Last Updated on June 8, 2021 by Jeysivaa | Published: April 18, 2020

An ETF, or Exchange Traded Fund, are basically a type of mutual Funds which follows an indices and the same are listed and traded on exchanges like stocks.

ETFs are funds that track any market securities like Index, bonds, Golds and foreign instruments.

The difference between ETFs and Mutual funds are as follows,

- You can buy as minimum units in ETFs whereas MF have minimum investment.

- ETFs traded in NSE/BSE while MFs are not traded in the exchanges.

- Only brokerage applies when redemption in ETFs

- no Exit loads in ETFs

- Lower fees than MFs makes it attractive for individual investors.

- Day trading is possible in ETFs whereas MFs it is not possible.

- Real time pricing of the asset while in MFs NAVs are based on the EOD.

One should understand how ETFs work before making any investment decisions. ETFs replicate the index which they track and they don’t outperform the underlying asset. ETFs don’t beat the market and whereas MFs funds differs in this.

Simply put, ETFs are basket of securities which mimic the Underlying benchmark and ETFs returns doesn’t exceed the benchmark index.

ETFs are passively managed funds where the portfolio adjustments are not required very often and makes its expense ratios lower.

These funds does not try to outperform the markets.

ETFs and Futures are not the same because Futures have the expiry and ETFs can be held as long as the investors wants.

The first ETF in India, “Nifty BEEs (Nifty Benchmark Exchange Traded Scheme) based on Nifty 50, was launched in January 2002.

The Dividends received from the stocks bought by the ETFs are reinvested in the fund itself.

To buy an ETF, you need a demat account while MFs doesn’t require bcz you are directly buying from the fund houses.

Are you looking for any below ?

How does an ETFs mimic ?

Let’s take an example of an ETF say, KOTAKNIFTY ETF which has an underlying NIFTY Index.

Let’s compare. Nifty50 has 50 stocks. And KotakNIFTY portfolio also having same 50 nos of stocks. In the Index, Not all 50stocks having the same percentage of weightage.

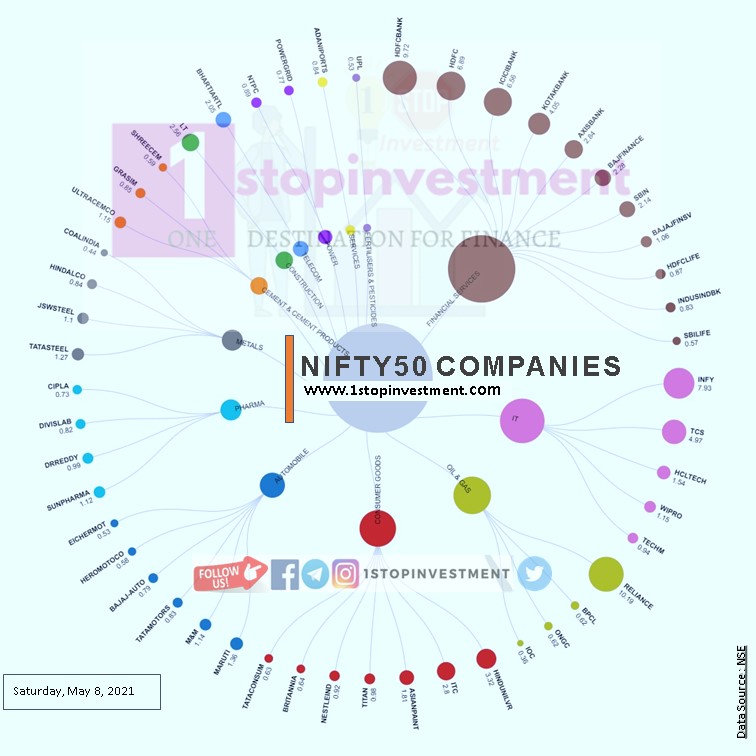

See below Pie chart for the Nifty weightage in Stocks.

So the KOTAKNIFTY50 also have the portfolio with same percentage of stocks.

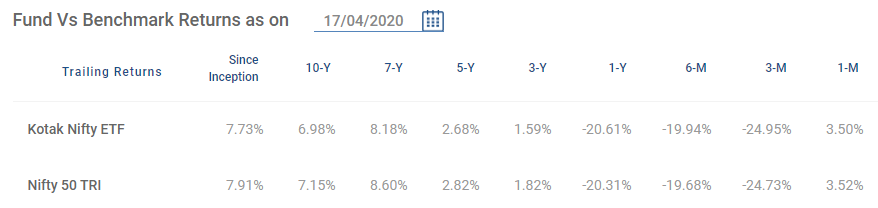

If you see the ETF movement in table, you will be more clear.

ETFs is almost following the NIFTY Trend in the past returns because it has the same portfolio as like Nifty.

Tracking Error:

Tracking error is the difference between an ETF portfolio’s returns and the underlying benchmark indices.

Sometimes, there will be a deviation due to the dividends received from the stocks and the deviation is reffered as tracking error and it is usually expressed in percentage.

Also, when there is change in Nifty weightage, the ETFs will have to do the right modification and there also it develops a deviations

Costs around ETFs

Like every other shares traded in the Exchanges, the brokerage applies to the ETFs also. STT and other usual costs of trading in stocks is applied to ETFs also.

Types of ETFs available in NSE

Any asset class that has a published index and is liquid enough to be traded daily can be made into an ETF. For Example , Stocks,Bonds, real estate, commodities, currencies, and multi-asset funds are all available in an ETF format.

- Equity ETFs

- GOLD ETFs

- Debt ETFs

- World Indices ETFs

Equity ETFs

Equity ETFs are instruments which based on indices and invest in securities in same proportion as the underlying index.

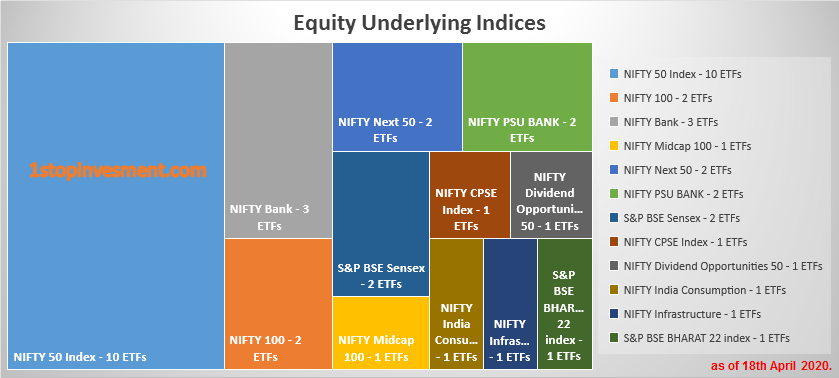

LIST of Underlying Indices in NSE:

Among the above underlying, the most common underlying indices are NIFTY50 AND NIFTYBANK.

Please see the list of NIFTY 50ETFs.

Please see below table for the complete list of Equity ETFs in NSE.

List of Equity ETFs listed on NSE

| Issuer Name | Name | Symbol | Underlying | Launch Date |

|---|---|---|---|---|

| Reliance Nippon Life Asset Management Limited | NIPPON INDIA ETF NIFTY BEES | NIFTYBEES | NIFTY 50 Index | 28-Dec-01 |

| ICICI Prudential AMC | ICICI SENSEX Prudential Exchange Traded Fund | ISENSEX | S&P BSE Sensex | 10-Jan-03 |

| Reliance Nippon Life Asset Management Limited | NIPPON INDIA ETF Junior BeES | JUNIORBEES | NIFTY Next 50 | 21-Feb-03 |

| Reliance Nippon Life Asset Management Limited | NIPPON INDIA ETF Bank BeES | BANKBEES | NIFTY Bank | 27-May-04 |

| Reliance Nippon Life Asset Management Limited | NIPPON INDIA ETF PSU Bank BeES | PSUBNKBEES | NIFTY PSU BANK | 25-Oct-07 |

| Kotak AMC | Kotak PSU Bank ETF | KOTAKPSUBK | NIFTY PSU BANK | 8-Nov-07 |

| Quantum AMC | Quantum Index Fund - Growth | QNIFTY | NIFTY 50 Index | 10-Jul-08 |

| Kotak AMC | Kotak NIFTY ETF | KOTAKNIFTY | NIFTY 50 Index | 2-Feb-10 |

| Motilal Oswal AMC | MOSt Shares M50 | M50 | NIFTY 50 Index | 28-Jul-10 |

| Reliance Nippon Life Asset Management Limited | Reliance ETF Infra BeES | INFRABEES | NIFTY Infrastructure | 29-Sep-10 |

| Motilal Oswal AMC | MOSt Shares M100 | M100 | NIFTY Midcap 100 | 31-Jan-11 |

| Religare AMC | Religare Invesco NIFTY ETF | RELGRNIFTY | NIFTY 50 Index | 13-Jun-11 |

| Birla Sun Life AMC | Birla Sun Life NIFTY ETF | BSLNIFTY | NIFTY 50 Index | 21-Jul-11 |

| ICICI Prudential AMC | ICICI Prudential NIFTY ETF | INIFTY | NIFTY 50 Index | 20-Mar-13 |

| Reliance Nippon Life Asset Management Limited | NIPPON INDIA ETF NIFTY 100 | RELCNX100 | NIFTY 100 | 22-Mar-13 |

| ICICI Prudential AMC | ICICI Prudential CNX 100 ETF | ICNX100 | NIFTY 100 | 20-Aug-13 |

| Reliance Nippon Life Asset Management Limited | CPSE ETF | CPSEETF | NIFTY CPSE Index | 28-Mar-14 |

| Reliance Nippon Life Asset Management Limited | NIPPON INDIA ETF Consumption | RELCONS | NIFTY India Consumption | 3-Apr-14 |

| Reliance Nippon Life Asset Management Limited | NIPPON INDIA ETF Dividend Opportunities | RELDIVOPP | NIFTY Dividend Opportunities 50 | 15-Apr-14 |

| Kotak AMC | Kotak Banking ETF | KOTAKBKETF | NIFTY Bank | 4-Dec-14 |

| SBI AMC | SBI ETF Banking | SETFBANK | NIFTY Bank | 20-Mar-15 |

| SBI AMC | SBI ETF NIFTY Junior | SETFNIFJR | NIFTY Next 50 | 20-Mar-15 |

| Edelweiss AMC | Edelweiss Exchange Traded Scheme - NIFTY | NIFTYEES | NIFTY 50 Index | 8-May-15 |

| SBI AMC | SBI ETF NIFTY | SETFNIFTY | NIFTY 50 Index | 23-Jul-15 |

| UTI AMC | UTI NIFTY ETF | UTINIFTETF | NIFTY 50 Index | 3-Sep-15 |

| UTI AMC | UTI Sensex ETF | UTISENSETF | S&P BSE Sensex | 3-Sep-15 |

| ICICI Prudential AMC | BHARAT 22 ETF | BHARATIWIN | S&P BSE BHARAT 22 index | 28-Nov-17 |

GOLD ETFs

Gold ETFs are instruments which are based on gold prices and invest in gold bullion.

Please see below table for the complete list of Gold ETFs

List of Gold ETFs listed on NSE

| Issuer | Name | Symbol |

|---|---|---|

| Axis Mutual Fund | Axis Gold ETF | AXISGOLD |

| Birla Sun Life Mutual Fund | Birla Sun Life Gold ETF | BSLGOLDETF |

| Invesco Mutual Fund | Invesco India Gold Exchange Traded Fund | IVZINGOLD |

| HDFC Mutual Fund | HDFC Gold Exchange Traded Fund | HDFCMFGETF |

| ICICI Prudential Mutual Fund | ICICI Prudential Gold Exchange Traded Fund | ICICIGOLD |

| IDBI AMC | IDBI Gold ETF | IDBIGOLD |

| Kotak Mutal Fund | Kotak Gold Exchange Traded Fund | KOTAKGOLD |

| Quantum Mutual Fund | Quantum Gold Fund (an ETF) | QGOLDHALF |

| SBI Mutual Fund | SBI Gold Exchange Traded Scheme | SETFGOLD |

| UTI Mutual Fund | UTI GOLD Exchange Traded Fund | GOLDSHARE |

| Reliance Nippon Life Asset Management Limited | Nippon India ETF Gold BeES | GOLDBEES |

Gold ETFs are subject to market risks impacting the price of gold.

Gold ETFs are ideal for investors who wish to invest in gold but do not want to invest in physical gold due to the storage hassles / doubt about purity of gold and are also looking to get tax benefits.

Other advantages are,

- ETFs are accepted as collateral in trading or loans.

- No making charges

- Exit loads – NIL

- No fear of theft

- No wealth tax

World Indices ETFs

Global Equity Exchange Traded Funds (ETFs) are simple investment products that allow the domestic investors to take an exposure to international indices.

As of now, 2 ETFs namely

- MOSt Shares NASDAQ 100 (N100) and

- Reliance ETF Hang Seng BeES (HangSeng)

Debt ETFs

Debt Exchange Traded Funds (ETFs) allows the investors to take an exposure to the fixed income securities. They invest the same proportion as the underlying index.

- LIC Nomura MF G-Sec Long Term ETF – Reg – Growth

- Reliance ETF Liquid BeES

- Reliance ETF Long Term Gilt

Check out the the latest info on ETFs available in BSE & NSE in India

How to select a right ETF for you?

1.Category/type/Benchmark

Based on your risk profile, Select the type where you want to invest.

As we seen earlier, there are 4 types of ETFs available in India such as Equity based, debt based, gold and world indices based.

Let’s assume you are would like invest in Equity based Nifty50 ETF.

2. Higher Trading Volume

Investors should choose an ETF where its trading volume is high. Why? Because low trading volume will result in higher bid-ask spread, leading to more cost.

See below Volumes,

3.Low Tracking Error

To mimic the Index, we should choose an ETF with less tracking error or lesser alpha.

See below table for the comparision. Investor must pick the ETF with minimum tracking error.

4.Low Expense Ratio

As the ETFs are not active funds, Any ETFs which are lesser than 0.5% is good.

Conclusion

ETF is the combination of Stock and Mutual funds. It offers advantages like Low risk, diversified portfolio ,Low cost structure and Finally, EASY to Trade like stocks.

By using the above guidelines, I hope you understand about ETFs and select the right instrument for you.

Happy Investing.!

Check out the Index Funds and learn how it differentiates from ETF !!