One question which many parents ask think is: “How much will be sufficient for my child entire school education from pre-school to high-school?”

If this question has crossed your mind, you’re not alone. Let’s dive into the numbers and considerations to find out.

Are you looking for any below ?

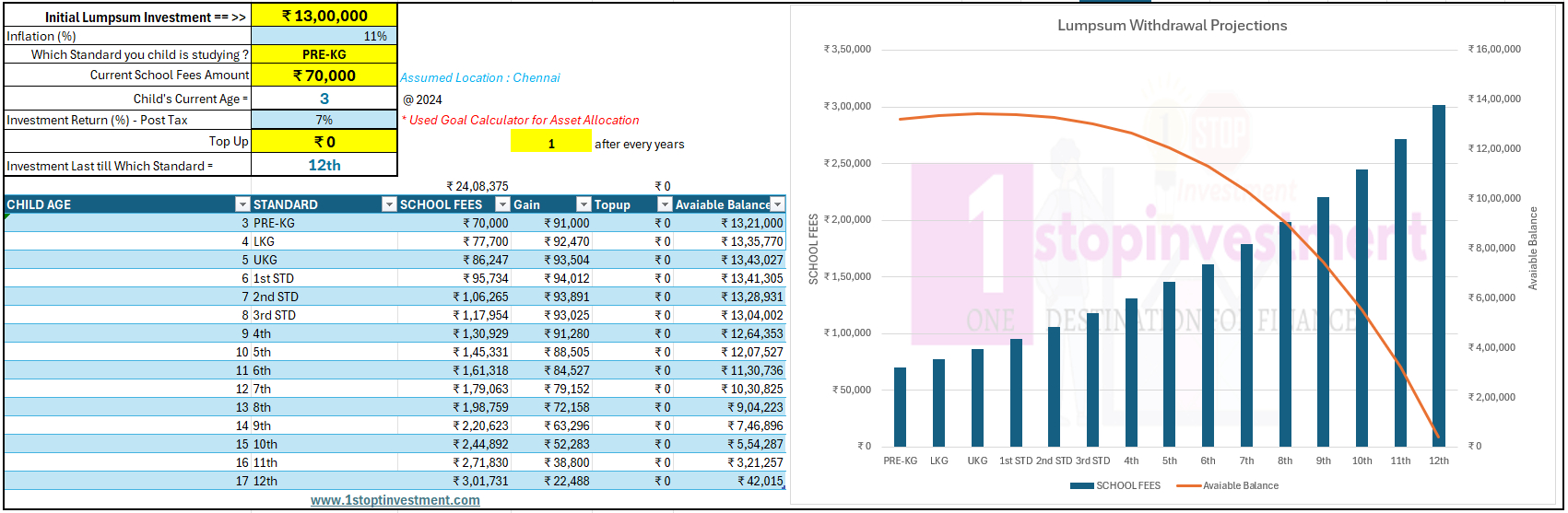

Assumptions :

The cost of schooling a child in India can vary depending on the level of education, the location, and the type of school we put our child into.

Location : Chennai

Type of School : CBSE School

Fees Considered : Tuition Fees + Essential fees.

Not Considered : Transportation Fees , Extra Curricular fees , Other Training fees, Special Coaching fees , etc.

Inflation Considered : 11% (EduFund says education costs have climbed by around 10-12% in India between 2012-2020.)

Kid’s Age : 3 years.

Cost of Tuition Fees for Pre-KG = 70,000 in Chennai. (School fees are available in this site for your ready reference → https://www.uniapply.com/schools/schools-in-chennai/)

Tenure : Till 12th Standard

Initial Lumpsum Required Assumed : 10 Lakhs

Read here for more details on Child’s education planning and where to invest → Guide to Plan for your Kids Higher Education cost in India; Download Excel

Calculations:

You can see the below calculation and With 7% return, 10Lakhs lumpsum investment will last till 9th STANDARD.

Strategy to make it last till Higher Secondary:

There are two ways – i) Increase the Initial Lumpsum investment at the Starting or ii) Top Up every year with minimum lumpsum.

i) How much the Initial Lumpsum investment required :

ii) Top Up Every year :

Excel Tool:

Curious about how much you need to save for your child’s complete schooling? Don’t leave it to guesswork!

Use our specially designed calculator to get accurate insights and plan with confidence. Download the calculator tool now for a small fee and take the first step toward securing your child’s future.

Final Thoughts

While 10 lakhs is a great start, it’s important to evaluate, adjust, and grow your investments to keep pace with rising costs.

With careful planning and proactive steps, you can ensure that your child’s educational journey is smooth and stress-free.

Hope this article helps you to plan for your child, share it with your friends who you might think it will be useful.