Sovereign Gold Bonds are tradable government securities with prices linked to the GOLD prices. SGBs is an another way of investing in Gold.

The Sovereign Gold Bond (SGB) Scheme was first launched by Government of India (GOI) on October 30, 2015. So far 51 tranches (till 2021-22 Series II) of the Sovereign Gold Bond Scheme have been issued.

These bonds are issued by the RBI on behalf of government. Hence it carries a Sovereign Guarantee by Govt of India.

Price of Bond will be fixed in Indian Rupees on the basis of simple average of closing price of gold of 999 purity, published by the India Bullion and Jewellers Association Limited for the last 3 working days of the week preceding the subscription period.

Issue Price of the Current Tranche is published by RBI.

♥ The Bond issue price is Rs.4777 per gram (Series-1 – FY 2021-22 – 17-May-21)

♥ The Bond issue price is Rs.4842 per gram (Series-2 – FY 2021-22 – 24-May-21)

♥ The Bond issue price is Rs.4889 per gram (Series-3 – FY 2021-22 – 31-May-21)

and discount of 50Rs is still applicable for those who are applying through digital payment method.

Watch out this space for the latest series / tranche updates.

Below are the Issue Price for the FY 2020-21 Tranche :

♥ The Bond issue price is Rs.4639 per gram (Series-1 – FY 2020-21 – 28-Apr-20)

♥ The Bond issue price is Rs.4590 per gram (Series-2 – FY 2020-21 – 19-May-20)

♥ The Bond issue price is Rs.4677 per gram (Series-3 – FY 2020-21 – 16-Jun-20)

♥ The Bond issue price is Rs.4852 per gram (Series-4 – FY 2020-21- 14-July-20)

♥ The Bond issue price is Rs.5334 per gram (Series-5 – FY 2020-21- 11-Aug-20)

♥ The Bond issue price is Rs.5117 per gram (Series-6 – FY 2020-21- 08-Sep-20)

♥ The Bond issue price is Rs.5051 per gram (Series-7 – FY 2020-21)

♥ The Bond issue price is Rs.5177 per gram (Series-8 – FY 2020-21)

♥ The Bond issue price is Rs.5000 per gram (Series-9 – FY 2020-21)

♥ The Bond issue price is Rs.5104 per gram (Series-10 – FY 2020-21)

♥ The Bond issue price is Rs.4912 per gram (Series-11 – FY 2020-21)

♥ The Bond issue price is Rs.4662 per gram (Series-12 – FY 2020-21)

[wpdatachart id=1]Key features of Sovereign Gold Bonds (SGB)

- These bonds also offer an interest* of 2.5 percent annually, paid on half yearly basis. This interest, you will not get if you invested in ETFs.

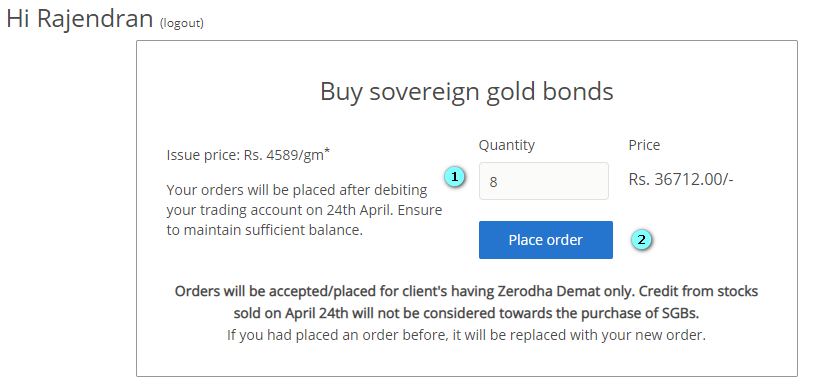

If you wish to buy 8grams via online, you will end up paying (36,712). You will receive 459Rs every six months.

- Tenue for the bonds is 8 Years.

- Premature withdrawal is available from 5th year on the interest payment dates.

- Minimum investment – 1 Gram

- Denomination – In multiples of gram(s) of gold with a basic unit of 1 gram.

- Maximum Investment – 4 KG for individual, 4 Kg for HUF and 20 Kg for trusts and similar entities per fiscal

Interest will be paid only for the nominal value.(not the market price)

Where to buy these SGB?

The bonds can be bought through scheduled

- Commercial banks (except Small Finance Banks and Payment Banks),

- the Stock Holding Corporation of India,

- National Stock Exchange

- BSE

- Post offices

Who can buy these Bonds?

The Bonds will be restricted for sale to resident individuals, HUFs, Trusts, Universities and Charitable Institutions.

⊗ NRIs are not eligible to buy these bonds.

Joint account shall also be opened.

The Gold Bonds will be issued as Government of India Stock under GS Act, 2006. The investors will be issued a Holding Certificate for the same. The Bonds are eligible for conversion into demat form.

Are there any tax exemptions available?

The sovereign bonds offer a tax incentive. The Capital Gains arising from the appreciation of Gold prices is Tax-Free. But the Interest (2.5%) is taxed as per the income slab.

How many tranches of bond issue?

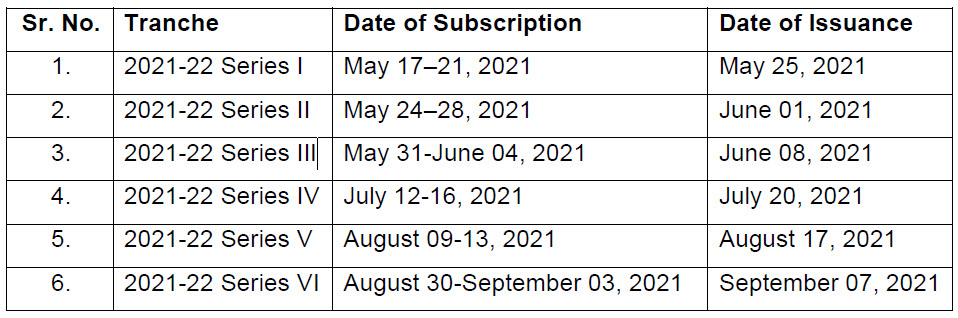

The Sovereign Gold Bonds will be issued in six tranches from May 2021 to September 2021 as per the calendar specified below:

Source : RBI Press Release

There will be 6 tranches of the latest sovereign gold bond issue (2021-22) in this Financial year.

The issue will be opened for 5days typically.

Other Advantages

- Like ETFs, These bonds doesn’t have annual recurring expenses.

- No Expense ratios also. (Gold ETF have low expense ratio)

- No theft worries

- No other charges like Making and GST.

- Bonds can be used as collateral for loans. The loan-to-value (LTV) ratio is to be set equal to ordinary gold loan mandated by the Reserve Bank from time to time.

- These bonds are transferable.

Should you invest in SGB?

Considering the current market situation, Gold is considered as safe heaven during the choppy market period.

If you compare the gold price(10grams) with Sensex, the gold has provided good returns .

Another fact if you seen from the above chart, whenever there is market fall there will be rise in gold price also because people will be buying it in large.

You can purchase the bonds in Paper format or demat holding as you preferred.

How to buy SGB via Zerodha ?

Clicking on the this link will take you to the login page and Login using your credentials. Enter the grams and Place your order.

Conclusion

Always Gold is being considered as part of long term investment in everyone’s financial planning and the tenure of this bonds helps investors to achieve their goal based accumulation.

Watch out the Quick Summary of SGB here :

Happy Investing.

Very nice,

Thanks Kumaran ! Keep following #1stopinvestment !

Awesome one….👍