On 31st March 2020, The Government announced rate cuts for small savings schemes for the Quarter April-June.

Recently the Reserve Bank of India’s (RBI) has surprised us 75 bps cut in its key interest rate. Following this rate cut, Small saving schemes also seen big interest rate cut from 0.7% to 1.4%.

See more about on RBI Announcement & Key Takeaways here.

Revision of Interest Rates for Small Saving scheme :

Are you looking for any below ?

1.Savings Deposit Rates :

Only Savings Scheme which kept unchanged at 4%.

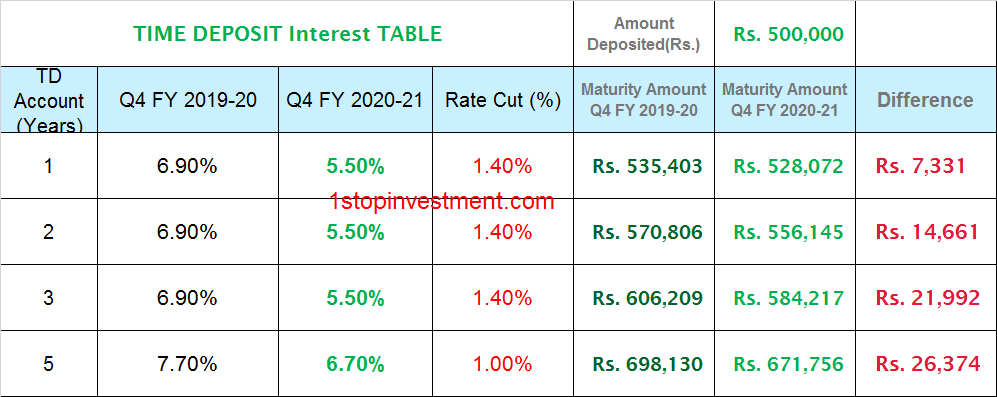

2.Time Deposits

The TD Interest rates saw a big cut of 1.4%.

- 1-year , 2- year & 3- year Time Deposit Interest rates are now at 5.5 % which was Previously 6.9% .

- For 5- year TD -Tax Saving Fixed Deposit, it has been brought down from 7.7% to 6.7%

For more scheme details, check out here Tax Saving Fixed Deposit – Post office

See our Below Calculation on How it affects the TD Account holders.

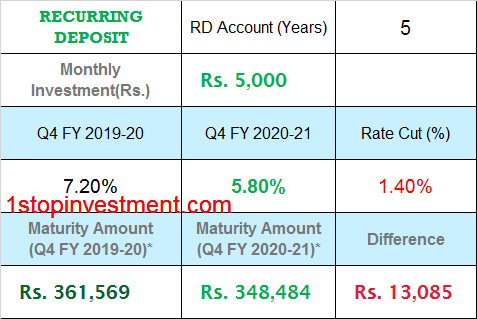

3.Recurring Deposits

The interest rate on five-year Recurring Deposit Rate sees a massive 1.4% cut to 5.8% from 7.2%.

On a monthly deposit of 5,000, depositors now would lose 13,085 Rs.

For more scheme details, check out here Recurring deposits

See our Below Summary:

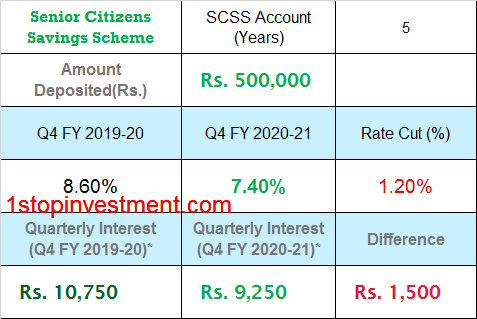

4.Senior Citizens Saving Scheme Deposits

The interest rate on SCSS Deposit Rate sees a huge cut of 1.2% to 7.4% from 8.6%.

On a deposit of 5 Lakhs , Old Age People now lose 1500 Rs every quarter.

For more scheme details, check out here Senior Citizens Savings Scheme

See Below Summary:

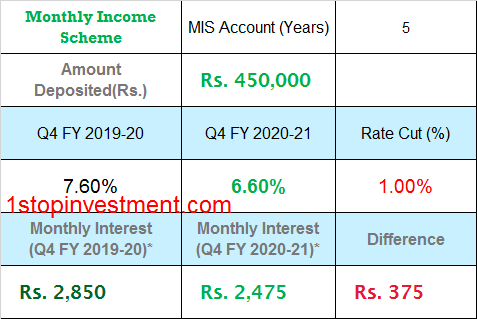

5.Monthly Income Account Deposits

The interest rate on MIS Deposit Rate sees a reduced rate of 1.0% to 6.6% from 7.6%.

On a Max deposit of 4.5 Lakhs , Depositors miss 375 Rs every month.

For more scheme details, check out here Post office Monthly Income Scheme

See our Below Summary

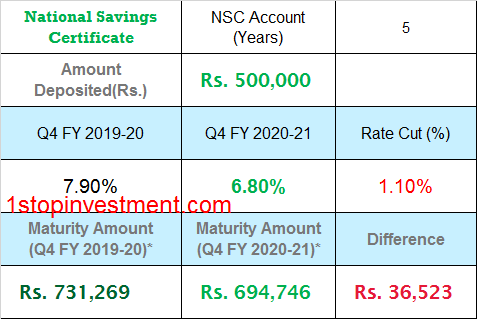

6.National Savings Certificate

The interest rate on National Savings Certificate has been slashed by 1.10 % to 6.8% from 7.9%.

On a deposit of 5 Lakhs , the Maturity value will be reduced by 36,500Rs.

For more scheme details, check out here National Savings Certificate

See our Below Summary

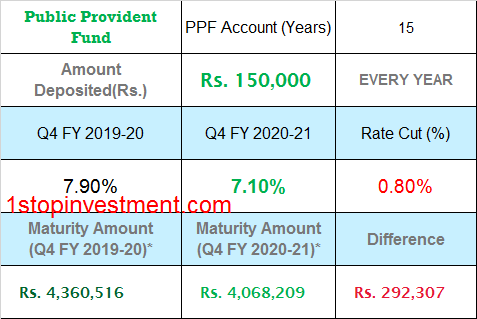

7.Public Provident Fund

The interest rate on PPF has been reduced by 0.8 % to 6.8% from 7.9%.

On a deposit of 1.5 Lakhs every year, the Maturity value after 15 years will be reduced by 2.9 lakhs.

For more scheme details, check out here PPF (Public Provident Fund) Scheme

See our Below Summary

8.Kisan Vikas Patra

The interest rate on KVP has been dropped by 0.7 % to 6.9% from 7.6%.

On any deposit in KVP, the Maturity period is increased to 124 months from 113 months. Now Investors has to wait for another 11months to redeem.

For more scheme details, check out here Kisan Vikas Patra – Double your money scheme

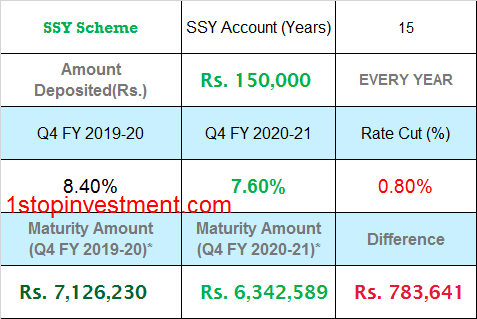

9. Sukanya Samriddhi Yojana

The interest rate on SSY has been cut by 0.8 % to 7.6% from 8.4%.

Now, this is the Highest Interest rate in Small Savings scheme.

On a deposit of 1.5 Lakhs for 14 year, the Maturity value after 21 years will be reduced by 7.83 lakhs.

For more scheme details, check out here Sukanya Samriddhi Yojana – A Complete Guide

See our Below Summary

The Rates on small savings schemes are revised on quarterly basis. Earlier this, banks had reduced interest rates on their fixed deposits.

The formula to arrive at the interest rates of the small savings schemes was given by the Shyamala Gopinath Committee. The committee had suggested that the interest rates of different schemes should be 25-100 bps higher than the yields of the government bonds of similar maturity.

New Small savings scheme interest rate :

Small savings scheme interest rate

| Instrument | Interest rate (%) from Jan 1, 2022 to Mar 31,2022 | Interest rate (%) - April 1, 2022 Onwards | Change(%) | Compounding frequency |

|---|---|---|---|---|

| Savings deposit | 4 | 4 | 0 | Annually |

| 1 year Time Deposit | 6.9 | 5.5 | -1.4 | Quarterly |

| 2 year Time Deposit | 6.9 | 5.5 | -1.4 | Quarterly |

| 3 year Time Deposit | 6.9 | 5.5 | -1.4 | Quarterly |

| 5 year Time Deposit | 7.7 | 6.7 | -1 | Quarterly |

| 5 year Recurring Deposit | 7.2 | 5.8 | -1.4 | Quarterly |

| 5 year Senior Citizen Savings Scheme | 8.6 | 7.4 | -1.2 | Quarterly & Paid |

| 5 year Monthly Income Account | 7.6 | 6.6 | -1 | Monthly and Paid |

| 5 year National Savings Certificate | 7.9 | 6.8 | -1.1 | Annually |

| Public Provident Fund | 7.9 | 7.1 | -0.8 | Annually |

| Kisan Vikas Patra | 7.6 | 6.9 | -0.7 | Annually |

| Sukanya Samriddhi Yojana | 8.4 | 7.6 | -0.8 | Annually |

The Rates cut now will be effected in the April month Mutual fund inflow data as Many will shift towards Mutual funds.

The SCSS scheme is meant for retirement people who depend on the interest on small savings scheme will now face little difficulties as it may be their only source of Income.

Hope the reduction table in each scheme will enlighten you how the interest rates have big impact on the schemes.

Happy Investing.