In the Investing journey, you need to understand the impact of Crude prices in the market. Crude oil remains the most important commodity around the world and it’s impact will be huge across every portfolio.

The rise and fall in crude oil prices affect the company financial performance and in turn it reflects in the stocks prices too. This is why prices of the oil matters to every economy.

One of the Major sector that is greatly influenced by the price of oil is Logistics and Transportation, which relies on fuel as a major input.

We shall see this post in two Conditions :

- Falling Oil prices

- Rising Oil prices

Are you looking for any below ?

Falling Oil prices Condition:

1.Currect Import Bill

India imports 80% of it’s oil need from the OPEC Countries (Organization of the Petroleum Exporting Countries) and other Countries. So when the Crude prices fall, it has direct impact on its import bill value. It helps India to reduce it’s current account balance deficit.

Current account balance measures the flow of goods, services and investments into and out of the country. We run into a deficit if the value of the goods and services we import exceeds the value of those we export.

Current account balance measures the external strength or weakness of an economy.

A fall in oil prices by $10 per barrel helps reduce the current account deficit by $9.2 billion. (study report by livemint)

2.Local Oil Producers

India is one of the top 10 petroleum product exporters in the world. Any fall in the prices directly hits the exports. The fall in exports again leads to trade deficit and it’s bad for the economy.

3.Inflation

As said earlier, the direct impact shall be seen in transportation which linked directly to the Consumers. So the fall in Crude price helps india to avoid any increase of prices in goods and its services. It helps inflation to stay in control.

A fall in oil prices by $10 per barrel helps reduce the retail inflation by 0.2% and WPI by 0.5%.(study report by moneycontrol)

4.Rise in Under-Recoveries

Under-recoveries are the losses which government compensates the Oil Marketing companies loss because the government fixes the price at subsidized rates. This loss adds to the government expenses and leads to rise in Fiscal deficit.

5.Rupee Valuation

The currency value mainly depends on the Country Current account balance. If a Currrent account balance is deficit, the value of the rupee falls. Why? Because, the country has to buy dollars to pay the bills. So in the fall of Oil prices, as seen earlier, it will reduce the deficit and good for the rupee. But It applies to every other currencies, so Dollar prices strengthen whenever price falls. So in the End, fall in oil price doesn’t impact on rupee valuation.

Rising Oil prices Condition:

1.Increase in Current Account Deficit

CAD = Imports – Exports

The rise in Oil prices leads to increase of Import bill numbers. Further will lead to deficit CA.

Every U$10 per barrel increase in oil price leads to a 0.55% or 55 bps increase in the current account deficit.

2.Inflation

The Increase of oils has the direct influence on transportation and lead to rise of prices for the consumers. This lead to rise of Inflation.

Every US $10 per barrel increase in oil price will result in a 0.5% or 50 bps increase in CPI in FY2019. To avoid too much of impact in inflation, government cuts the excise duty and minimize the consumer price inflation(CPI). This again takes a hit on the government Fiscal deficit.

If the Fiscal deficits shoots up, the rating of Indian economy will go down and the companies doesn’t attract any Foreign Investments and will have huge impact on the market.

3.Fall in rupee Valuation

The rise in oil leads to higher imports than exports. This causes Balance of payments at Negative. Then rupee weakens due to deficit in current account.

Sectors and its stocks impacted directly by Crude prices :

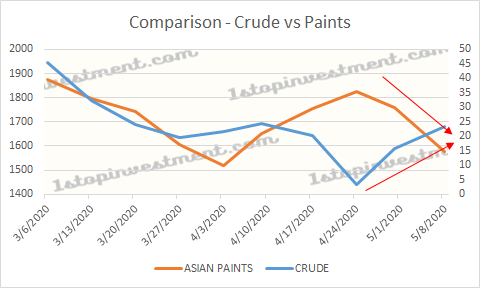

Fall in Crude prices benefits below Companies (sectors) like

- Tyre

- Paints

- Lubricants

- Logistics

- Footwear

- Refinery and

- Airlines

The fall in prices reduces the raw material cost for these companies.

Small Comparision of the recent fall and rise in Crude Prices. How it affect in Paint sectors.

Fall in Crude prices affects below Oil Companies like

- Oil Companies

- Upstream Companies – ONGC, OIL INDIA – AFFECTS due to fall in Oil price

- Downstream Companies – IOC ,HPCL , BPCL — Beneficial due to fall in Oil price

Investors might want to consider shorting the stocks of the above sectors when oil prices are high. Conversely, they buy when oil prices are low.

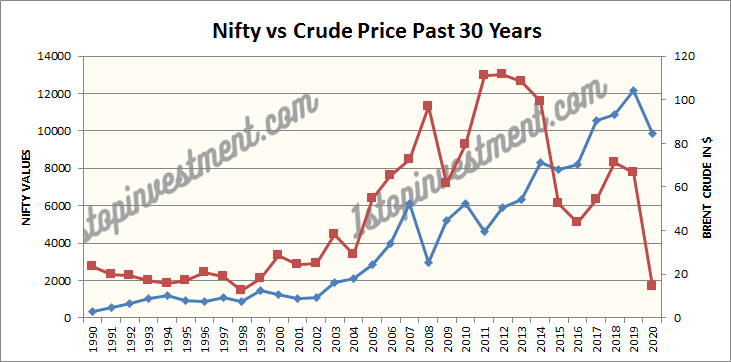

Nifty vs Crude prices

From the above graph, the rise in crude prices takes the market to new high and fall in crude prices tanks the market but not compared to the commodity slide.

The rise in Crude price indicates the Market Up-trend also.

Conclusion :

The price of Cruide oil not only affects the stock of oil related companies but also the stocks of industries which use crude as a byproduct or raw material.

I hope you understand the Crude price impact on markets. Invest with the trend.

Happy Investing.