Public Provident Fund :

Public Provident Fund ( PPF ) was introduced in India in 1968 by the National Savings Institute of the Ministry of Finance under Indira Gandhi’s tenure. The Central Government is fully backing up this scheme and this is the reason why the investors with less-risk appetite choose this type of investment.

It helps to generate the fund for retirement or for children’s education.

*Interest rates mentioned here as on date 1-Jan-2020. Check out latest Interest rates here.

In this post, we discuss everything you wanted to know about PPF.

Tax benefits

While investing, it offers many tax benefits such as,

- During the investment time – the invested amount is tax-exempted under section 80C – maximum 1.50Lakhs.

- There is tax-exempted for the interest earned during the lock-in period which is reinvested (compounding annually and credited to the account at the end of the financial year).

- At the time of maturity, the amount received is also tax-exempted.

This makes PPF investment under EEE Category.

Who can open PPF :

- Residents of India who aged above 18 are eligible to open a PPF account.

- Indian Parents can open PPF in the name of their minor children with a nominee registered.

- NRI’s and HUF’s are not eligible to open a PPF account.

- Joint accounts and Multiple accounts are not allowed in the PPF scheme.

How long has to Invest :

- PPF has a minimum duration of 15 years

- It can be extended for 1 or more blocks of 5 years each as per your wish.

Interest rates :

The Current Interest rate is 7.1% (compounded annually).

However, PPF interest rates have been revised quarterly by the Central Government Finance Ministry. The interest rates are started at 4.8% in 1968 and peaked at 12% for 14 years from 1986 to 2000. After that, the interest rates are decreasing and dipped to 7.6 and climbed a bit to 7.9% for the third quarter of the 2019-20 Financial year. The below graph shows the historic rates of Interest for this scheme.

How Risk-Free it is :

- PPF has the sovereign guarantee and it is guaranteed by the Government of India. It means the credit risk of the principal and interest is almost NIL!

- PPF cannot be attached by any decree of courts or government under any circumstances.

How to open a PPF Account :

A PPF account can be opened either in a Post-Office or any Authorized banks such as State Bank of India, Punjab National Bank, ICICI Bank, HDFC Bank and Axis Bank with the required documents such as PAN Card, Aadhar Card and Bank Statement. You can also open a PPF account online if you have an account in the above-mentioned banks through net banking facility.

How many deposits per year in a PPF Account :

Earlier only 12 Deposits per year was allowed. But now with recent Amendment, PPF account holder can deposit in multiples of Rs.50 for any number of times in a fiscal year with the maximum of cumulative deposit of 1.5 lakhs in a financial year.

Options when PPF at Maturity Time

The PPF account holder has 3 options when the tenure is over.

- Withdrawal of the Accumulated Corpus amount without any tax deductions.

- Extension with no additional contributions. Sometimes, if the account holder doesn’t take any action within one year and this option gets activated automatically. Any amount can be withdrawn later in this stage. Single withdrawal is permitted every year and the rest of the amount keeps earning interest.

- Extension with additional contributions. For this option, the account holder has to submit Form-H where he is having his PPF account before the completion of 16 years from his account opening date. Extension duration will be a block of 5 years. By choosing this option, he can withdraw a maximum of 60% of his PPF amount. The investor can withdrawal One time every year.

LOAN OPTION DURING THE TENURE :

- The loan can be opted using the PPF account between the 3rd and 6th financial year from the date of account opening.

- Maximum loan amount will be 25% of the balance available at the close of two years preceding the loan applied year.

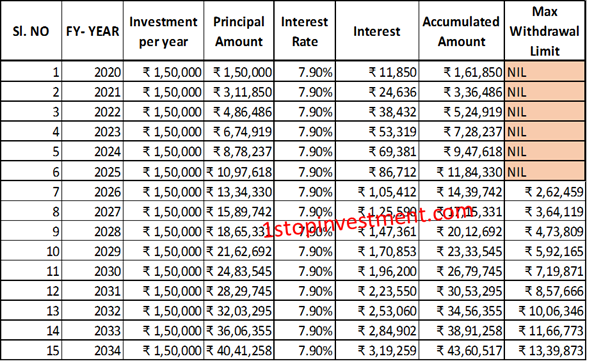

- Please see the below table for the maximum eligible loan amount if you invested the Maximum limit of 1.5Lakhs per year.

- The Interest rate for the loans will be 1 percent higher than the PPF Interest as per the new rules, Earlier it was 2%.

- No Loans are eligible from the 7th year because partial withdrawal option is eligible at that time.

- The loan amount should be repaid either in Lumpsum or monthly instalments within 3 years.

- If the loan is not fully paid, Extra 6% interest will be levied and the same amount will be debited from your PPF account.

PREMATURE CLOSURE RULES IN PPF:

- From April 1, 2016, As per Amendment made to the Scheme, premature closure of PPF is allowed in special cases after completion of 5 years for medical treatment of family members.

- But now applying new rules to the PPF to whoever holding the account or whoever opening the new account, the account shall be closed prematurely after 5 years and can be withdrawn before maturity if the investor needs money to fund his higher education or the dependent children’s education.

- However, both the closure comes with Interest rate penalty charges of 1%.

Partial Pre-Withdrawal RULES IN PPF

- If the account holder requires money invested in PPF, partial withdrawal is possible.

- The First withdrawal is available in the 7th year from the date of account opening.

- But there is a limit on the withdrawal money.

- The account holder can withdraw a maximum of, 50% of the accumulated amount at the end of the fourth year or 50% of the balance at the current year.

Please see below table for maximum eligible withdrawal amount if you have invested the maximum limit of 1.5Lakhs per year.

What if the Investor become NRI in the Future :

- During the Investment tenure, if you become an NRI, you have the option to continue like residents of India but cannot extend the PPF account beyond the maturity period.

What if the account holder demise :

- In PPF, it’s mandatory to have nominee while opening the account.

The nominee has two options,

-

- to either withdraw accumulated corpus amount and close the account.

- or to let the account be open till maturity and continue to earn interest but there is a limitation that no additional payments can be added.

Can one transfer the PPF account from one bank to the post office or other banks in the future?

- Yes, It is possible to change from bank to post office or vice versa.

- Also It is possible to transfer to different banks.

What if one miss to pay?

- If you didn’t make any contribution to PPF, the current account will be deactivated.

- To make the account active again, Rs.50 per inactive year has to be paid as penalty charges and the minimum investment of Rs.500 per inactive year to be paid.

How to reap maximum benefit :

- To gain the maximum interest, the account holder has to make the investment in Lumpsum before 5th April every year. I will post a separate article for this with the tricks.

This April, Before Investing in PPF, know this trick!!

- Please see the below table and Once you see the returns, I definitely assure you that you will right away choose to invest in PPF.

I hope that I have covered all the sections in the PPF investment. So If you have any doubts or clarifications, you may feel free to contact me.

Please check out PPF Calculator available in our website.

Please read the other available investing options here.

Pingback: This April, Before Investing in PPF, know this trick!! - 1stopinvestment.com

Hat’s off to your work Jeysivaa !

In the post it is said :

The First withdrawal is available in the 7th year from the date of account opening.

The account holder can withdraw a maximum of, 50% of the accumulated amount at the end of the fourth year or 50% of the balance at the current year.

Is the 50% from fourth or third year accumulated amount ?

As in example Rs.2,62,459 comes from Rs.5,24,919

Thanks for your wishes !

Regarding your doubt in Partial withdrawal in PPF.. The balance available at the fourth year means Balance at the 4th year starting.. So (Interest credited on 31st of March 3rd year).. to simply look from the table, Look at 3rd year Accumulated column.

The balance available at the 4th year is 5,24,919.. 50% eligible withdrawal amount is 2,62,459 !!

Hope I clarified your doubt. 😀