Are you looking for any below ?

What is India VIX ?

India VIX is a Volatility Index based on the Index option prices of NIFTY.

It shows the Volatility or Momentum / Market fluctuations i.e Increase or Decrease expected in the Nifty50 over the next 30 Calendar days.

In other words, “It is a measure of underlying market index expected to fluctuate in the near term based on the Index option prices of NIFTY.”

Lower the VIX – Investors won’t have to worry about their portfolio.

Higher the VIX – Fear or Uncertainty will be higher among the Investors/Traders.

FACT : VIX is originally derived from Chicago Board Options Exchange(CBOE) in 1933.

Computation:

India VIX value is computed based on the below factors :

- Time to expiry

- Interest rate

- Forward Index Level

- Bid-Ask Ratio

However, there is a detailed procedure on the calculation available in the NSE website. In India, NSE Computes the VIX value and this shall be used directly by the Investors & Traders without going through tedious calculations.

Range Calculation:

VIX is calculated based on the Implied Volatility. Black-Scholes option pricing formula is adopted to calculate Implied Volatility.

Implied Volatility helps to find the extremes.

Expected Range (+/-) = IV * SQRT(x/365)

IV-> Implied Volatility

Where x is the number of days to expiry. (this shall be calculated taking weekends into account)

For Example:

India VIX – 41.1625 as on March 12,2020. March 26 is the Expiry date. Implied Volatility is 50.17.

x = 14 days

If Nifty Closing Price is 9590.

Expected Range, sigma = (50.17/100)*SQRT(14/365) = 942 Points

On the Upside, we may expect 942Points in the next 14 days and Vice versa on the downside.

VIX Values is available in the NSE Website.

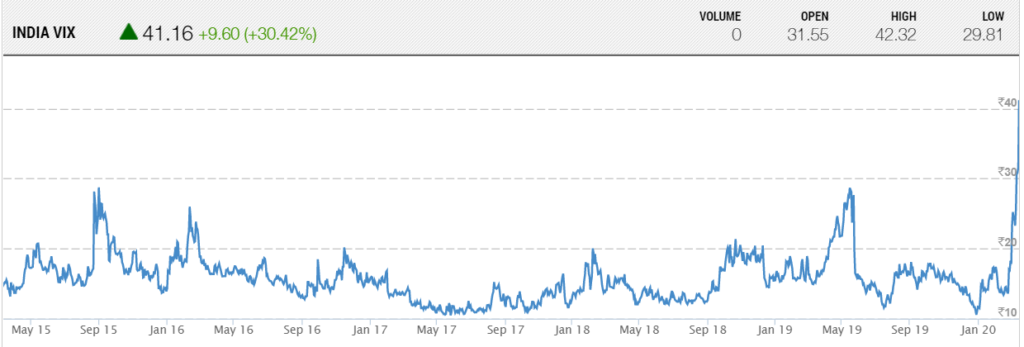

NIFTY VIX Chart :

Chart Source: Moneycontrol

How it helps the Investors :

- There is a correlation with the Nifty & VIX. With Rising VIX, NIFTY falls and with Falling VIX, Nifty Rises. On the sideways, Nifty also rangebounds. This helps both investors and traders in advance to take position accordingly.

- Traders uses VIX in their trading setup. For example, For those who deploy Iron Condor, the range defines the OTM Calls and Puts.

- Since the Higher Volatility shows the Rapid Change in Prices, Small traders can avoid trading those days, No trade is also a Good Trade. Capital protection is also Important. This can prevent retail traders.

- As a Hedging instrument. On raising VIX Period , Investors shall buy PUT options or Carry MARRIED PUT positions. On Rangebound VIX Period, they shall have COVERED CALL positions.

- Use Volatility based STOP Loss (Extreme Calculation shown above) and helps the trader to avoid huge loss in Options selling.

- On Rising VIX, Avoid shorting PUT options and Vice-versa.

Few Setbacks:

- VIX Value calculation methodology is tedious.

- Black Swan events does not follow these extremes. But VIX gives a warning well ahead of it happens. VIX above 20 means trade with warning.

Tools for your calculation:

Excel Templates : → Templates – 1stopinvestment.com

Premium Tools in Store : → https://instamojo1stopinvestment.myinstamojo.com/

Web Calculators : → Financial Calculators-1stopinvestment

Conclusion:

If you are looking to benefit from the VIX, Keep VIX in your watchlist.

The above watchlist is from Zerodha Watchlist, you can Join Zerodha by signing up here.

Happy Investing.!

To read more articles, checkout here.