In Share Market, Rise and Fall are inevitable. Stock prices change every day by market forces. The prices are fluctuating because of supply and demand. Most of us know how the bid/ask ratio works and results in Stock prices.

The Rising market is the “Bull Market” and the Falling market is “Bear Market”. Although both are coined by some percentage of rising and falling.

Bear Market is when the index or asset falls more than 20% from its recent highs.

Although there is no such numerical value for Bull Market, some analysts say when the index rises by 20% after two declines of 20%, also when the stocks have been hitting new high continuously.

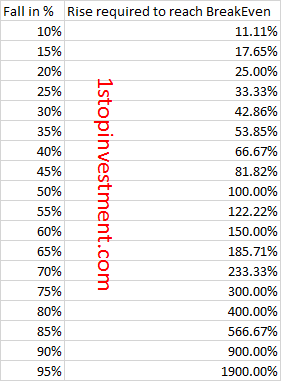

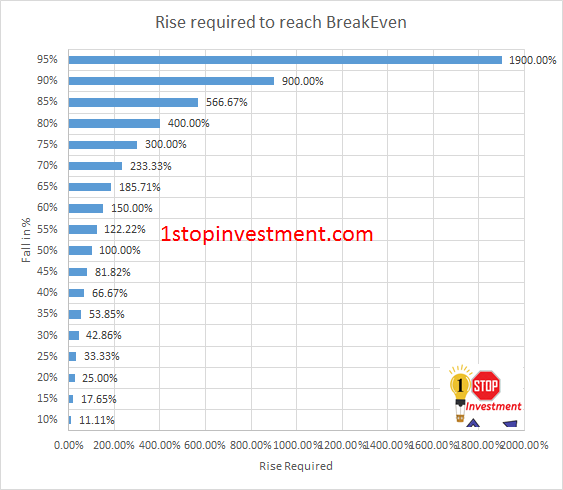

Now, Let see below table and How much percentage required to Breakeven if your Portfolio is beaten down heavily in this fall.

Let’s crunch in Numbers.

During Covid-19, Nifty50 was trading at 7800 and it’s previous high was 12430. It has fallen 4630 points or 37.25%.

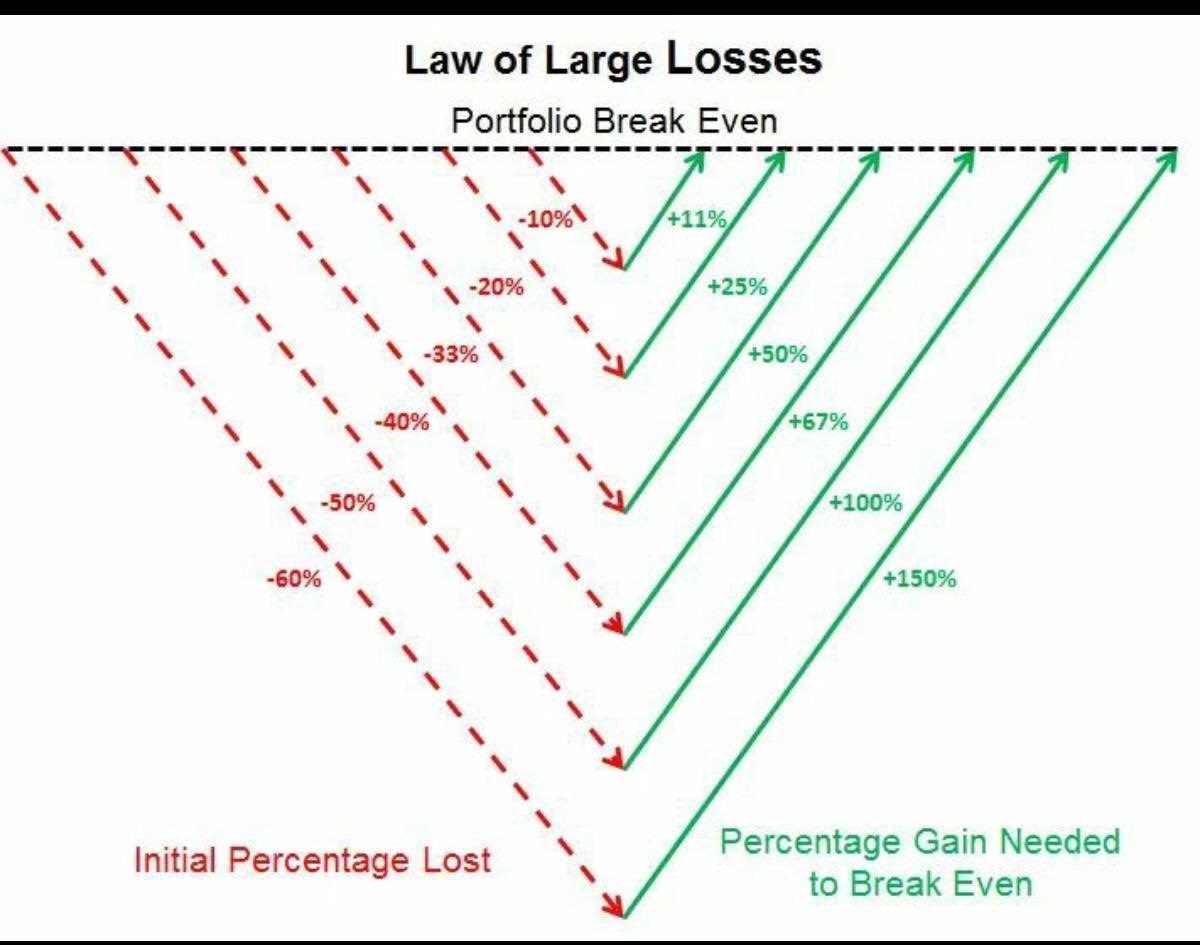

Again to reach the same high, it is not the same percentage for rising required.

Now it’s required more than the fallen percentage.

Even though It requires the same 4630 points to Reach 12430 again from 7800, The Percentage wise it is not 37.25%. Now to rise, it requires 59.35%.

Yes, the Fall & Rise is not the same.

Here it is Chart & table of Rise required to reach the Breakeven after a fall , I made for you to ease the calculation.

I hope the above table helps you to calculate your breakeven analysis.

Check out the other calculators available which will help your calculation.

Happy Investing.

Pingback: How can you spend this Lockdown that may change your financial life forever - 1stopinvestment.com