In the latest press release, the central bank said, “The Government of India (GoI), vide Notification F.No.4(28)-(W&M)/2017 dated May 27, 2020, hereby announces that 7.75% Savings (Taxable) Bonds, 2018 shall cease for subscription with effect from the close of banking business on Thursday, the 28thof May 2020.

The Government of India issues bonds so as to fund programmes of public welfare, increase the investment in the economy as well as help the citizens of the country take part in the growth of the nation.

Savings bonds are usually looked at as safe and secure investments as the national government backs their returns.

As these bonds are sovereign in nature, payment is guaranteed on maturity.

The Central Government is fully backing up this scheme and this is the reason why the investors with less-risk appetite should be aware of this type of investment.

Are you looking for any below ?

What is RBI 7.75% Saving bond?

RBI savings bond now replaced the previous 8% bonds with 7.75% from 10th January 2018. These bonds comes with a maturity of 7 years. (notification No. F.4 (28)-W&M/2017 dated January 03, 2018.)

Since the maturity comes with 7years, it helps to achieve one’s medium term goal.

Who can invest?

- An Individual Citizen of India

- Joint account also be opened

- Indian Parents can open in the name of their minor children with a nominee registered.

- HUF (Hindu Undivided Family)

- NRIs are NOT ELIGIBLE to invest in these bonds.

How long one has to invest?

Maturity period is 7 years.

Limit of investment

The minimum permissible investment for this Bonds is Rs. 1000/- and in multiples of Rs. 1000/- thereof. However, There is is no maximum limit of investment.

The applications must be submitted with the necessary payment in the form of Net-banking/ cash/ cheque/ draft.

Who will issue the Bonds and where can you buy?

The Bonds will be issued in the form of the Bond Ledger Account by and held with designated branches of the agency banks and Stock Holding Corporation of India Limited (SHCIL) as authorized by the Reserve Bank of India.

- All SHCIL offices,

- Specific branches of the State Bank of India,

- All other nationalized banks and,

- Few private sector banks, such as ICICI Bank and HDFC Bank.

New Bond Ledger series with the prefix (TB) will be opened in the name of the issuer of the bonds.

The Bonds will be issued in demat form (Bond Ledger Account) only.

Bond Ledger Account will be opened by Receiving Office in the name of investor/s.

As soon as the bonds are credited to your Bond Ledger Account, an e-mail will be sent to you specifying the Bond ledger Account number and the number of bonds held. You can also view your Bond Ledger Account number on the Portfolio Page and the Order Book.

Receiving Office will also send a certificate of holding detailing your investment. This should reach you within 15 days of allotment of Bond Ledger Account number.

What are the type of options available?

- Cumulative (TBX Forms)

- Non-Cumulative (TBY Forms)

In case of non-cumulative option, interest is payable on half yearly basis.

Half-yearly interest is payable on 1st February / 1st August. Bank account details to be filled correctly to facilitate the interest payment and maturity payment directly to the account.

In case of Cumulative option, interest will be compounded every 6 months and it is payable at the time of maturity along with principal amount

For 1000Rs invested in Cumulative option, 1703 will be payable after 7 years.

You shall also use the calculator available in our website to calculate the returns.

The change of option is not permitted once it is subscribed.

No interest will accrue on the bond post its maturity date.

Are the interests Taxable ?

The income from these bonds are taxable as per the investor’s tax slab under the Income Tax Act of 1961. The tax will be deducted at source (TDS) while the interest is paid.

No income tax exemption available under section 80C.

However, the bonds will be exempt from Wealth-Tax under the Wealth-Tax Act, 1957.

Premature Closure

Premature closure option is available for the investors as per their age bracket.

Facility is available to the eligible investors after Lock in period of 4, 5 and 6 years from the date of issue in the age bracket of 80 years and above, between 70 to 80 years and 60 to 70 years respectively.

Loan Eligibility

These bonds are not eligible as collateral for loans from banking institutions, non-banking financial companies or financial institutions.

What happens in the event of death of the bond holder?

It is mandatory to nominee a person through Form-B while applying for the bond. The sole Holder or all the joint holders may nominate one or more persons as nominee. The nominated person or persons shall be entitled to the ownership as well as any payment due on the bond.

These Bonds are not transferable and not traded in the secondary market.

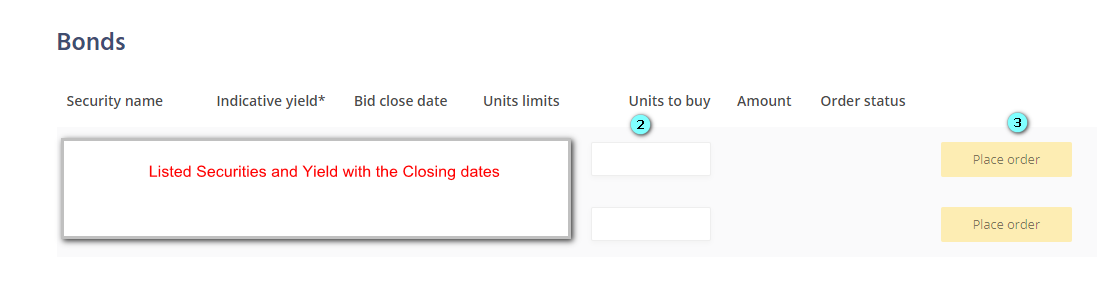

Issuance Calendar for Marketable Dated Securities :

Every week Monday to Friday, these bonds shall be purchased. RBI will publish the bond issuance calendar periodically. It includes other details like Security wise allocation and amount .

For dates: RBI Website for April – September 2020.

How to buy SGB via Zerodha ?

Clicking on the this link will take you to the login page and Login using your credentials. Enter the grams and Place your order.

Conclusion:

Overall, for those who is looking for to save some money while accumulating a better rate of interest than what is available in today’s fluctuating market, this bond is an extremely fit and profitable option.

Happy Investing.

Other articles to read :

Great