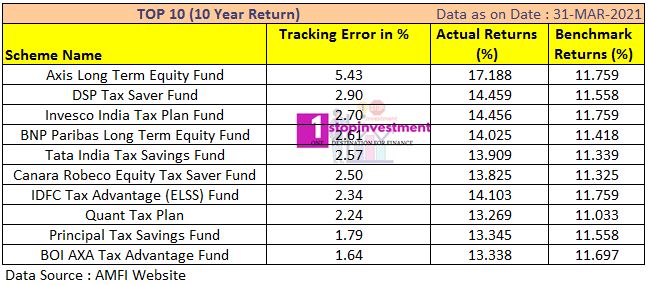

Here, I have taken 1,3,5 year returns with the benchmark returns. Even longer period of return like 10 year also be taken for analysis.

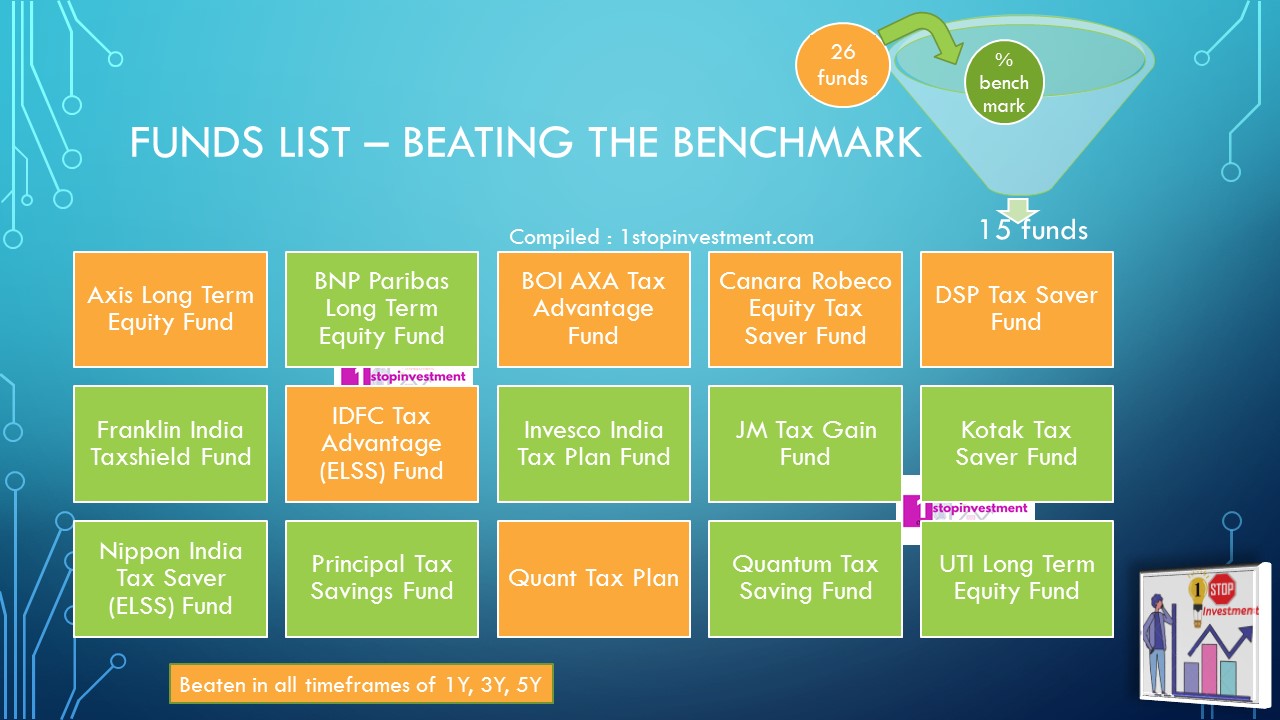

Out of 26 funds with more than 10 years Experience in ELSS funds, I am filtering the funds which has beaten the Benchmark atleast in one period.

6 Funds have outperformed the benchmark in all the period and other 10 funds also outperformed the index.

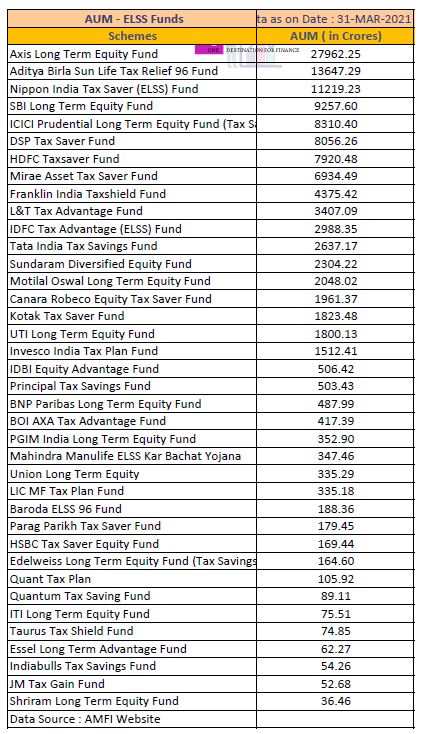

4. Assets under Management (AUM) Value

AUM is the overall market value of the mutual fund that the scheme holds in the market. AUM is the measure of how big the fund house in the category. Although, this number is just an another filter to choose with HIGHER AUM funds. Higher the AUM size means many investors have already invested in that fund. However, the AUM depends on the fund manager skill to deliver the good returns beating the Index.

Already the performance metrics been done, AUM based sorting shall be done to filter out the funds.

For your information, All AMC AUMs are sorted below :

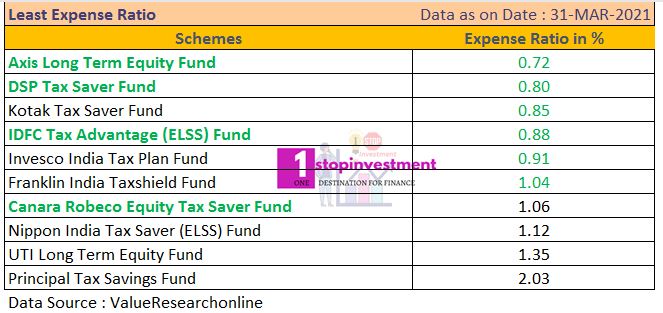

5. Expense Ratio

Expense ratios are lesser in Direct Funds and costlier in Regular funds. That’s why direct fund is the first filter, I have set.

From the Above 10 funds in the AUM, Below table is sorted out based on its Expense ratio.

Best ELSS Funds to Invest in the FY 2021-22

Considering the analysis of AUM value, Expense ratio and Past Performance in all the Time Frames, Either AXIS , DSP , Canara Robeco or IDFC will be my choice of Investment.

- Axis Long Term Equity Fund – Direct Plan – Growth

- DSP Tax Saver Fund

- IDFC Tax Advantage (ELSS) Fund

- Canara Robeco Equity Tax Saver Fund

As, we have set 10 year Period. In the Less than 10 Year period from the Launch date, One can also check Mirae Asset Tax Saver Fund.

Every year in the start of the Financial Year, Do the same analysis and Check your portfolio.

“Mutual Fund investments are subject to market risks, read all scheme related documents carefully.”

Happy Investing.

Please check out our SIP Calculator available here.

Good article and shared very good information

What about BOI AXA Tax?

Dear Shriram,

Thank you. BOI- AXA has not passed through our filters / criteria. Maybe in the next FY, it might come.

Please watch out our new post.