First, let us understand what the asset allocation is.

Are you looking for any below ?

Asset allocation

Asset allocation is an investment strategy or portfolio technique or financial approach of distributing your investments to dissimilar types of assets to minimize the risks.

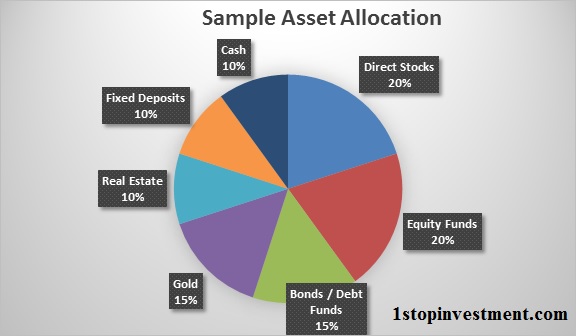

For example: Lets assess with 10,00,000 surplus money and the investor would like to invest in different type of instruments say 20% in direct stocks (a part of 20% in global equities) , 20 equity funds, 15% in gold, 20% in fixed deposits, 15% in bond / debt funds (which includes PPF) and rest 10% probably towards Keeping as cash or recurring deposits or Liquid funds or any other cash equivalent instruments.

The above split up of your money into various financial instrument is identified as asset allocation.

You can download the Excel sheet here to view your asset allocation graph.

Some people here confuse with diversification, so to make it clear, Diversification is spreading the investment with a single asset. In the above Example, we have made 20% of Direct Equities allocation in Global market and remaining 80% in the domestic market.

Most investors use asset allocation to spread their investments among various asset classes.

Don’t put all your eggs in a single basket

You might have heard above proverb ‘n’ number of times but it is aptly fit for Asset allocation. Let’s see a short story with the above proverb, A Pilot who was working in a Big Airline company and he was investing all of his money in the same Airline shares thinking nothing would happen to his employer and all of sudden due to Covid-19 the Airline business took a huge hit and its shares plummets and that airline went bankrupt. Unexpectedly, all his invested money was lost. If he followed the asset allocation strategy, he would be saved by other investments in his portfolio.

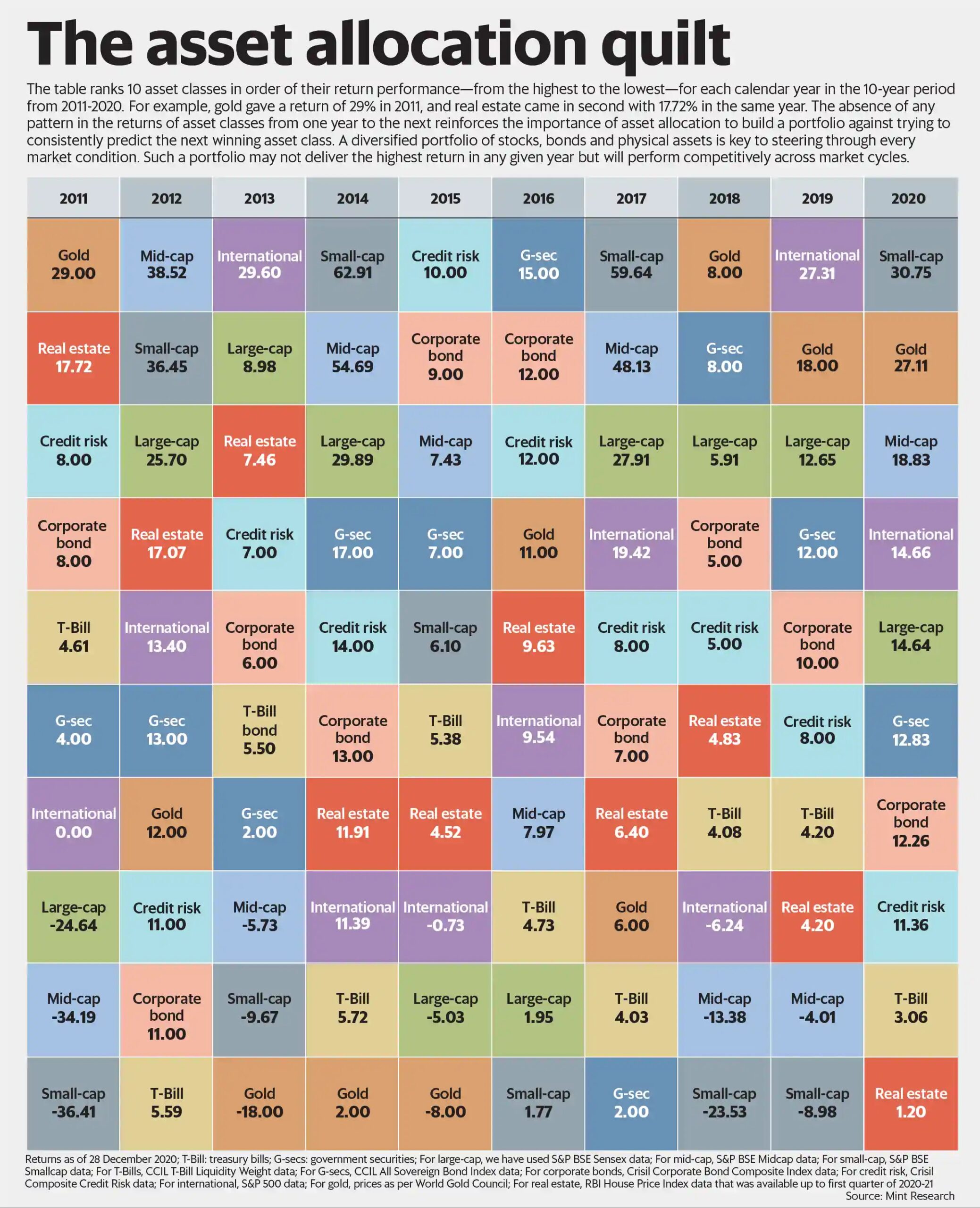

See below Asset allocation Quilt, you will understand better.

Every year one asset or the other would perform better than the other. The lesser return in one asset gets offset by the more returns in another asset. Henceforth, Portfolio becomes Well asset allocated portfolio. Now you would have understood its importance.

However, the decision to allocate the money differs from investor to investor as it is based on multiple criteria like investor’s needs, time horizon, risk appetite, liquidity and financial goals.

There is no fixed strategy which works for all.

Few Guidelines which one should follow to arrive at the Asset allocation ratio:

- Liquidity

- Financial goals

- Risk tolerance

- Time

Liquidity

Always start with the reserve, Min 5% to 10% keep in high Liquid assets that can be used in Emergency Situation.

Financial goals

Each Goal requires specific plan.

For example, For the Children’s higher education which is 3 years away shouldn’t allocate to Equity type of asset which has higher risk in Investing nature. But if the same is 15 years away, one should have good portion of Equity to increase the Education Corpus.

Risk & Time

The investor may be low or high-risk appetite with short time and long time horizon.

- Conservative (C)

- Balanced (M)

- Aggressive (H)

See below table for the typical asset allocation by age:

If you want to remember all the time, The Age = Debt funds will suit better for the Conservative Investor

Still if you are confused and need any financial planning assistance, you can reach out to me at mailto1stopinvestment@gmail.com with your queries.

Conclusion

In an uncertain Financial market situation, always a wise allocation strategy helps you to minimize the portfolio volatility.

Remember this, Asset allocation is not an one time activity. Every year, Remember to rebalance your portfolio considering the current needs so that your asset allocation stays on target.

Happy investing.!