Are you looking for any below ?

What is FD?

FD stands for Fixed Deposits. It is a financial saving instrument with guaranteed returns that offers interest at an Interest rate for the deposit made by the investor after a certain period i.e. Maturity. The Interest rates vary with maturity time. Also the interest rates are higher than the normal savings account.

This is the most famous saving method in India despite it offers returns lower than the inflation rate because of the Capital Protection.

The Investors can open a FD account in the banks where they have an account. They can also open it in the post office. Generally the Interest rates offered for the same period varies with banks to banks and selecting the right organisation where you want to open the Fixed Deposit account, takes the next step.

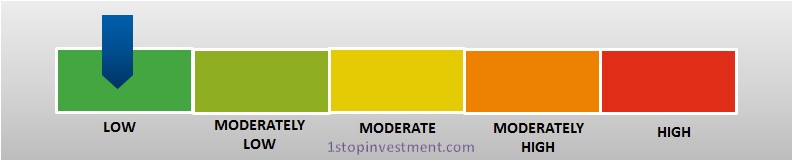

For the risk-averse investors, they can open a fixed deposit account in Nationalised Public sector banks and major Private Banks. In any case avoid the organisation where there is no transparency or credibility or not trustworthy though they give a better interest rate than the normal banks offer.

Those who want better returns with little risk, they can look for fixed deposits in Small Finance Banks and NBFCs.

For the risk-taking investors, they can look into companies where they offer a higher interest rate for the fixed period. These interest rates are higher than the financial firms. Subsequently, the higher interest rate comes with higher risk and when the company faces bankruptcy, the investors face difficulties to recover their deposit. The credit rating of the company shows the Strength of the company. As a rule, always go with ratings above AAA.

Who can open the Fixed Deposits?

- All Indian Citizens are eligible for Fixed deposit accounts.

- A resident can open any number of FD accounts.

- They can open it as Joint accounts too.

- Parents or legal guardians can also open on behalf of the minor.

- NRI’s & HUF’s are also eligible to open a Fixed Deposit account.

Types of Accounts Availability:

There are 2 kinds of accounts available with different interest rates applicable to each account.

- Normal account,

- Senior Citizen account,

Particularly, senior citizens account earn 0.5% to 1% higher interest than normal accounts.

Where can it be opened?

One can open a FD account in any post office or in authorized banks.

While opening the account, a Fixed Deposit account number will be given with investor and nominee details and maturity date with value. It can be viewed in Online also.

Nominee

The depositor has to indicate a nominee for the FD account. In an unfortunate event of death of the depositor, the nominee will receive the payments.

In the case of a Joint account, Joint holders are eligible to make changes in the nomination after the death of the one joint holder.

How long has to Invest :

Minimum tenure starts with 7 days and a maximum of 10 years in some banks.

The Investor has to remain invested in this account for any years depends on the type of account he/she chosen while opening the account.

A depositor has to make only one deposit in an account. But he/she can open any number of accounts. There is no restriction on the numbers.

Some of the banks offer sweep-in facility. This facility has the auto credit facility to the Fixed deposits where the Surplus money in the Savings account earns higher interest in fixed deposit account. This is called the Flexi-FD account.

When the investors did not withdraw on the maturity date, the interest rates gets renewed on the date of maturity for the initially opened period.

How Risk-Free Fixed Deposits are?

It provides capital protection and fixed returns to the investor. This is more suitable for the people who do not want to take any risk in their financial planning.

Interest Rates of Fixed Deposits

The current Interest rate is around 7.0% for 1 year. The Interest rate will not be the same throughout the tenure. RBI reviews the interest rates every quarter. If RBI makes a rate cut, the interest rate will change thereafter.

The banks offer flexible interest payout options like monthly, quarterly, annually at the time of maturity.

For instance, check the SBI interest rates here.

Compounding frequency

The FD works on simple interest and not in compound interest.

Income Tax Benefits

The deposit account with a lock-in period of 5 years is eligible for tax exemption upto Rs 1.5 lakhs under Section 80C of the Income Tax Act,1961

One cannot have Tax deduction under Section 80C of the Income Tax Act,1961 for any other fixed deposits.

The Interest received is Taxable.

As per IT Act 1961 under section 194A, if the interest earned exceeds 40,000 rupees, 10% TDS is applicable. The depositor has to submit Form-15G/15H in order get tax exemption for the interest earned. However, the depositor has to declare it while filing Income Tax under “Income from Other Sources”.

Investment payments / deposits

The payment mode shall be in cash or online transfer or Cheque.

Minimum deposit shall be Rs.50 in some banks and it varies to Rs. 1000 in some banks and No cap on maximum investment.

Premature Closure

Premature closure option is available with a penalty charge of 1% on the interest earned during the lock-in.

Partial Withdrawal

Some banks allow partial withdrawal from the Fixed deposit.

Extension Period

Yes. With an auto-renewal option, one can extend the account maturity to any number of periods.

Loan Facility

The depositors shall avail loan facility of 50% to 90% of the FD value in the same institution against the FD. But the Interest on the loan is higher than the FD interest rate.

Example / Illustration

Conclusion

So for the people who want to increase wealth for over small tenure, FD is the best option to raise their capital without any risk. They can open a FD account for goals like,

- To create a Lumpsum fund for the Investment or buy land.

- Investors who want to manage their risk exposure in the equity market, they can hedge some % of their capital in Fixed deposits.

Using time deposits, buy some assets (It should generate positive cash flow) and never make a mistake of buying some liabilities(which depreciates than the present value) like Bike, Car, TV.

Please check out our FD Calculator available in our website.

Happy Reading Investors.. Click here to read more articles.