PMVVY stands for Pradhan Mantri Vaya Vandana Yojana. The Government of India introduced this scheme in the 2018-19 budget to provide financial certainty to senior citizens with guaranteed regular income.

Now the PMVVY scheme is extended for 3 years. (earlier it was planned to end on 31st March 2020). Senior citizens can now invest in this scheme up to 31st March 2023.

This scheme is one of the best choices for the post-retirement planning for a regular income stream with the retirement corpus available.

The Capital invested in this scheme is completely safe and backed by the government.

Are you looking for any below ?

Who can open Pradhan Mantri Vaya Vandana Yojana Scheme?

- Any Indian resident who aged above 60 on the date of opening is eligible for the PMVYY scheme.

- NRI’s & HUF’s are not eligible for this scheme.

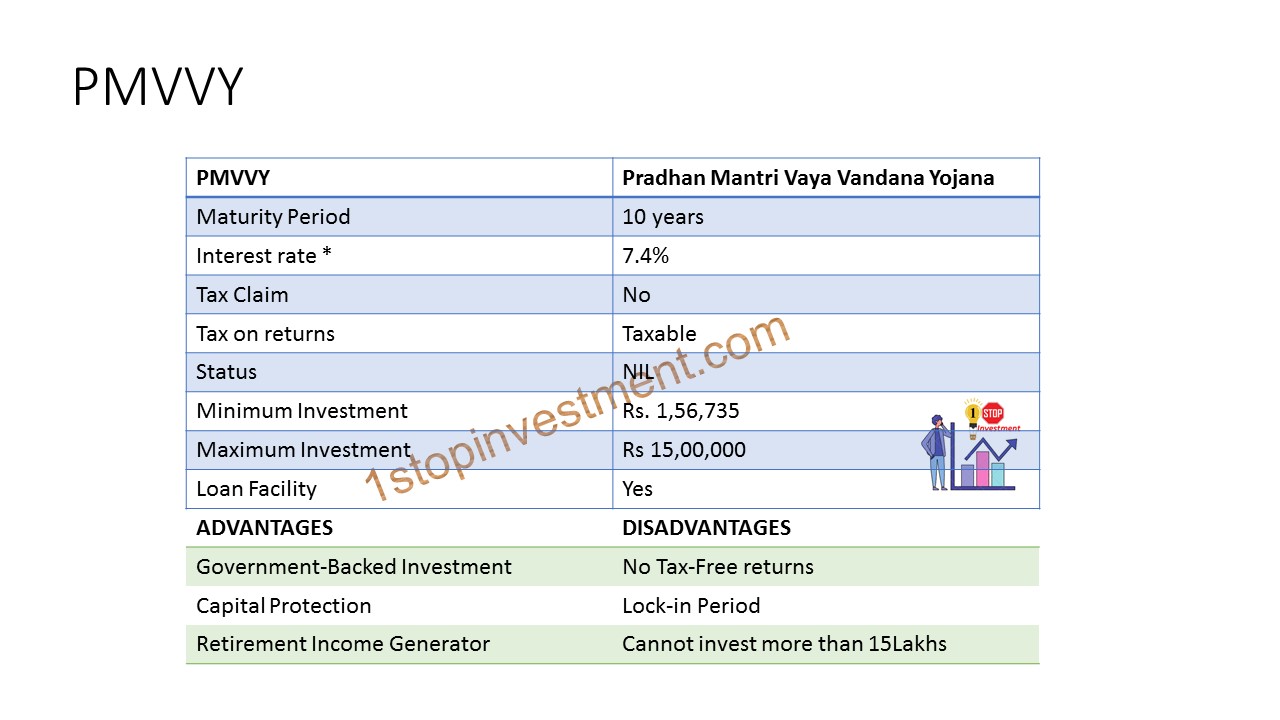

- Investment Duration: 10 years

- Maximum Investment: 15 Lakhs.

LIC of India has been given the sole privilege to operate this scheme.

Those who want to invest in the scheme can do so online via the LIC website. You can also purchase the scheme offline by visiting the nearest LIC office.

Scheme Restrictions:

The scheme has a minimum pension value and maximum pension value.

Pension Mode Minimum Pension Minimum Purchase Maximum Pension Maximum Purchase

Monthly Rs. 1,000/- Rs. 1,62,162 Rs. 10,000/- Rs. 15,00,000

Quarterly Rs. 3,000/- Rs. 1,61,166

Rs. 30,000/- Rs. 14,90,788

Half Yearly Rs. 6,000/- Rs. 1,59,680

Rs. 60,000/- Rs. 14,77,041

Yearly Rs. 12,000/- Rs. 1,56,735

Rs. 1,20,000/- Rs. 14,49,803

The above table shows the Minimum & Maximum purchase value for the current interest rate.

Interest Rate:

The current interest rate is 7.4% which was 8.0% earlier. The interest rate will be set every year by the government. It will be in line with the Senior Citizens Savings Scheme.

Pension Payout Mode

The modes of pension payment are monthly, quarterly, half-yearly & yearly. The pension payment shall be through NEFT or Aadhaar Enabled Payment System.

What if the policyholder demise

On the death of the Pensioner during the policy term of 10 years, the Purchase Price shall be refunded to the beneficiary/nominee.

Pre-mature withdrawal / Surrender Value

This scheme allows premature exit during the policy term under exceptional circumstances like the Pensioner requiring money for the treatment of any critical/terminal illness of self or spouse. The Surrender Value payable in such cases shall be 98% of Purchase Price.

Loan Facility

The loan facility is available after completion of 3 policy years. The maximum loan that can be granted shall be 75% of the Purchase Price.

For the loan sanctioned for the pension receiver, the applicable interest rate is 9.5% p.a. payable half-yearly for the entire term of the loan.

Free-Look Period

If a policyholder is not satisfied with the “Terms and Conditions” of the policy, he/she may return the policy to the Corporation within 15 days. (30 days if this policy is purchased online) from the date of receipt of the policy stating the reason for objections.

Summary

Conclusion

This plan is good for the retirement people who are looking for Regular monthly income. This scheme is having equal interest rate as like the Senior Citizens Savings Scheme. But SCSS tenure is 5 years and PMVVY tenure is 10years. Once if a retiree max out 15lakhs in SCSS, he/she shall invest another 15 lakhs in this scheme and receive higher interest than other banks fixed deposit.