Hello readers,

Knowing the financial rules can do wonders for you, be it in investing or in your day-to-day activities. There are thumb rules that can solve financial queries in no time.

Are you looking for any below ?

Rule of 72

Many of you have heard of the Rule of 72, but let me review in short just in case.

To estimate the time it will take to DOUBLE your money, divide 72 by the expected growth rate(%) at which you are compounding your money

For example, if you expect to earn 8% per year on a Rs. 1,00,000 investment, it will double to Rs.2,00,000 in about 9 years (72 / 8).

To ease your mind, see below table,

Rule of 114

For example, to triple a Rs 1,00,000 to Rs 3,00,000 on 8% return = 14.25 years.(114/8 = 14 years & 3 Months)

Rule of 144 – Quadruple

This rule helps you to estimate the time required to QUADRUPLE your money. Divide 144 by the interest rate gives you the year in which it triple.

For example, to triple a Rs 1,00,000 to Rs 4,00,000 on 8% return = 18 years.(144/8)

Rule of 15x15x15 – 1 Crore

To acquire 1 crore, simple investing of 15,000 per month for 15 years in a SIP with a fund CAGR of 15%.

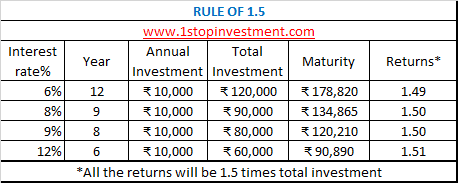

Rule of 1.5 (Felix’s Corollary)

This rule says that for a flow of investments where the Number of years times the Interest equals 72, the final value will equal approximately 1.5 times the amount invested.

Say, investing Rs.10,000 per year for 8 years at 9% interest. = Rs.1,20,000 (which is 1.5 times the total invested amount 80,000)

Rule of 70 – Future value

This helps in calculating the Future buying potential. Divide 70 / Inflation rate to know how fast the value of your retirement fund gets decreased to half its present value. This will help to set your monthly withdrawal.

If a Retired person is having Rs.1 Crore and the inflation rate considered is 7%. So, 70 divide by 7 equals 10. In 10 years his 1 Crore worth will be having 50 lakhs of purchasing power.

Rule of 100-Age

This rule shall be helpful in choosing your asset allocation over Equity.

If you are aged 30, then 100-30 equals 70% in Equity.

Rule of 4% in Withdrawal

Use this 4% rule to ensure how long your corpus lasts after retirement. This rule is based on the assumption of giving the interest and inflation remains same. Say, 1 Crore and 4% rule is applied.(4 lakhs per year) gives 25 years

You can withdraw 33,333 every month if the Corpus fund earns 7% and the Inflation stays at 7% for the next 25 years.

Conclusion:

Investing doesn’t have to be difficult in understanding the numbers. By following the above numbers , I hope it will help you to invest rightly and save time.

Happy Investing

That is very good information

Thank you Sandeep ! Keep following us for more informative articles !