Hello Reader,

Are you looking for a way to track your expenses ?

The first step in Financial Freedom is to know your Expenses.

Financial Freedom is the state of mind that can be felt when you are totally worry-free about your finances.

Read more details on Financial Freedom here.

Change the Formula of Savings.

✘ Income – Expenses = Savings to ✔ Income – Savings = Surplus (Expenses)

The Main Idea to follow “Income – Savings = Expenses” is to develop the Saving nature before we start to spend.

Yes. Now the Surplus shall be spent for our wants and needs.

Many people are just in tough situations so it’s hard for them to get a grip on their finances and for those people to reach their Financial Goals, Only Way to have a grip on their wallet is to Track Expenses.

Why do we need to track our expenses?

Tracking Personal & Household expenses are Crucial. It allows you to

- Become more conscious of what you are spending

- Helps you to Prioritize your expenses ( Needs & Wants)

- Improves your Money Management & Accounting skills

- A crucial role in Calculating your Savings rates

- Supports you to save more money & Create Financial Awareness.

- It helps you to Forecast your upcoming expenses.

- Never get surprised by your Bank Balance at the end of the month.

- Guides you to reinvest the balance from the surplus.

- End up becoming more disciplined and Organised

- Keeps you away from Overspending

Here’s how to get started tracking your monthly expenses.

1. Paper – Way

This is the easiest way and simply write down every money spend on a piece of paper with details. This is the old school method but very effective than in digital ways.

Every day, make time to write your expenses.

If you want it in an Organised Way, Buy an Expense tracker Notebook or Simple Daily Cash flow log. These journals will help you work more efficiently, smarter and better at tracking expenses. A simple tool to keep accurate expenses. These journals come with a little cost.

Do it yourself an Accounting ledger with 5 Columns.

Date | Description | Category | Debit | Balance

The paper way doesn’t have any fancy graphs or notifications but at least it makes you understand where you are spending.

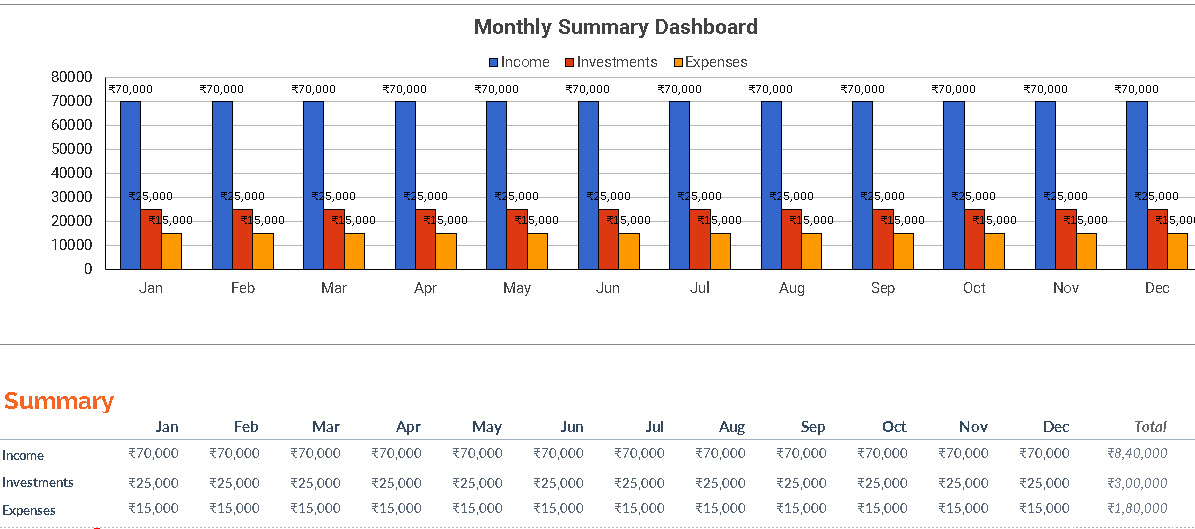

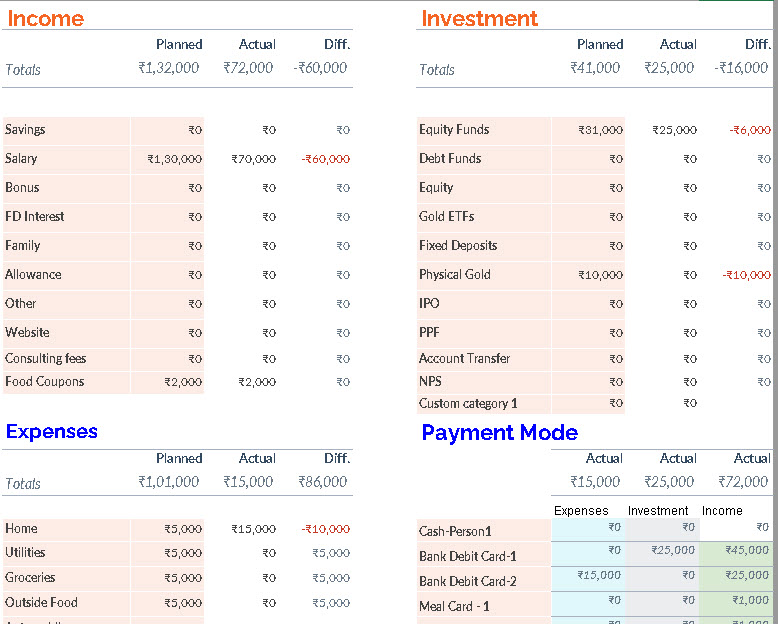

2. Excel – Way

Plenty of readers use spreadsheets in their daily life. Excel provides you with loads of options to display your data. It has a plethora of templates and it’s customizing ability to meet our needs on the screen is the beauty of having Excel as the tracking expenses.

The only disadvantage is getting to the computer to enter your expenses. But there is a solution to that too. Google Sheets is there.

If you want any already developed Budget tracking sheet, you can purchase as well.

To avoid Convenience fee, you shall use UPI payment also. (For Indian payments only)

How to Buy via UPI?

- Pay Rs.499 via UPI Payment to 1stopinvestment@icici / Scan below QR Code

- Send the same Screenshot to the email id : mailto1stopinvestment@gmail.com with subject ID : Budget tracker sheet

- Unprotected file download Link will be emailed after payment verification

Please find this link to see supported UPI Payments App.

3. Google Sheets – Way

As I hope, everyone will be having a Gmail id. Then you can use Google Sheets to track your expenses as a single person or as a Family.

Keeping it as a Shared workbook, you and other family members enter your daily expenses.

4. Budgeting Apps – Way

Mobile Apps help you to manage your expenses better as it is available with you every minute.

There are many apps available in the Apps Store. Here is the list of apps that I personally tried and using it even now.

- Expense Manager – (Best Expense Manager app I used so far)- Download here

- Monito Expense Manager

- Money Manager Expense & Budget

- Money Manager: Expense Tracker, Free Budgeting App

- Spending Tracker

- Expense Manager – Track your Expense

The caution here I would like to mention is “Don’t use multiple Apps to track your expenses, This is just a tool to enhance your expenses”. The main motto to use these budgeting apps is “As & When you spend on something, you put it in the app. Don’t make excuses”.

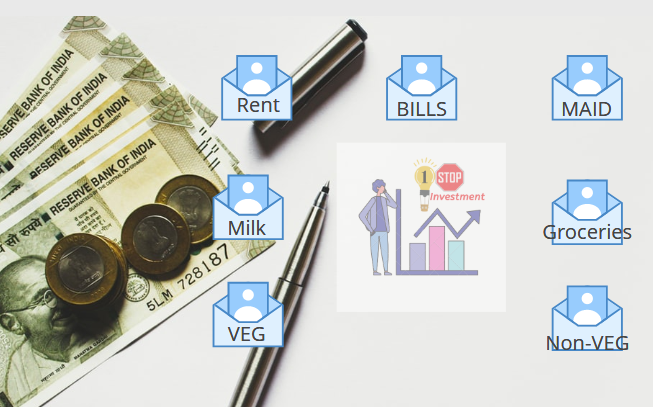

5. Envelope – Way

This way is called the “Pay in Cash method”. The reason behind it is that when you use cash, you typically pay more attention to what you’re spending than you do if you’re just swiping a card.

Once you made all your Investment/Savings, Draw 75% of the Money and keep it as “CASH” at home.

Buy some Envelopes from the Book Store or available in Amazon also.

a) Label Each Envelope and Put the estimated money Inside.

b) Note down the details in the envelopes when some money is taken out.

Now Paying in Cash can be Inconvenient but Watching the money goes out of the envelope gives an additional sense before spending. This Feel doesn’t come in Virtual Cash.

Most successful people in this world track their expenses, Start tracking your Expenses from Today using any of the way mentioned above.

Are you tracking your expenses? What are your best budgeting and expense tracking tips? Let others know in the comments below!

Share this with your family members! Happy Tracking!

Read the most popular article here :

Check out how the Stocks Portfolio Spreadsheet works.

Please share with us if you like to add any features. You shall comment below and the same shall be implemented.

Please Check out other Calculators available here and other excel sheets available here!

I have read your article; it is very informative and helpful for me. I admire the valuable information you offer in your articles. Thanks for posting it.