An emergency fund is a fund that helps during the financial crisis or any unexpected expenses in one’s life. There are many unforeseen events in life like the death of a known person, sudden hospitalization, car breakdown, house repairs, etc.

For you to realize the need for this type of fund in your Finance, Let me tell an example which we all have faced in our life.

“In the middle of the day or night, we might have received a phone call from a relative or friend and asks for money (any amount starting from 10,000 to 1 lakh) for a cause. You will send your money in savings to his account or give cash in hand.”

“Have you ever imagine the situation of the person who asks you? He/she will undergo heavy stress before asking for money because his self-esteem is at stake to repay and they don’t want to have any empathy on them when they face you again. “

So, yes if they have any such emergency funds to tackle their cause, they don’t have to depend on anyone.

Need for the Emergency fund:

So from the above example, you understand the need to have an emergency fund in anyone’s kitty.

“Still a lot of people believe that emergency is rare and we shouldn’t have to worry about it much for the one-day event.”

Yes, I didn’t say to worry about the situation and I say to prepare for the worst.

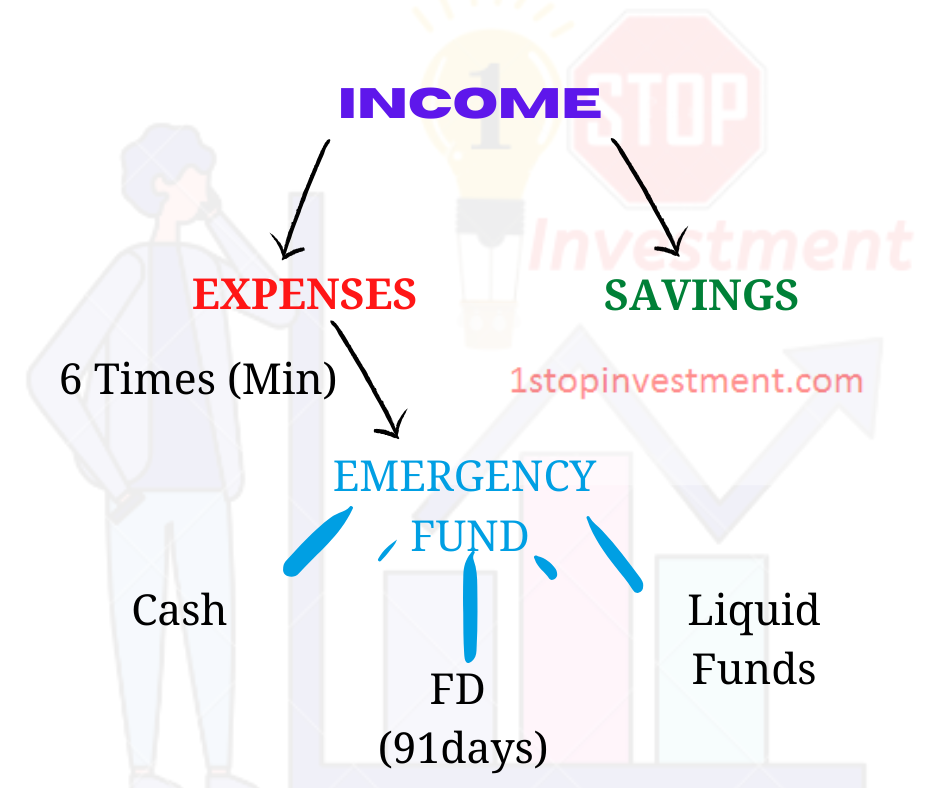

How much do we require or Emergency Fund size?

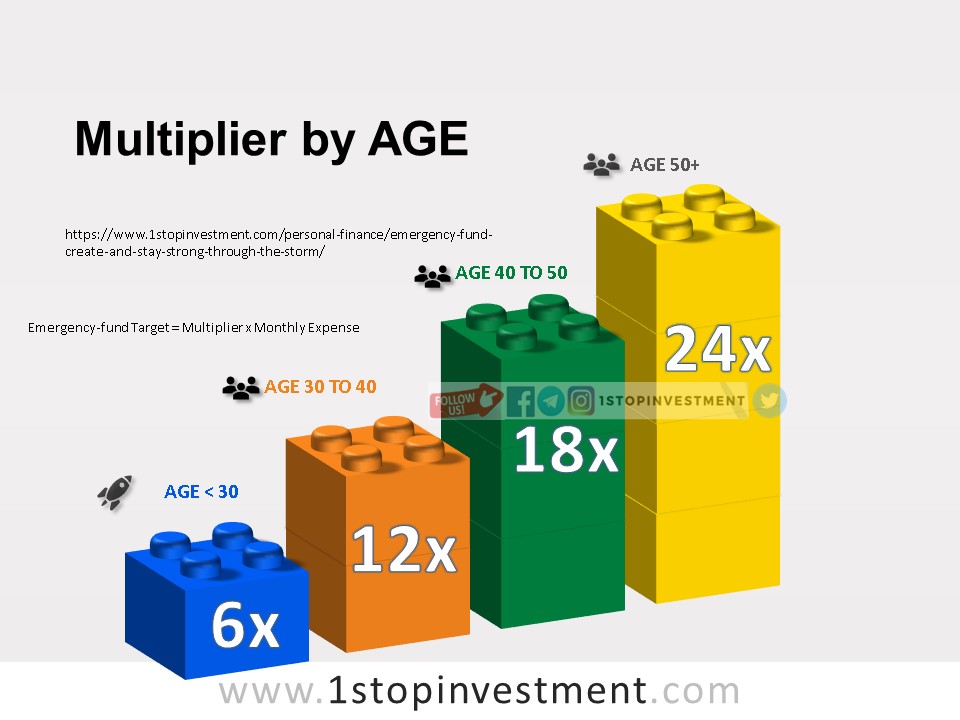

Simple thumb rule, the Emergency fund should be minimum 6 times your Average monthly Expenses(Including if any EMIs) or simply your Salary. Bigger the fund size, you will handle the situation better.

If someone is working in a government sector or steady income source, his multiplier shall be 6 times. But at the same time, If someone working in Airlines or sector where layoffs are happening often, their multiplier shall be 12times.

On case to case, the fund’s size varies. You have to know your average monthly expenses. You shall calculate by this method.

If your salary is 50,000 and monthly expense is 30,000 rupees(Includes Rent, Food, Utilities, Fuel, School Fees, EMI), then you should have a minimum of 1,80,000 or 3,00,000. This should be your emergency fund.

Once you reached the 6 times the monthly expense, You shall grow further 3x, 3x, 3x and more the Emergency fund you have more the peace you get.

The Multiplier in the Emergency fund also linked to the age.

How to build this Emergency fund

You may think now how should you start building this fund. This shall be done by increasing your savings rate. Already you may be committed to some EMIs or SIPs.

- Every month, you may have a surplus amount (Income – Investments – Expenses) and move the entire surplus to this emergency fund.

- What if you don’t have any surplus, Look for any Investments which you already have. Say, if you have a Fixed deposit of 5 lakhs, then Split the FD into parts and Keep a part for an emergency fund. But always prefer to create by moving surplus amount.

- Another option is, Move your Fixed deposit to Post office monthly income scheme and the interest shall be used to create an emergency fund along with surplus from income.

Where to park this emergency Fund?

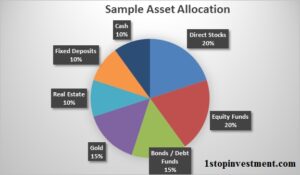

- Cash – Keep 20% of your Emergency fund at home in cash. (No returns parking)

- Savings account – 10% of the fund to be kept at a non-active bank account.

- Sweeping FD – Keep 20% of your Emergency Fund in a Fixed Deposit. (Tenure shall be any but should be opened in Online mode, so that it will have Instant credit system and have the auto-renew option to Maturity value)

- Further 30% in Liquid Funds. ( you shall gain better interest than FD)

- ETFs – Gold option – Equivalent to 10% of your emergency fund size.

- Advance payment of EMIs is one option but this is an ultra-conservative approach.

For the emergency fund, don’t look for smaller interest rates gain. You shall take risks as per your risk profile in any other investments.

Other Investments to tackle emergency situation:

- Term Insurance – This gives the protection to your family members in the worst case of your death.

Read more in detail about Term Insurance here.

- Health / Medical Insurance – Mostly Companies give their employees a basic medical cover as a health insurance policy and if you don’t have any, Start taking one funded by self.

- Bike/Car Insurance – Buying this insurance will cover the huge cost if your vehicle takes a hit.

- Property Insurance – In India, although it is not famous. Most countries abroad it is mandatory. This includes a lot of things like Fire accidents, water broke, or other miscellaneous damages.

The above said recurring expenses shall be kept in a Sinking Fund.

Read more in detail about Sinking funds – Meaning and how it helps you to manage your Finance here.

Conclusion

Start preparing your emergency fund today.

You will stay strong through the storm (unforeseen event) if you have an Emergency fund to take care of your needs.

This Emergency fund is not only simpler but also has huge other long term benefits.

If you are living abroad, Read more in detail about Emergency Fund or Rainy day Fund for Expats !!