Best Investment Options & Plans for your Daughter ! – Building a Brighter Future

“The best time to plant a tree was 20 years ago. The second-best time is now.” This old proverb holds especially true when it comes to securing your child’s financial future.

Whether you’ve recently welcomed a beautiful baby girl into your family or already have a wonderful daughter growing up before your eyes, congratulations!

Now, let’s talk about how you can give her the gift of a secure future by making smart investments today.

Are you looking for any below ?

The Power of Early Investments

Did you know that starting early could be the single most important factor in growing wealth? Compound interest, often called the eighth wonder of the world, works wonders when given enough time. For a newborn, even small, regular investments can lead to significant wealth by adulthood.

A Father’s Story:

When daughter was born, the father was overwhelmed with joy—and a little nervous about the future. One day, as he held her tiny hand, he realized that while he couldn’t predict the future, he could prepare for it. So, he started researching the best financial plans for her.

The first decision he made was to start small but consistent. Every month, he allocated a portion of his salary to her future, treating it as a non-negotiable expense. Many years later, watching that account grow has been one of the most satisfying experiences of his life. Now she’s happily married and living with her kids and following my steps for my grandchildren.

Top Investment Plans for Your Baby Girl:

A. Sukanya Samriddhi Yojana (SSY)

In India, the Sukanya Samriddhi Yojana is a government-backed savings scheme designed specifically for girl children. Here’s why it’s a great choice:

More in details → Sukanya Samriddhi Yojana – A Complete Guide

- Better Interest Rates: Offers higher returns than most traditional savings accounts. See the Interest rates in this table → Post Office Small Saving Schemes interest Rates

- Tax Benefits: Contributions are tax-deductible under Section 80C, and the interest earned is tax-free.

- Flexibility: You can invest as little as ₹250 annually, making it accessible to everyone. and Maximum INR. 1,50,000/- in a financial year.

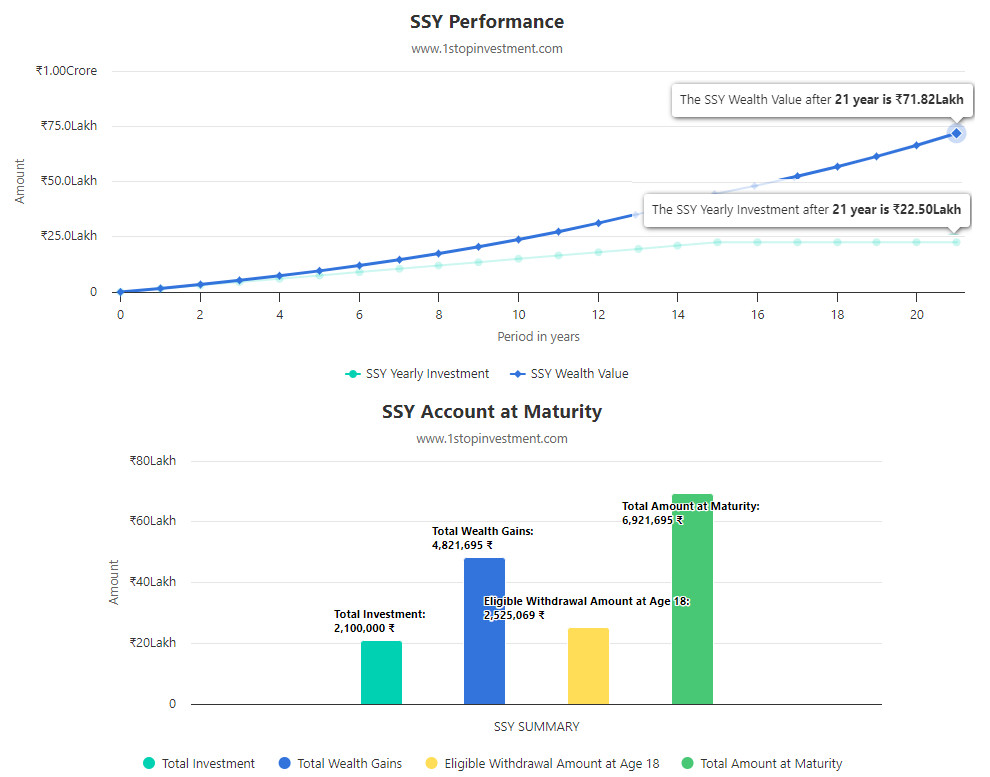

Interactive Calculator to find the maturity value based on your child’s age → SSY Calculator-1stopinvestment

B. Mutual Funds – SIPs

Investing in Systematic Investment Plans (SIPs) through equity mutual funds can help you harness the power of compounding. Here’s how:

- Long-Term Growth: Equities tend to outperform other asset classes over the long term. Index Funds could be a more suited mutual funds for the better returns.

- Affordable: Start with as little as ₹500 per month.

- Diversification: Choose a mix of equity and debt funds to balance risk and return.

More about SIPs here → Does the SIP investment concept suit you?

C. Gold ETFs or Digital Gold or Gold Mutual Funds

Gold has always been considered a symbol of security and tradition in our country. With digital gold, you can now invest in small increments and avoid the hassles of physical storage. Later, you can convert these accumulated goal wealth into physical GOLD while at the time of her marriage or redeem for her education purpose as well.

More about ETFs here → What should Investors know about Exchange Traded Funds (ETF) in India – Beginner Guide

D. Fixed Deposits or Recurring Deposits

Fixed Deposits (FDs) are a secure and reliable investment option to build a financial safety net for your newborn baby girl. With guaranteed returns and flexible tenures ranging from a few months to years, FDs ensure steady growth of your savings. Generally, during the final accumulation phase, this investment option will be more suited for the investor to protect the wealth against any uncertainity.

More about Fixed deposits here → Fixed Deposits in India

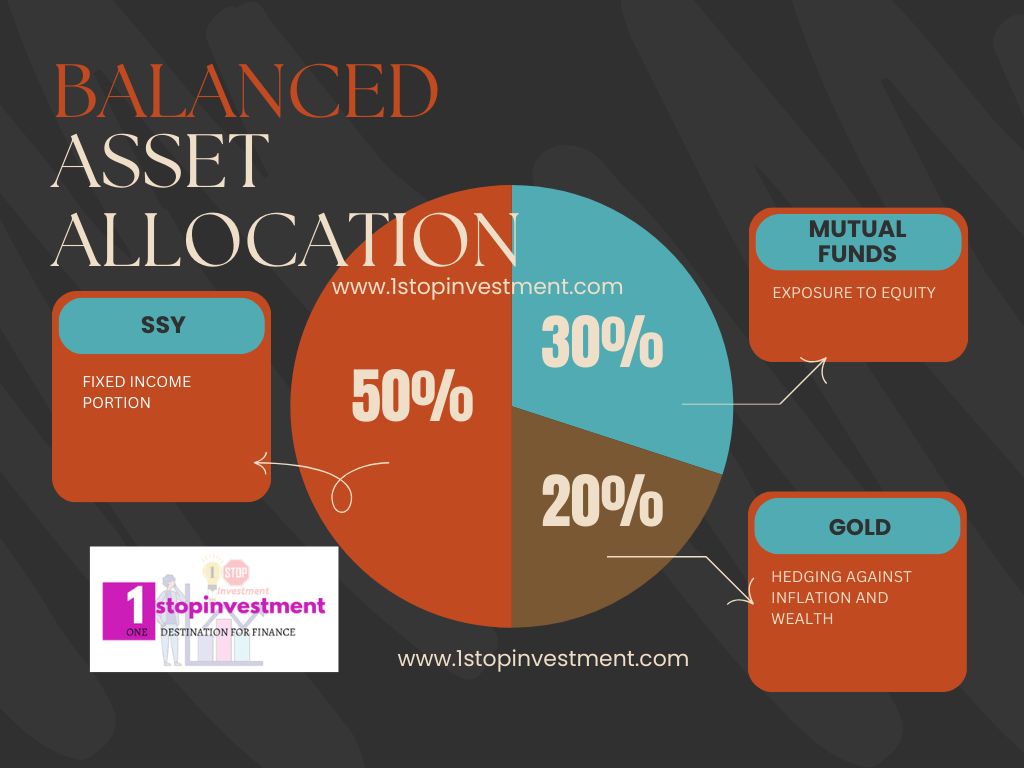

Asset allocation :

Asset allocation is key to securing a bright future for your newborn baby girl. Begin with Sukanya Samriddhi Yojana (SSY) for government-backed, tax-free returns tailored to her long-term needs. Pair this with mutual funds, focusing on equity or hybrid options, for wealth creation over time. Diversify with fixed deposits to ensure stability and liquidity. Adding gold offers a hedge against inflation and serves as a valuable asset for future milestones. A balanced mix of these investments ensures growth, safety, and flexibility, providing a strong financial foundation as she grows.

More about asset allocation here → How asset allocation helps you to protect your Portfolio.?

An example portfolio where assuming an investor maxed 1.5L in SSY i.e) 12500 per month, 7500 per month in an Index Fund, 5000 per month in Gold from the Age of born till her 21st year.

Total Investments in SSY would be 21Lakhs (only 15years), 18.9Lakhs (21years), 12.6Lakhs(21years) and Cumulative wealth accumulated would be approx 2 Crores. (Variable returns assumed for each asset class)

Comparison in a glance :

| Feature | Sukanya Samriddhi Yojana (SSY) | Mutual Funds | Fixed Deposits (FDs) | Gold |

|---|---|---|---|---|

| Purpose | Secure future for a girl child | Wealth creation through equity, debt, or hybrid funds | Risk-free savings with fixed returns | Wealth preservation and hedge against inflation |

| Returns | ~8% (government-backed, revised quarterly) | Market-linked; can range from -10% to 15%+ | 6-8% (varies by bank and tenure) | Market-linked; depends on gold prices |

| Risk Level | Low (government-guaranteed) | Varies: High (equity), Medium (hybrid), Low (debt) | Low | Low to Medium (price fluctuations) |

| Tax Benefits | Full EEE (Exempt-Exempt-Exempt) under Section 80C | ELSS funds offer tax benefits under Section 80C; LTCG applicable | Interest taxable as per income slab; no EEE benefits | None (except for capital gains exemptions on certain gold investments) |

| Liquidity | Low; partial withdrawal allowed after age 18 | High; can redeem anytime (may incur charges) | Medium; premature withdrawal incurs penalties | High; easily sold in market or pledged for loans |

| Investment Tenure | Up to 21 years from account opening | Flexible; no fixed tenure | 7 days to 10 years | No fixed tenure; can hold indefinitely |

| Hedge Against Inflation | No | Limited (depends on fund type) | No | Yes |

| Minimum Investment | ₹250/year | ₹500 (varies by scheme) | ₹1,000 to ₹5,000 (varies by bank) | 1 gram of gold or equivalent |

| Maximum Investment | ₹1.5 lakh/year | No cap | Varies by bank | No cap |

| Ideal For | Long-term secure savings for girl child | Wealth creation with higher risk appetite | Risk-averse individuals seeking fixed returns | Diversification, wealth preservation, inflation hedge |

| Government Support | Fully backed by the Government of India | Private sector-managed | Bank/government-managed | None; market-driven |

| Ease of Investment | Moderate (requires physical account setup) | High (online platforms available) | High (available at banks) | High (buy from jewelers, banks, or digital gold) |

Key to Consistent Investing:

- Automate Investments: Set up auto-debits to ensure consistency.

- Increase Contributions Annually: As your income grows, increase your investment amounts.

- Track Progress: Review your portfolio at least once a year to ensure it aligns with your goals.

Tool → Track your Mutual fund portfolio using this Automated Mutual Fund Portfolio Tracker Spreadsheet | Download

Conclusion:

Investing for your baby girl is more than just numbers—it’s about creating opportunities and securing a bright future. Remember, the earlier you start, the greater the impact.

Start today because every step you take brings your child closer to a financially secure tomorrow at the needy time! 💖💖

You can write to us with your query @ mailto1stopinvestment@gmail.com.

What investments have you considered for your child’s future? Or do you have any unique tips to share?

Share your thoughts, questions, or experiences in the comments section below.